Answered step by step

Verified Expert Solution

Question

1 Approved Answer

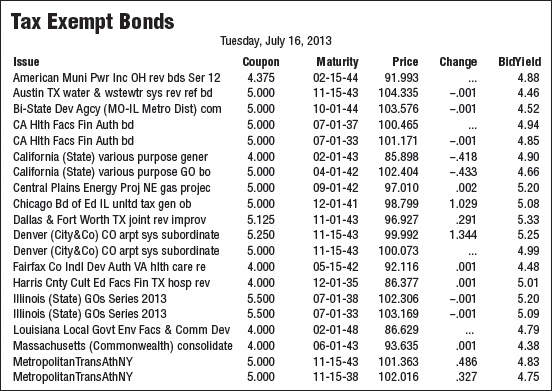

TABLE 6-6 TABLE 6-7 11. Refer to Table 66. Verify the Bid Yield of 4.52 percent on the Bi-State Development Agency municipal bonds. Settlement occurs

TABLE 6-6

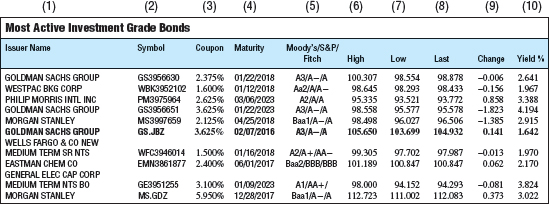

TABLE 6-7

11. Refer to Table 66. Verify the Bid Yield of 4.52 percent on the Bi-State Development Agency municipal bonds. Settlement occurs two days after purchase, so actual ownership of the bond occurs on July 18, 2013. (LG 6-2)

13. Refer to Table 67. (LG 6-2)

- What was the closing price on the Goldman Sachs 2.375 percent coupon bonds on July 16, 2013?

- What was the S&P bond rating on Wells Fargo 1.500 percent coupon bonds maturing in 2018 on July 16, 2013?

- What was the closing price on Morgan Stanley 5.950 percent bonds on July 15, 2013?

