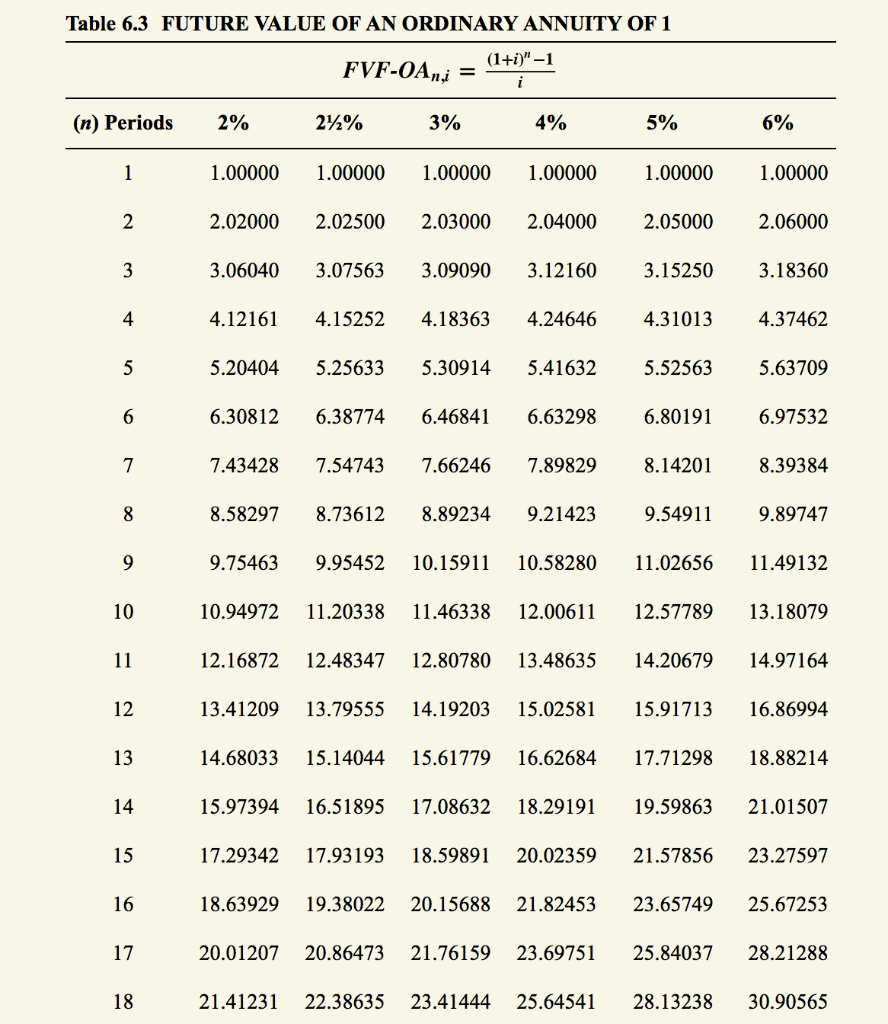

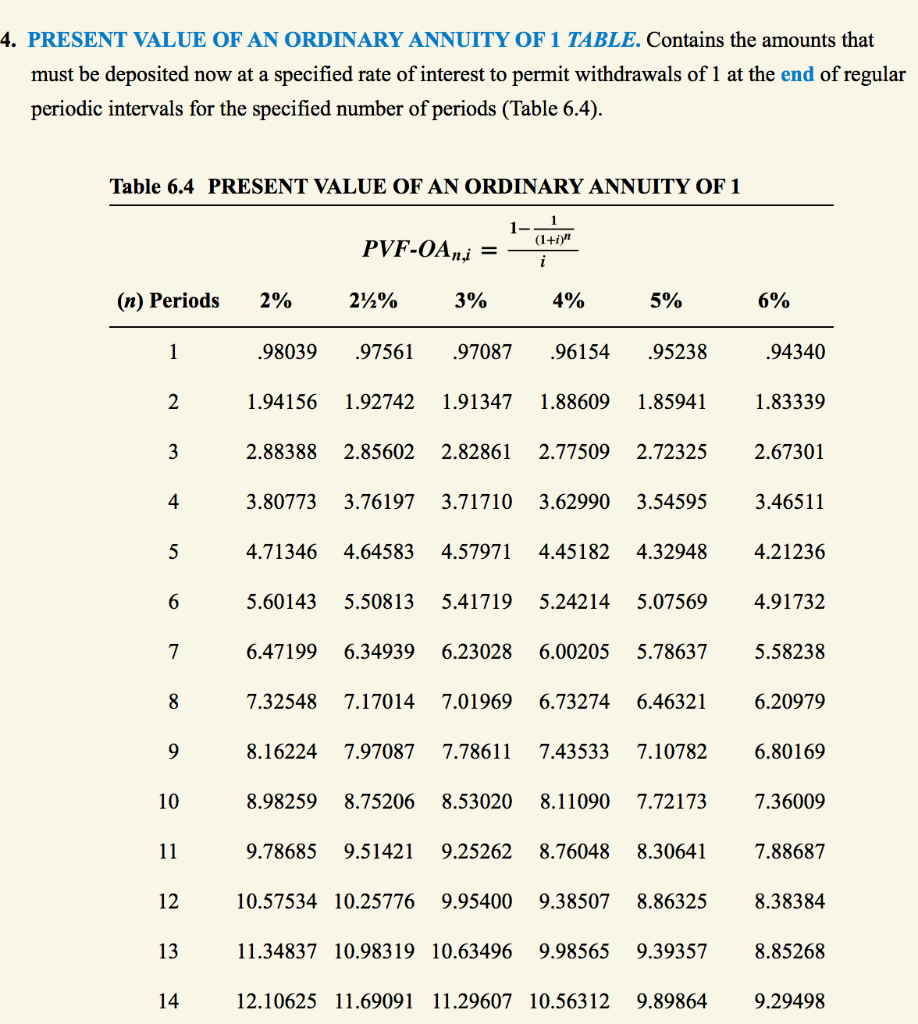

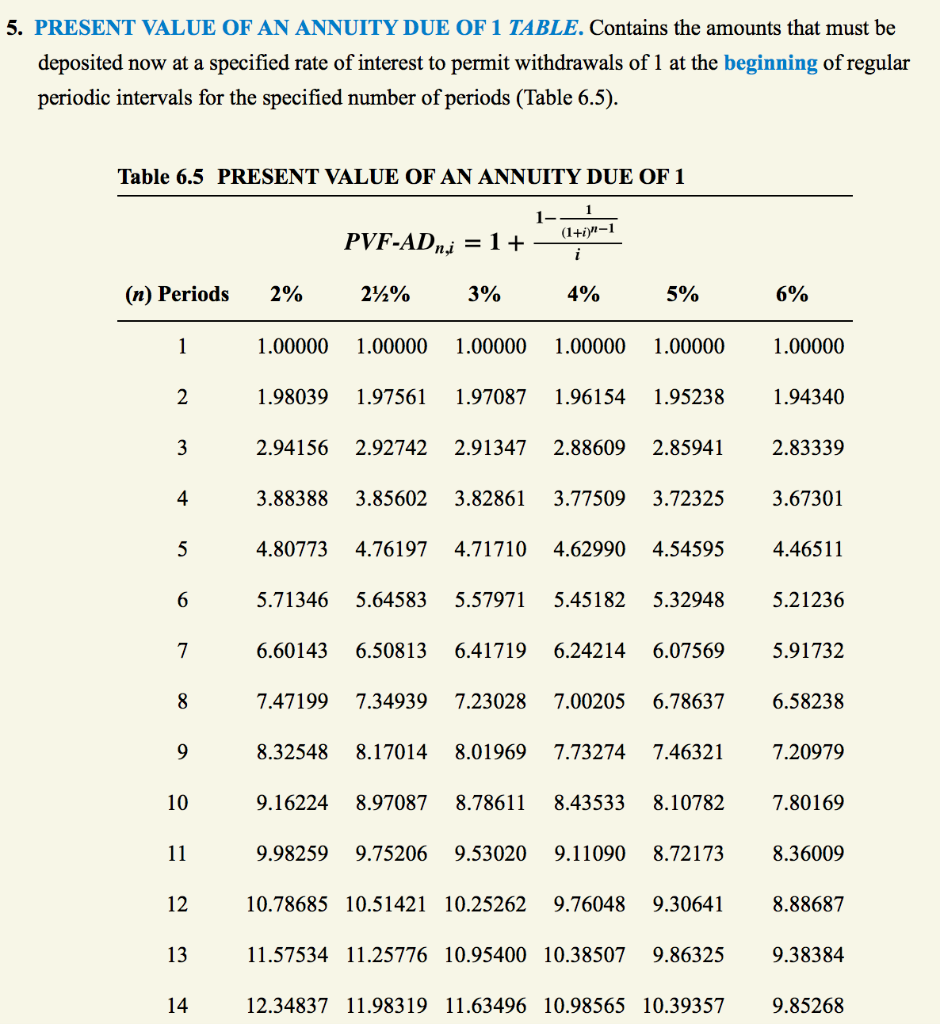

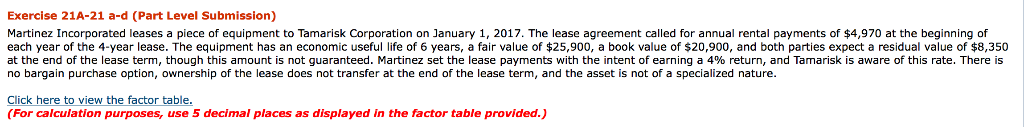

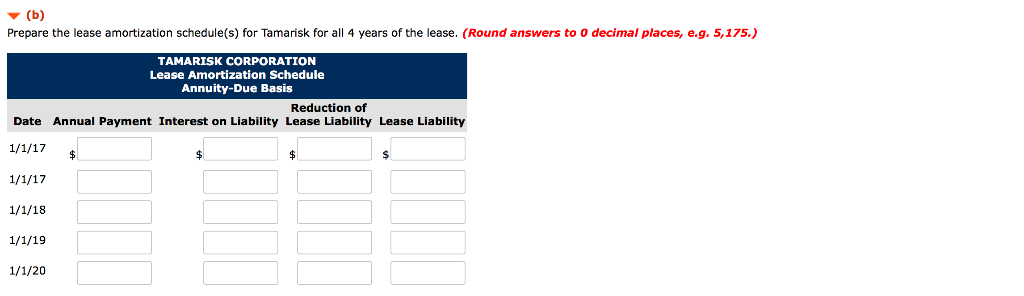

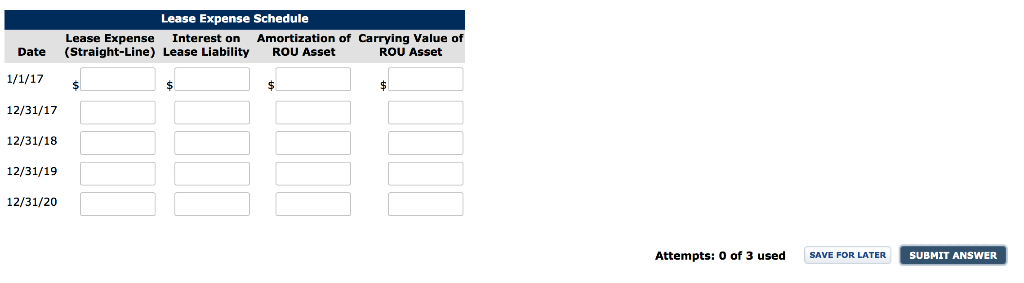

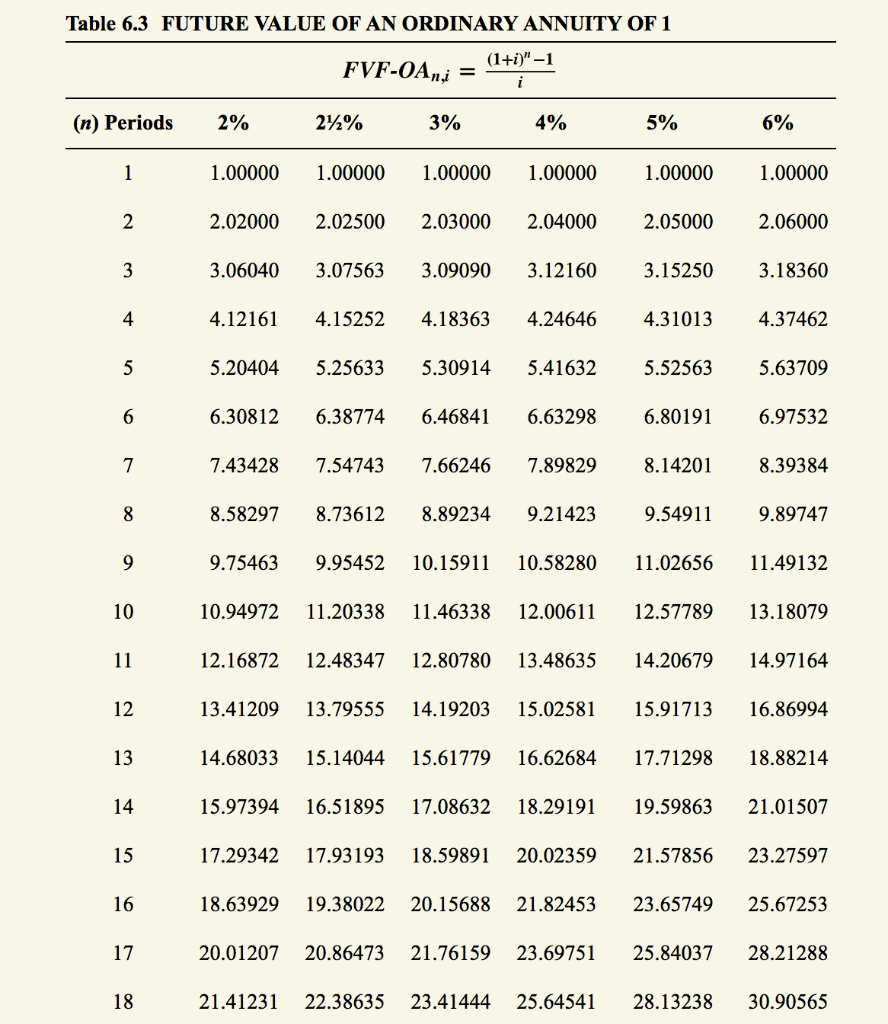

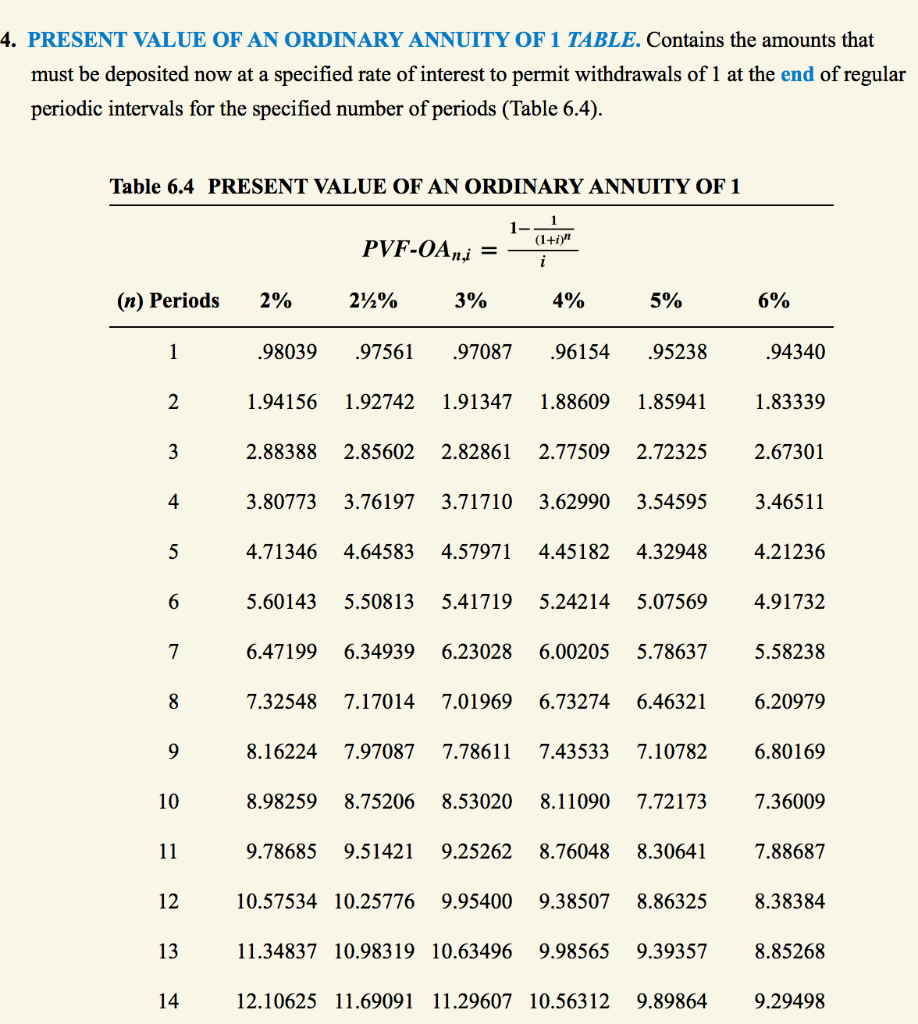

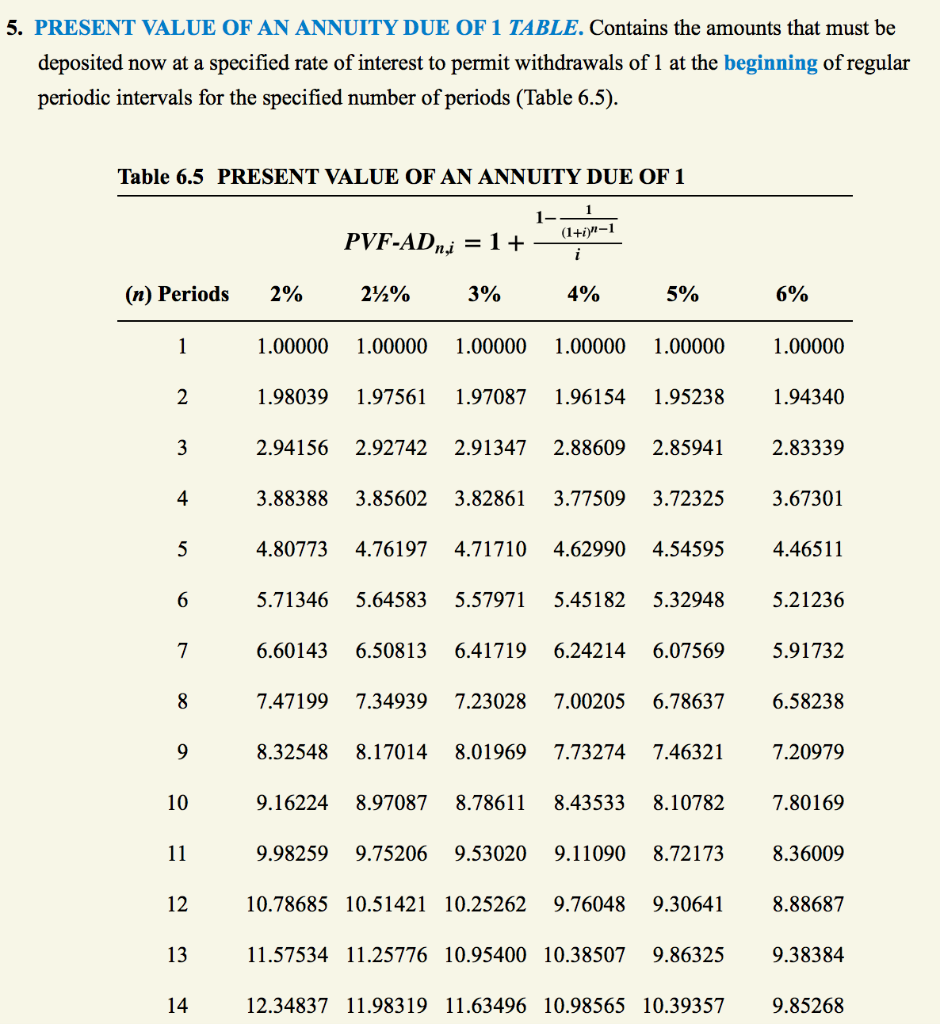

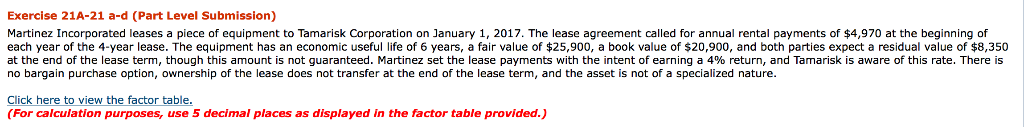

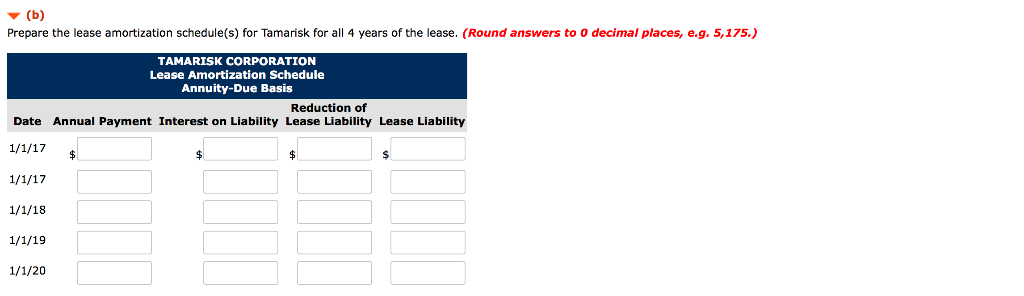

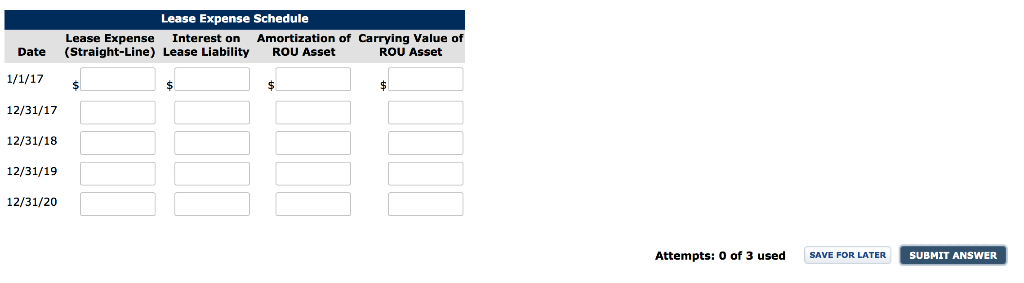

Table 6.3 FUTURE VALUE OF AN ORDINARY ANNUITY OF 1 (n) Periods 2% 3% 4% 5% 6% 1.00000 2.02000 2.02500 2.03000 2.040002.05000 2.06000 3.06040 3.07563 3.09090 3.12160 3.15250 3.18360 4.12161 