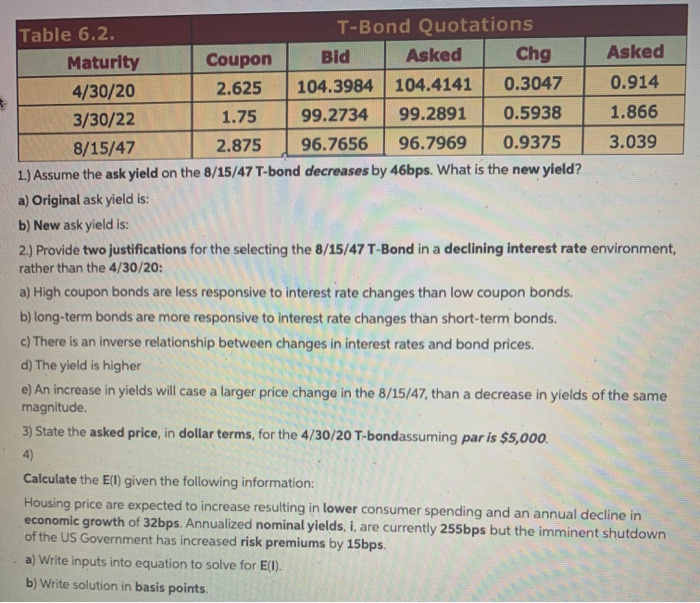

Table 6.2. T-Bond Quotations Maturity Coupon Bid Asked Chg Asked 4/30/20 2.625 104.3984 104.4141 0.3047 0.914 3/30/22 1.75 99.2734 99.2891 0.5938 1.866 8/15/47 2.875 96.7656 96.7969 0.9375 3.039 1.) Assume the ask yield on the 8/15/47 T-bond decreases by 46bps. What is the new yield? a) Original ask yield is: b) New ask yield is: 2.) Provide two justifications for the selecting the 8/15/47 T-Bond in a declining interest rate environment, rather than the 4/30/20: a) High coupon bonds are less responsive to interest rate changes than low coupon bonds. b) long-term bonds are more responsive to interest rate changes than short-term bonds. c) There is an inverse relationship between changes in interest rates and bond prices. d) The yield is higher e) An increase in yields will case a larger price change in the 8/15/47, than a decrease in yields of the same magnitude. 3) State the asked price, in dollar terms, for the 4/30/20 T-bondassuming par is $5,000. 4) Calculate the E(l) given the following information: Housing price are expected to increase resulting in lower consumer spending and an annual decline in economic growth of 32bps. Annualized nominal yields, I, are currently 255bps but the imminent shutdown of the US Government has increased risk premiums by 15bps. a) Write inputs into equation to solve for E(l). b) Write solution in basis points. Table 6.2. T-Bond Quotations Maturity Coupon Bid Asked Chg Asked 4/30/20 2.625 104.3984 104.4141 0.3047 0.914 3/30/22 1.75 99.2734 99.2891 0.5938 1.866 8/15/47 2.875 96.7656 96.7969 0.9375 3.039 1.) Assume the ask yield on the 8/15/47 T-bond decreases by 46bps. What is the new yield? a) Original ask yield is: b) New ask yield is: 2.) Provide two justifications for the selecting the 8/15/47 T-Bond in a declining interest rate environment, rather than the 4/30/20: a) High coupon bonds are less responsive to interest rate changes than low coupon bonds. b) long-term bonds are more responsive to interest rate changes than short-term bonds. c) There is an inverse relationship between changes in interest rates and bond prices. d) The yield is higher e) An increase in yields will case a larger price change in the 8/15/47, than a decrease in yields of the same magnitude. 3) State the asked price, in dollar terms, for the 4/30/20 T-bondassuming par is $5,000. 4) Calculate the E(l) given the following information: Housing price are expected to increase resulting in lower consumer spending and an annual decline in economic growth of 32bps. Annualized nominal yields, I, are currently 255bps but the imminent shutdown of the US Government has increased risk premiums by 15bps. a) Write inputs into equation to solve for E(l). b) Write solution in basis points