Change BidYield 4.88 4.46 -.001 -.001 4.52 Tax Exempt Bonds Tuesday, July 16, 2013 Issue Coupon Maturity Price American Muni Pwr Inc OH rev bds Ser 12 4.375 02-15-44 91.993 Austin TX water & wstewtr sys rev ref bd 5.000 11-15-43104.335 Bi-State Dev Agcy (MO-IL Metro Dist) com 5.000 10-01-44 103.576 CA HIth Facs Fin Auth bd 5.000 07-01-37 100.465 CA HIth Facs Fin Auth bd 5.000 07-01-33101.171 California (State) various purpose gener 4.000 02-01-43 85.898 California (State) various purpose GO bo 5.000 04-01-42 102.404 Central Plains Energy Proj NE gas projec 5.000 09-01-42 97.010 Chicago Bd of Ed IL unltd tax gen ob 5.000 12-01-41 98.799 Dallas & Fort Worth TX joint rev improv 5.125 11-01-43 96.927 Denver (City&Co) CO arpt sys subordinate 5.250 11-15-43 99.992 Denver (City&Co) CO arpt sys subordinate 5.000 11-15-43100.073 Fairfax Co Indl Dev Auth VA hith care re 4.000 05-15-42 92.116 Harris Cnty Cult Ed Facs Fin TX hosp rev 4.000 12-01-3586.377 Illinois (State) GOs Series 2013 5.500 07-01-38 102.306 Illinois (State) GOs Series 2013 5.500 07-01-33 103.169 Louisiana Local Govt Env Facs & Comm Dev 4.000 02-01-48 86.629 Massachusetts (Commonwealth) consolidate 4.000 06-01-43 93.635 Metropolitan TransAthNY 5.000 11-15-43101.363 Metropolitan TransAthNY 5.000 11-15-38 102.016 -.001 -.418 -433 .002 1.029 .291 1.344 4.94 4.85 4.90 4.66 5.20 5.08 5.33 5.25 4.99 4.48 5.01 5.20 5.09 4.79 4.38 4.83 4.75 .001 .001 -.001 -.001 .001 .486 .327 (3) (4) (5) (6) (7) (8) (9) (10) (2) Most Active Investment Grade Bonds Issier Name Symbol Coupon Maturity GS3966630 WBK395210 PM3975964 GS3966651 MS3997659 GS.JBZ 2.375% 1.600% 2.625% 3.625% 2.125% 3.625% 01/22/2018 01/12/2018 08/06/2008 01/22/2023 04/25/2018 02/07/2016 Moody's/S&P/ Fitch AB/A-IA Aa2/AA- A2 AVA VA-A Baa1/A-A A3/A-A High 100.307 98.645 05.335 98.558 98.498 105.650 Low 98.554 98.293 03.521 95.577 96.027 103.699 Last 98.878 98.433 0 3.772 95578 96506 104.932 Change -0.006 -0.156 0.859 -1.823 -1.385 0.141 Yield 2.641 1.967 3388 4.194 2.915 1642 GOLDMAN SACHS GROUP WESTPAC BKG CORP PHILIP MORRIS INTL INC GOLDMAN SACHS GROUP MORGAN STANLEY GOLDMAN SACHS GROUP WELLS FARGO & CO NEW MEDIUM TERM SR NTS EASTMAN CHEM CO GENERAL ELEC CAP CORP MEDIUM TERM NTS BO MORGAN STANLEY WFC3946014 EMN3861877 1.500% 2.400% 01/16/2018 06/01/2017 A2/A+/AA- Baa2/BBB/BBB 99.305 101.189 97.702 100.847 97.987 100.847 -0.013 0.062 1.970 2.170 GE3961255 MS.GDZ 3.100% 5.950% 01/09/2003 12/28/2017 A1/AA+ Baa1/A-IA 98.000 112.723 94.152 111.002 94.293 112.083 -0.081 0.373 3.824 3.022 Change BidYield 4.88 4.46 -.001 -.001 4.52 Tax Exempt Bonds Tuesday, July 16, 2013 Issue Coupon Maturity Price American Muni Pwr Inc OH rev bds Ser 12 4.375 02-15-44 91.993 Austin TX water & wstewtr sys rev ref bd 5.000 11-15-43104.335 Bi-State Dev Agcy (MO-IL Metro Dist) com 5.000 10-01-44 103.576 CA HIth Facs Fin Auth bd 5.000 07-01-37 100.465 CA HIth Facs Fin Auth bd 5.000 07-01-33101.171 California (State) various purpose gener 4.000 02-01-43 85.898 California (State) various purpose GO bo 5.000 04-01-42 102.404 Central Plains Energy Proj NE gas projec 5.000 09-01-42 97.010 Chicago Bd of Ed IL unltd tax gen ob 5.000 12-01-41 98.799 Dallas & Fort Worth TX joint rev improv 5.125 11-01-43 96.927 Denver (City&Co) CO arpt sys subordinate 5.250 11-15-43 99.992 Denver (City&Co) CO arpt sys subordinate 5.000 11-15-43100.073 Fairfax Co Indl Dev Auth VA hith care re 4.000 05-15-42 92.116 Harris Cnty Cult Ed Facs Fin TX hosp rev 4.000 12-01-3586.377 Illinois (State) GOs Series 2013 5.500 07-01-38 102.306 Illinois (State) GOs Series 2013 5.500 07-01-33 103.169 Louisiana Local Govt Env Facs & Comm Dev 4.000 02-01-48 86.629 Massachusetts (Commonwealth) consolidate 4.000 06-01-43 93.635 Metropolitan TransAthNY 5.000 11-15-43101.363 Metropolitan TransAthNY 5.000 11-15-38 102.016 -.001 -.418 -433 .002 1.029 .291 1.344 4.94 4.85 4.90 4.66 5.20 5.08 5.33 5.25 4.99 4.48 5.01 5.20 5.09 4.79 4.38 4.83 4.75 .001 .001 -.001 -.001 .001 .486 .327 (3) (4) (5) (6) (7) (8) (9) (10) (2) Most Active Investment Grade Bonds Issier Name Symbol Coupon Maturity GS3966630 WBK395210 PM3975964 GS3966651 MS3997659 GS.JBZ 2.375% 1.600% 2.625% 3.625% 2.125% 3.625% 01/22/2018 01/12/2018 08/06/2008 01/22/2023 04/25/2018 02/07/2016 Moody's/S&P/ Fitch AB/A-IA Aa2/AA- A2 AVA VA-A Baa1/A-A A3/A-A High 100.307 98.645 05.335 98.558 98.498 105.650 Low 98.554 98.293 03.521 95.577 96.027 103.699 Last 98.878 98.433 0 3.772 95578 96506 104.932 Change -0.006 -0.156 0.859 -1.823 -1.385 0.141 Yield 2.641 1.967 3388 4.194 2.915 1642 GOLDMAN SACHS GROUP WESTPAC BKG CORP PHILIP MORRIS INTL INC GOLDMAN SACHS GROUP MORGAN STANLEY GOLDMAN SACHS GROUP WELLS FARGO & CO NEW MEDIUM TERM SR NTS EASTMAN CHEM CO GENERAL ELEC CAP CORP MEDIUM TERM NTS BO MORGAN STANLEY WFC3946014 EMN3861877 1.500% 2.400% 01/16/2018 06/01/2017 A2/A+/AA- Baa2/BBB/BBB 99.305 101.189 97.702 100.847 97.987 100.847 -0.013 0.062 1.970 2.170 GE3961255 MS.GDZ 3.100% 5.950% 01/09/2003 12/28/2017 A1/AA+ Baa1/A-IA 98.000 112.723 94.152 111.002 94.293 112.083 -0.081 0.373 3.824 3.022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started