4.15252 4.18363 4.24646 4.31013 4.37462 5.204045.25633 5.30914 5.41632 5.525635.63709 6.30812 6.387746.468416.63298 6.801916.97532 8.39384 9.54911 9.89747 9.75463 9.95452 10.15911 10.5828011.02656 11.49132 10.94972 11.20338 11.46338 12.00611 12.5778913.18079 12.16872 12.4834712.80780 13.48635 14.20679 14.97164 13.41209 13.7955514.19203 15.0258115.9171316.86994 14.68033 15.14044 15.61779 16.62684 17.71298 18.88214 15.97394 16.51895 17.08632 18.29191 19.59863 21.01507 17.29342 17.93193 18.59891 20.0235921.5785623.27597 18.63929 19.38022 20.15688 21.8245323.6574925.67253 20.01207 20.86473 21.76159 23.6975 25.84037 28.21288 21.41231 22.3863523.41444 25.64541 28.13238 30.90565 1.00000 1.000001.00000 1.00000 1.00000 4 7.43428 7.547437.66246 7.898298.142 01 8.582978.73612 8.89234 9.21423 10 12 13 14 15 17 18 4. PRESENT VALUE OF AN ORDINARY ANNUITY OF 1 TABLE. Contains the amounts that must be deposited now at a specified rate of interest to permit withdrawals of 1 at the end of regular periodic intervals for the specified number of periods (Table 6.4) Table 6.4 PRESENT VALUE OF AN ORDINARY ANNUITY OF 1 (n) Periods 2% 2 % 3% 4% 5% 6% 94340 1.94156 1.92742 1.91347 1.88609 1.85941 1.83339 2.88388 2.85602 2.82861 2.77509 2.72325 2.67301 3.80773 3.76197 3.71710 3.62990 3.545953.46511 4.71346 4.645834.579714.45182 4.329484.21236 5.601435.50813 5.417195.242145.075694.91732 6.47199 