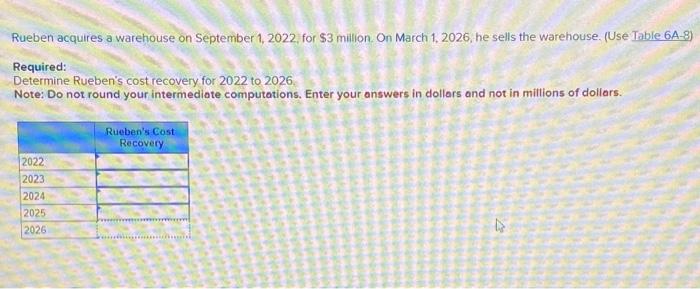

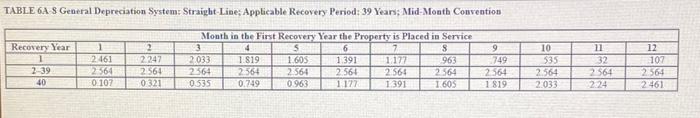

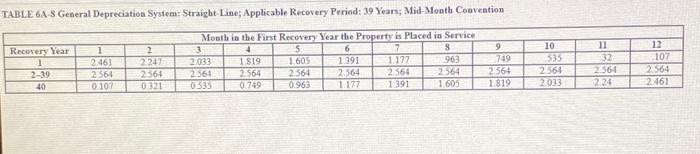

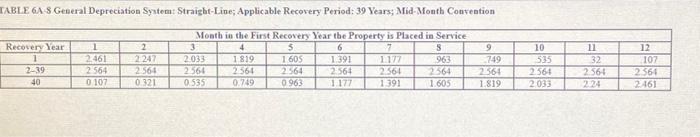

TABLE 6A S General Depreciation System: Straight-Line; Appticable Recovery Period: 39 Years; Mid-Month Convention \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{10}{|c|}{ Month in the First Recovery Year the Property is Placed in Service } \\ \hline Recovery Year & 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & 9 & 10 & 11 & 12 \\ \hline 1 & 2461 & 2247 & 2.033 & 1.819 & 1.605 & 1.391 & 1.177 & 963 & 749 & 535 & 32 & 107 \\ \hline 239 & 2564 & 2564 & 2564 & 2564 & 2564 & 2.564 & 2.564 & 2.564 & 2564 & 2564 & 2564 & 2564 \\ \hline 40 & 0.107 & 0321 & 0.535 & 0.749 & 0.963 & 1.177 & 1.391 & 1.605 & 1.819 & 2.033 & 224 & 2461 \\ \hline \end{tabular} TABLE 6A-8 General Depreciation System: Straight-Line; Applicable Recovery Period: 39 Years; Mid-Month Convention \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{13}{|c|}{ Month in the First Recoveny Year the Property is Placed in Service. } \\ \hline Recovery Year & 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & 9 & 10 & 11 & 12 \\ \hline 1 & 2461 & 2247 & 2033 & 1819 & 1.605 & 1.391 & 1.177 & 963 & 749 & 535 & 32 & 107 \\ \hline 239 & 2564 & 2564 & 2564 & 2564 & 2564 & 2.564 & 2564 & 2564 & 2564 & 2564 & 2564 & 2564 \\ \hline 40 & 0107 & 0.321 & 0335 & 0.749 & 0.963 & 1177 & 1391 & 1605 & 1.819 & 2.033 & 224 & 2.461 \\ \hline \end{tabular} TABLE 6A-8 General Depreciation System: Straight-Line; Applicable Recovery Period: 39 Years; Mid-Month Convention \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{13}{|c|}{ Month in the First Recoveny Year the Property is Placed in Service. } \\ \hline Recovery Year & 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & 9 & 10 & 11 & 12 \\ \hline 1 & 2461 & 2247 & 2033 & 1819 & 1.605 & 1.391 & 1.177 & 963 & 749 & 535 & 32 & 107 \\ \hline 239 & 2564 & 2564 & 2564 & 2564 & 2564 & 2.564 & 2564 & 2564 & 2564 & 2564 & 2564 & 2564 \\ \hline 40 & 0107 & 0.321 & 0335 & 0.749 & 0.963 & 1177 & 1391 & 1605 & 1.819 & 2.033 & 224 & 2.461 \\ \hline \end{tabular} Rueben acquires a warehouse on September 1, 2022, for $3 milion. On March 1, 2026, he sells the warehouse. (Use Table 6A-8) Required: Determine Rueben's cost recovery for 2022 to 2026 Note: Do not round your intermediate computations. Enter your answers in dollars and not in millions of dollars. TABLE 6A S General Depreciation System: Straight-Line; Appticable Recovery Period: 39 Years; Mid-Month Convention \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{10}{|c|}{ Month in the First Recovery Year the Property is Placed in Service } \\ \hline Recovery Year & 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & 9 & 10 & 11 & 12 \\ \hline 1 & 2461 & 2247 & 2.033 & 1.819 & 1.605 & 1.391 & 1.177 & 963 & 749 & 535 & 32 & 107 \\ \hline 239 & 2564 & 2564 & 2564 & 2564 & 2564 & 2.564 & 2.564 & 2.564 & 2564 & 2564 & 2564 & 2564 \\ \hline 40 & 0.107 & 0321 & 0.535 & 0.749 & 0.963 & 1.177 & 1.391 & 1.605 & 1.819 & 2.033 & 224 & 2461 \\ \hline \end{tabular} Rueben acquires a warehouse on September 1, 2022, for $3 milion. On March 1, 2026, he sells the warehouse. (Use Table 6A-8) Required: Determine Rueben's cost recovery for 2022 to 2026 Note: Do not round your intermediate computations. Enter your answers in dollars and not in millions of dollars. TABLE 6 A 8 General Depreciation Systen: Straight-Line; Applicable Recovery Period: 39 Years; Mid-Month Convention \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{10}{|c|}{ Moath in the First Recovery Year the Property is Placed in Service } \\ \hline Recovery Year & 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & 9 & 10 & 11 & 12 \\ \hline 1 & 2461 & 2247 & 2.033 & 1.819 & 1.605 & 1.391 & 1.177 & 963 & 749 & 535 & 32 & 107 \\ \hline 239 & 2564 & 2564 & 2564 & 2564 & 2564 & 2564 & 2564 & 2564 & 2564 & 2564 & 2564 & 2564 \\ \hline 40 & 0107 & 0.321 & 0.535 & 0.749 & 0.963 & 1.177 & 1.391 & 1.605 & 1.819 & 2.033 & 224 & 2.461 \\ \hline \end{tabular}