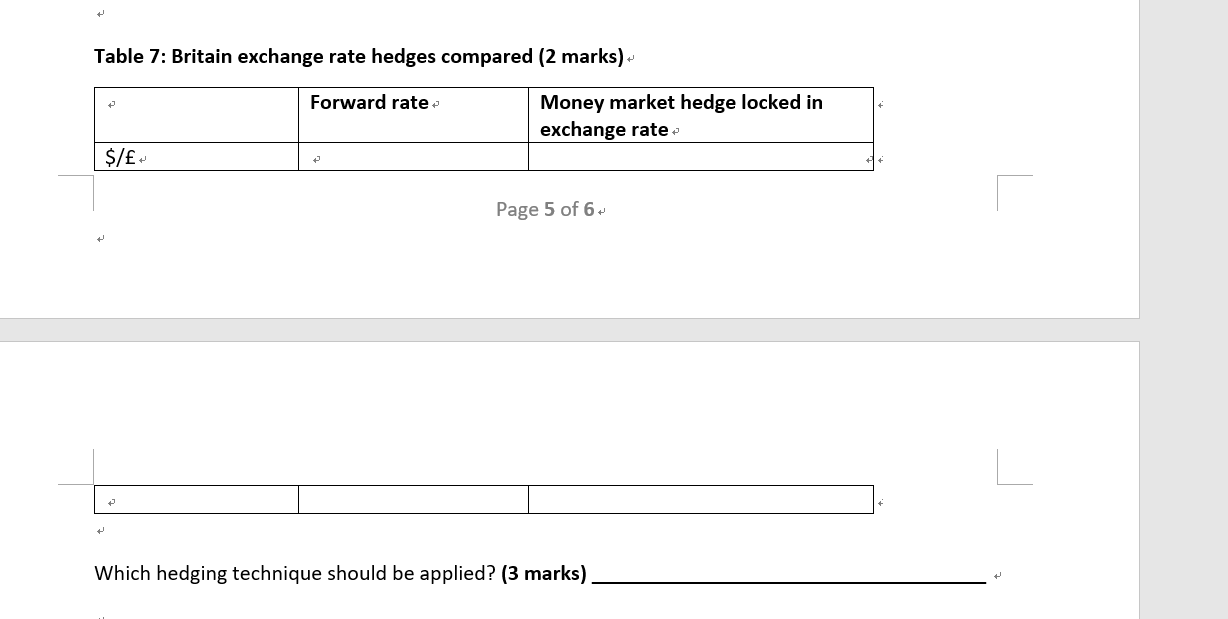

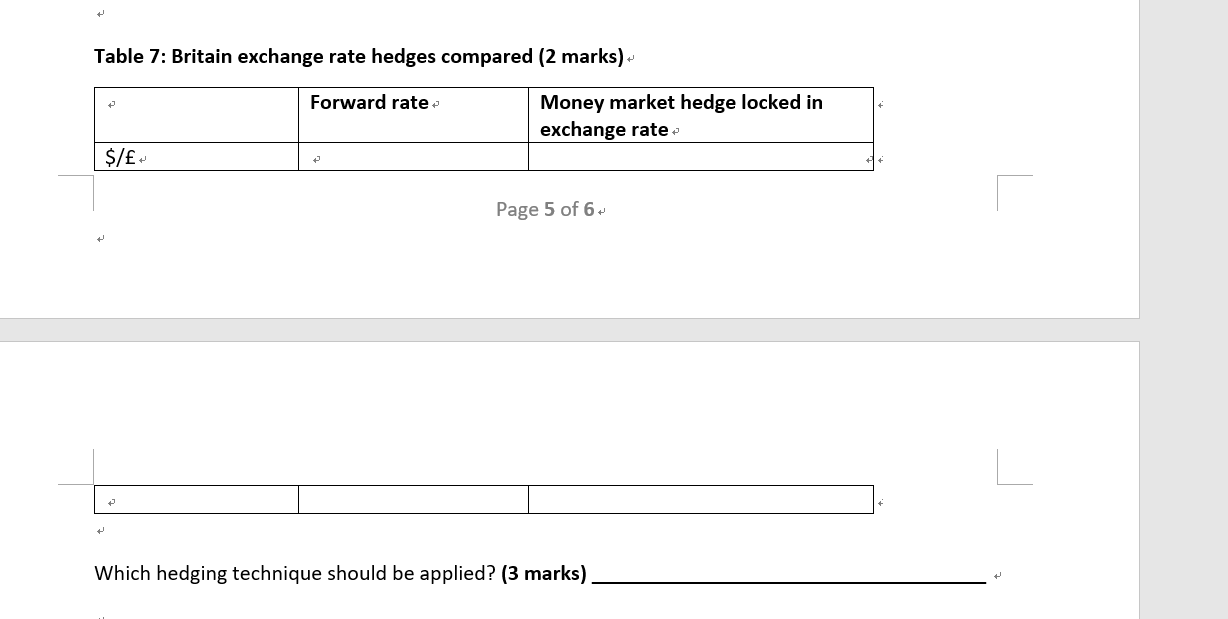

Table 7: Britain exchange rate hedges compared (2 marks)- Forward rate Money market hedge locked in exchange rate $/ Page 5 of 6 Which hedging technique should be applied? (3 marks) the separate answer sheet). + b. Determine the option types that you will consider based on the exchange rate quotes provided by your bank. Remember we will long or short the base currencies (in this case study the currencies that are not $) and the FV of premium cost is based on the borrowing cost of $ for the time period of the option. For example, if it is a 3-month option, then the interest rate that should be applied is United States 3 month borrowing rate of 2.687%/4 = 0.67175%). Calculate the total cost of using options as hedging instrument for the imports from Australia (Complete Table 4 on the separate answer sheet). c. Compare the forward quotes, money market hedges and options with each other to determine the best exchange rate hedges for Australia (Complete Table 5 on the separate answer sheet). d. Calculate the exchange rates that will apply if the money market hedges are used for the exports to Britain (Complete Table 6 on the separate answer sheet). e. Compare the forward quotes and money market hedges with each other to determine the best exchange rate hedges for Britain (Complete Table 7 on the separate answer sheet). f. Assume you entered into the forward hedge for the import from Australia. Two months have passed since you entered into the hedge. Interest rates are the same as before. The spot exchange rate of the $/AUD is 0.73000. Calculate the value of your forward position. Please use a 360 day- count convention, since the bank also used a 360 day-count convention with the forward quotes provided to you. Also remember for interest rates use risk free rates provided under scenario 1. Show your calculation in Table 8 on the