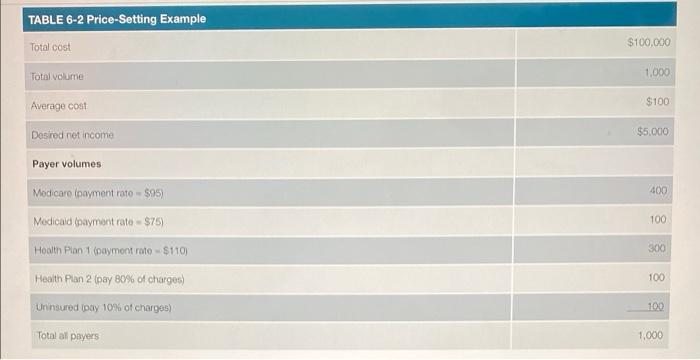

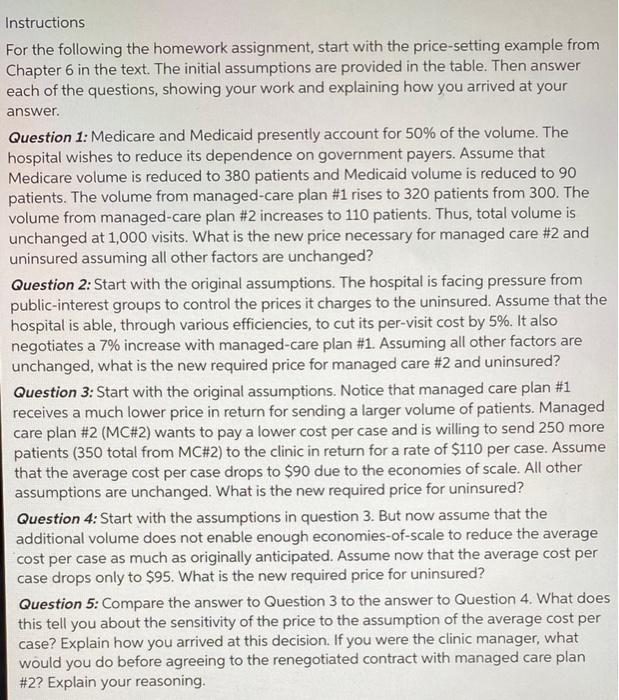

TABLE 6-2 Price-Setting Example Total cost $100,000 Total volume 1,000 Average cost $100 $5.000 Desred not income Payer volumes Medicare (payment rato - $95) 400 100 Medicaid (payment rate - $75) Hoolt Plan 1 (paymont roto $110) Health Plan 2 (pay 80% of charges) 300 100 Uninsured pay 10% of charge) 100 Total al payers 1,000 Instructions For the following the homework assignment, start with the price-setting example from Chapter 6 in the text. The initial assumptions are provided in the table. Then answer each of the questions, showing your work and explaining how you arrived at your answer. Question 1: Medicare and Medicaid presently account for 50% of the volume. The hospital wishes to reduce its dependence on government payers. Assume that Medicare volume is reduced to 380 patients and Medicaid volume is reduced to 90 patients. The volume from managed-care plan #1 rises to 320 patients from 300. The volume from managed-care plan #2 increases to 110 patients. Thus, total volume is unchanged at 1,000 visits. What is the new price necessary for managed care #2 and uninsured assuming all other factors are unchanged? Question 2: Start with the original assumptions. The hospital is facing pressure from public-interest groups to control the prices it charges to the uninsured. Assume that the hospital is able, through various efficiencies, to cut its per-visit cost by 5%. It also negotiates a 7% increase with managed-care plan #1. Assuming all other factors are unchanged, what is the new required price for managed care #2 and uninsured? Question 3: Start with the original assumptions. Notice that managed care plan #1 receives a much lower price in return for sending a larger volume of patients. Managed care plan #2 (MC#2) wants to pay a lower cost per case and is willing to send 250 more patients (350 total from MC#2) to the clinic in return for a rate of $110 per case. Assume that the average cost per case drops to $90 due to the economies of scale. All other assumptions are unchanged. What is the new required price for uninsured? Question 4: Start with the assumptions in question 3. But now assume that the additional volume does not enable enough economies-of-scale to reduce the average cost per case as much as originally anticipated. Assume now that the average cost per case drops only to $95. What is the new required price for uninsured? Question 5: Compare the answer to Question 3 to the answer to Question 4. What does this tell you about the sensitivity of the price to the assumption of the average cost per case? Explain how you arrived at this decision. If you were the clinic manager, what would you do before agreeing to the renegotiated contract with managed care plan #2? Explain your reasoning