6.34939 6.23028 6.002055.786375.58238 7.32548 7.17014 7.01969 6.73274 6.46321 6.20979 8.16224 7.97087 7.78611 7.435337.10782 6.80169 8.98259 8.75206 8.53020 8.11090 7.721737.36009 9.78685 9.51421 9.25262 8.760488.306417.88687 10.57534 10.25776 9.95400 9.38507 8.86325 8.38384 11.34837 10.98319 10.63496 9.98565 9.39357 8.85268 12.10625 11.69091 11.29607 10.56312 9.898649.29498 98039 .97561 97087.96154.95238 2 10 13 14 5. PRESENT VALUE OF AN ANNUITY DUE OF 1 TABLE. Contains the amounts that must be deposited now at a specified rate of interest to permit withdrawals of 1 at the beginning of regular periodic intervals for the specified number of periods (Table 6.5) Table 6.5 PRESENT VALUE OF AN ANNUITY DUE OF 1 n,l (n) Periods 2% 2 % 3% 4% 5% 6% 1.00000 1.98039 1.97561 1.97087 1.96154 1.95238 1.94340 2.94156 2.92742 2.91347 2.88609 2.85941 2.83339 3.88388 3.85602 3.82861 3.77509 3.72325 3.67301 4.80773 4.76197 4.71710 4.62990 4.545954.46511 5.713465.645835.579715.45182 5.329485.21236 6.60143 6.50813 6.41719 6.242146.075695.91732 7.47199 7.349397.23028 7.00205 6.78637 6.58238 8.32548 8.17014 8.019697.732747.463217.20979 9.16224 8.970878.78611 8.43533 8.10782 7.80169 9.98259 9.75206 9.53020 9.11090 8.721738.36009 10.78685 10.51421 10.25262 9.76048 9.30641 8.88687 11.57534 11.25776 10.95400 10.38507 9.863259.38384 12.34837 11.98319 11.63496 10.98565 10.393579.85268 1.00000 