Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Which of the following statements is true? Taxes on dividend income are paid when the stock is sold. Taxes on dividend income are paid in

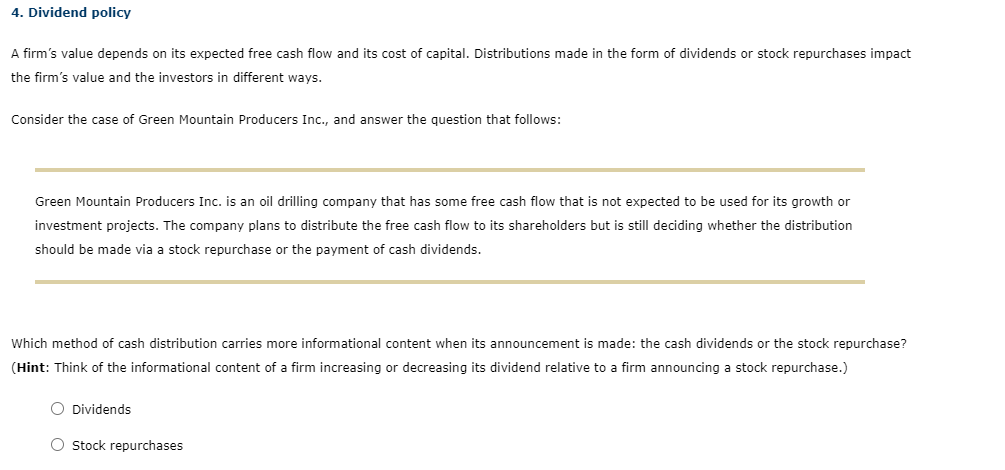

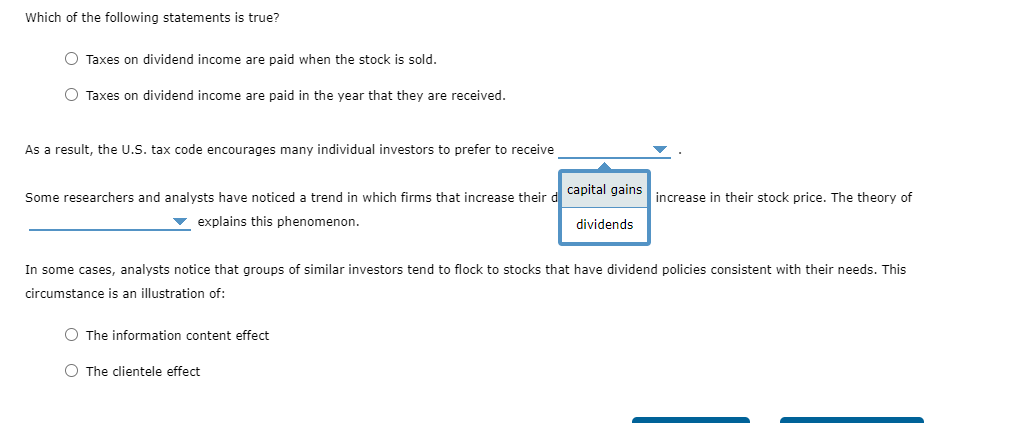

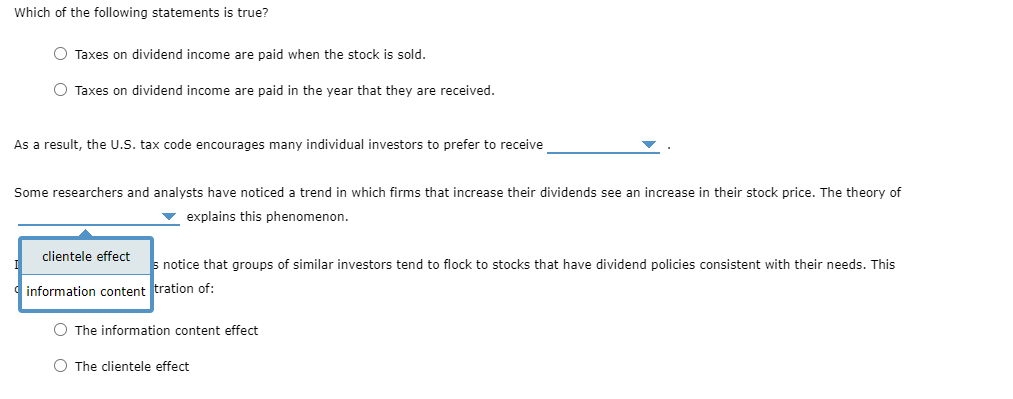

Which of the following statements is true? Taxes on dividend income are paid when the stock is sold. Taxes on dividend income are paid in the year that they are received. As a result, the U.S. tax code encourages many individual investors to prefer to receive Some researchers and analysts have noticed a trend in which firms that increase their d capital gains increase in their stock price. The theory of explains this phenomenon. dividends In some cases, analysts notice that groups of similar investors tend to flock to stocks that have dividend policies consistent with their needs. This circumstance is an illustration of: The information content effect The clientele effect 4. Dividend policy A firm's value depends on its expected free cash flow and its cost of capital. Distributions made in the form of dividends or stock repurchases impact the firm's value and the investors in different ways. Consider the case of Green Mountain Producers Inc., and answer the question that follows: Green Mountain Producers Inc. is an oil drilling company that has some free cash flow that is not expected to be used for its growth or investment projects. The company plans to distribute the free cash flow to its shareholders but is still deciding whether the distribution should be made via a stock repurchase or the payment of cash dividends. Which method of cash distribution carries more informational content when its announcement is made: the cash dividends or the stock repurchase? (Hint: Think of the informational content of a firm increasing or decreasing its dividend relative to a firm announcing a stock repurchase.) Dividends Stock repurchases Which of the following statements is true? Taxes on dividend income are paid when the stock is sold. Taxes on dividend income are paid in the year that they are received. As a result, the U.S. tax code encourages many individual investors to prefer to receive Some researchers and analysts have noticed a trend in which firms that increase their dividends see an increase in their stock price. The theory of explains this phenomenon. clientele effect s notice that groups of similar investors tend to flock to stocks that have dividend policies consistent with their needs. This information content tration of: The information content effect The clientele effect

