Question

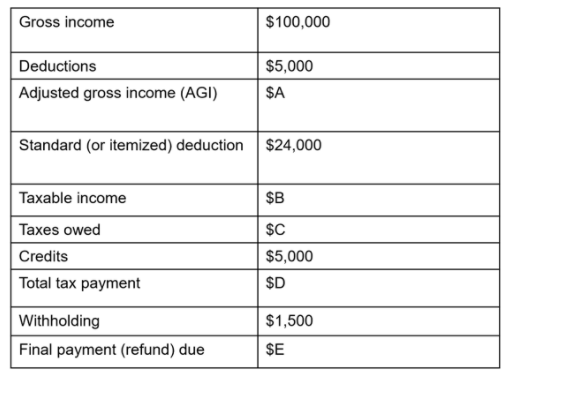

Table 9-3 below shows information about an individuals income tax. Suppose the marginal tax rate is as follows: For any dollar of taxable income below

Table 9-3 below shows information about an individuals income tax. Suppose the marginal tax rate is as follows: For any dollar of taxable income below $19,050, there is a tax of 10 on each dollar of taxable income. For the next $58,350 of taxable income, there is a tax of 12 on each dollar of taxable income. For the next $87,600, there is a tax of 22 on each dollar of taxable income.

1. Refer to Table 9-3. What number should be in the place of A, where A is the adjusted gross income of the individual? In your answer, do not enter a dollar sign.

2. Refer to Table 9-3. What number should be in the place of B, where B is the taxable income of the individual? In your answer, do not enter a dollar sign.

3. Refer to Table 9-3. What number should be in the place of C, where C is the taxes owed by the individual? In your answer, do not enter a dollar sign.

4. Refer to Table 9-3. What number should be in the place of D, where D is the total tax payment of the individual after accounting for credits, but not including withholdings? In your answer, do not enter a dollar sign.

5. Refer to Table 9-3. What number should be in the place of E, where E is the final tax payment of the individual after including credits and withholdings? In your answer, do not enter a dollar sign.

Gross income $100,000 Deductions $5,000 Adjusted gross income (AGI) $A Standard (or itemized) deduction $24,000 Taxable income $B Taxes owed $C Credits $5,000 Total tax payment $D Withholding $1,500 Final payment (refund) due $E Gross income $100,000 Deductions $5,000 Adjusted gross income (AGI) $A Standard (or itemized) deduction $24,000 Taxable income $B Taxes owed $C Credits $5,000 Total tax payment $D Withholding $1,500 Final payment (refund) due $EStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started