1.00000 1.00000 1.00000 1.00000 4 10 13 14 Exercise 21A-21 a-d (Part Level Submission) Martinez Incorporated leases a piece of equipment to Tamarisk Corporation on January 1, 2017. The lease agreement called for annual rental payments of $4,970 at the beginning of each year of the 4-year lease. The equipment has an economic useful life of 6 years, a fair value of $25,900, a book value of $20,900, and both parties expect a residual value of $8,350 at the end of the lease term, though this amount is not guaranteed. Martinez set the lease payments with the intent of earning a 4% return, and Tamarisk is aware of this rate. There is no bargain purchase option, ownership of the lease does not transfer at the end of the lease term, and the asset is not of a specialized nature. Click here to view the factor table. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) (b) Prepare the lease amortization schedule(s) for Tamarisk for all 4 years of the lease. (Round answers to 0 decimal places, e.g. 5,175.) TAMARISK CORPORATION Lease Amortization Schedule Annuity-Due Basis Reduction of Date Annual Payment Interest on Liability Lease Liability Lease Liability 1/1/20 Lease Expense Schedule Lease Expense Interest on Amortization of Carrying Value of Date (Straight-Line) Lease Liability ROU Asset ROU Asset 12/31/17 12/31/18 12/31/19 12/31/20 Attempts: 0 of 3 used OR LATER SUBMIT