Which of the following statements is true? Taxes on dividend income are paid when the stock is sold. Taxes on dividend income are paid in the year that they are received. As a result, the U.S. tax code encourages many individual investors to prefer to receive Some researchers and analysts have noticed a trend in which firms that increase their d capital gains increase in their stock price. The theory of explains this phenomenon. dividends In some cases, analysts notice that groups of similar investors tend to flock to stocks that have dividend policies consistent with their needs. This circumstance is an illustration of: The information content effect The clientele effect 4. Dividend policy A firm's value depends on its expected free cash flow and its cost of capital. Distributions made in the form of dividends or stock repurchases impact the firm's value and the investors in different ways. Consider the case of Green Mountain Producers Inc., and answer the question that follows: Green Mountain Producers Inc. is an oil drilling company that has some free cash flow that is not expected to be used for its growth or investment projects. The company plans to distribute the free cash flow to its shareholders but is still deciding whether the distribution should be made via a stock repurchase or the payment of cash dividends. Which method of cash distribution carries more informational content when its announcement is made: the cash dividends or the stock repurchase? (Hint: Think of the informational content of a firm increasing or decreasing its dividend relative to a firm announcing a stock repurchase.) Dividends Stock repurchases Which of the following statements is true? Taxes on dividend income are paid when the stock is sold. Taxes on dividend income are paid in the year that they are received. As a result, the U.S. tax code encourages many individual investors to prefer to receive Some researchers and analysts have noticed a trend in which firms that increase their dividends see an increase in their stock price. The theory of explains this phenomenon. clientele effect s notice that groups of similar investors tend to flock to stocks that have dividend policies consistent with their needs. This information content tration of: The information content effect The clientele effect Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started