separate answer sheet. + END OF QUESTIONS Table 7: Britain exchange rate hedges compared (2 marks)- Forward rate Money market hedge locked in exchange rate $/ Page 5 of 6 Which hedging technique should be applied? (3 marks) the separate answer sheet). + b. Determine the option types that you will consider based on the exchange rate quotes provided by your bank. Remember we will long or short the base currencies (in this case study the currencies that are not $) and the FV of premium cost is based on the borrowing cost of $ for the time period of the option. For example, if it is a 3-month option, then the interest rate that should be applied is United States 3 month borrowing rate of 2.687%/4 = 0.67175%). Calculate the total cost of using options as hedging instrument for the imports from Australia (Complete Table 4 on the separate answer sheet). c. Compare the forward quotes, money market hedges and options with each other to determine the best exchange rate hedges for Australia (Complete Table 5 on the separate answer sheet). d. Calculate the exchange rates that will apply if the money market hedges are used for the exports to Britain (Complete Table 6 on the separate answer sheet). e. Compare the forward quotes and money market hedges with each other to determine the best exchange rate hedges for Britain (Complete Table 7 on the separate answer sheet). f. Assume you entered into the forward hedge for the import from Australia. Two months have passed since you entered into the hedge. Interest rates are the same as before. The spot exchange rate of the $/AUD is 0.73000. Calculate the value of your forward position. Please use a 360 day- count convention, since the bank also used a 360 day-count convention with the forward quotes provided to you. Also remember for interest rates use risk free rates provided under scenario 1. Show your calculation in Table 8 on the separate answer sheet. + END OF QUESTIONS