Answered step by step

Verified Expert Solution

Question

1 Approved Answer

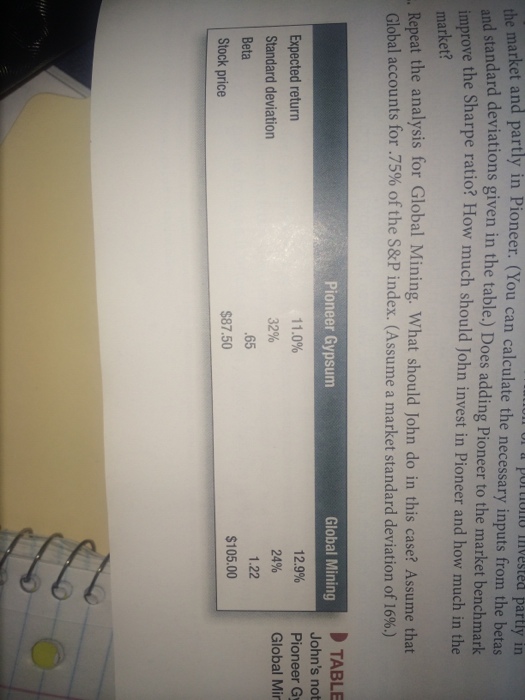

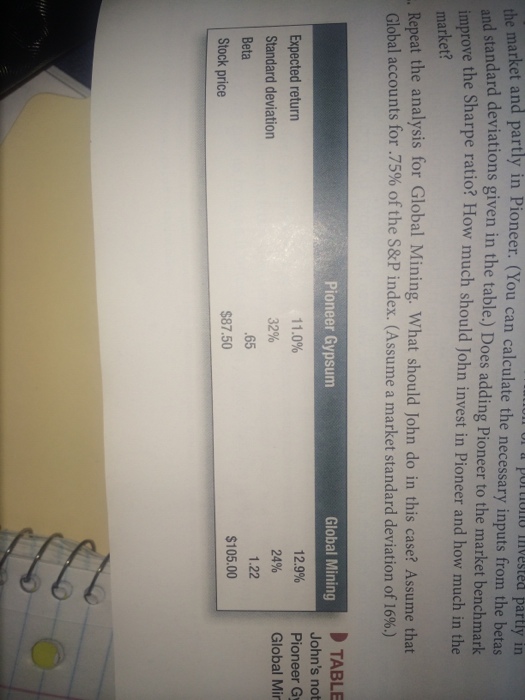

Table 8.4 reproduces John's notes on Pioneer Gysum and Global Mining. Calculate the expected return, risk premium, and standard deviation of a portfolio invested partly

Table 8.4 reproduces John's notes on Pioneer Gysum and Global Mining. Calculate the expected return, risk premium, and standard deviation of a portfolio invested partly in the market and partly in Pioneer.( You can calculate the necessary inputs from the betas and standard deviations given in the table) Does adding Pioneer to the market benchmark improve the Sharpe ratio? How much should John invest in Pioneer and how much in the market?

MINI-CASE John and Marsha on Portfolio Selection The scene: John and Marsha hold hands in a cozy French restaurant in downtown Manhattan several years before the mini-case in Chapter 9. Marsha is a futures-market trader. John manages a $125 million common-stock portfolio for a large pension fund. They have just ordered tourne dos financiere for the main course and flan financiere for dessert. John reads the financial pages of The Wall Street Journal by candlelight. John: Wow! Potato futures hit their daily limit. Let's add an order of gratin dauphinoise. Did you manage to hedge the forward interest rate on that euro loan? Marsha: John, please fold up that paper. (He does so reluctantly.) John. I love you. Will you marry me? John: Oh, Marsha, I love you too, but... there's something you must know about me-something I've never told anyone. Marsha: (concerned) John, what is it? John: I think I'm a closet indexer. Marsha: What? Why? John: My portfolio returns always seem to track the S&P 500 market index. Sometimes 1 do a little better, occasionally a little worse. But the correlation between my returns and the market returns is over 90%. Marsha: What's wrong with that? Your client wants a diversified portfolio of large-cap stocks. John: Why doesn't my client justas fund? Why is he paying me? Am I really adding Marsha: Oh, John, I know you're addinglue. You were a star security analyst. Of course your portfolio will follow the market value by active management? I ;ry, ont . 2uss !'m just an. . . indexer. John: It's not easy to find stocks that are truly over- or undervalued. I have firm opinions about a few, of course. Marsha: You were explaining why Pioneer Gypsum is a good buy. And you're bullish on Global Mining Repeat the analysis for Global Mining. What should John do in this case? Assume that Global accounts for .75% of the S&P index.(Assume!a market standard deviation of 16%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started