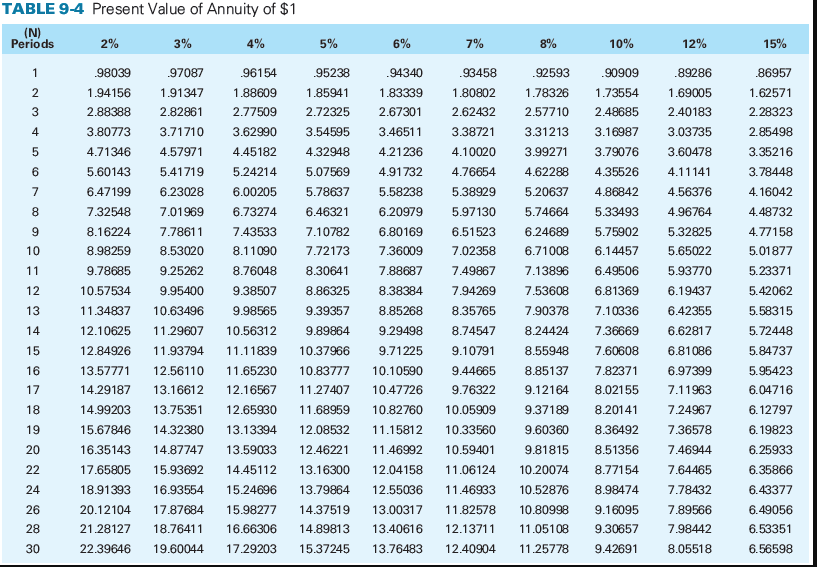

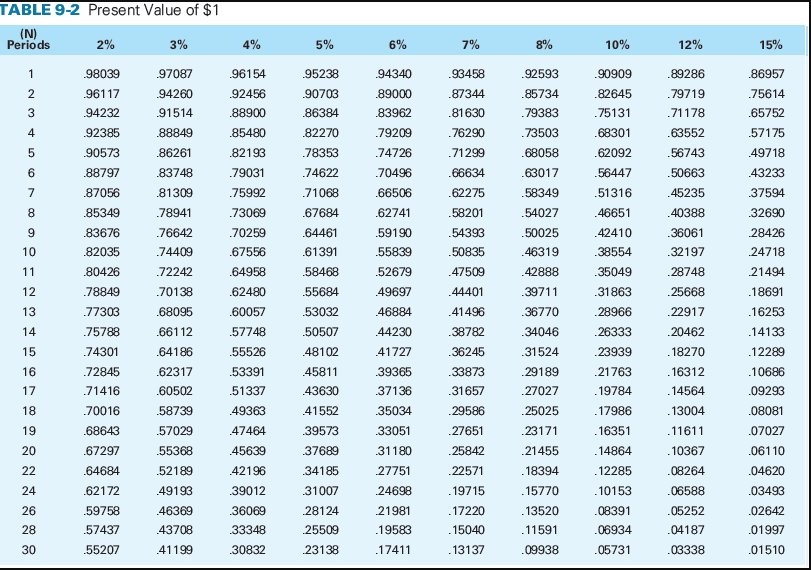

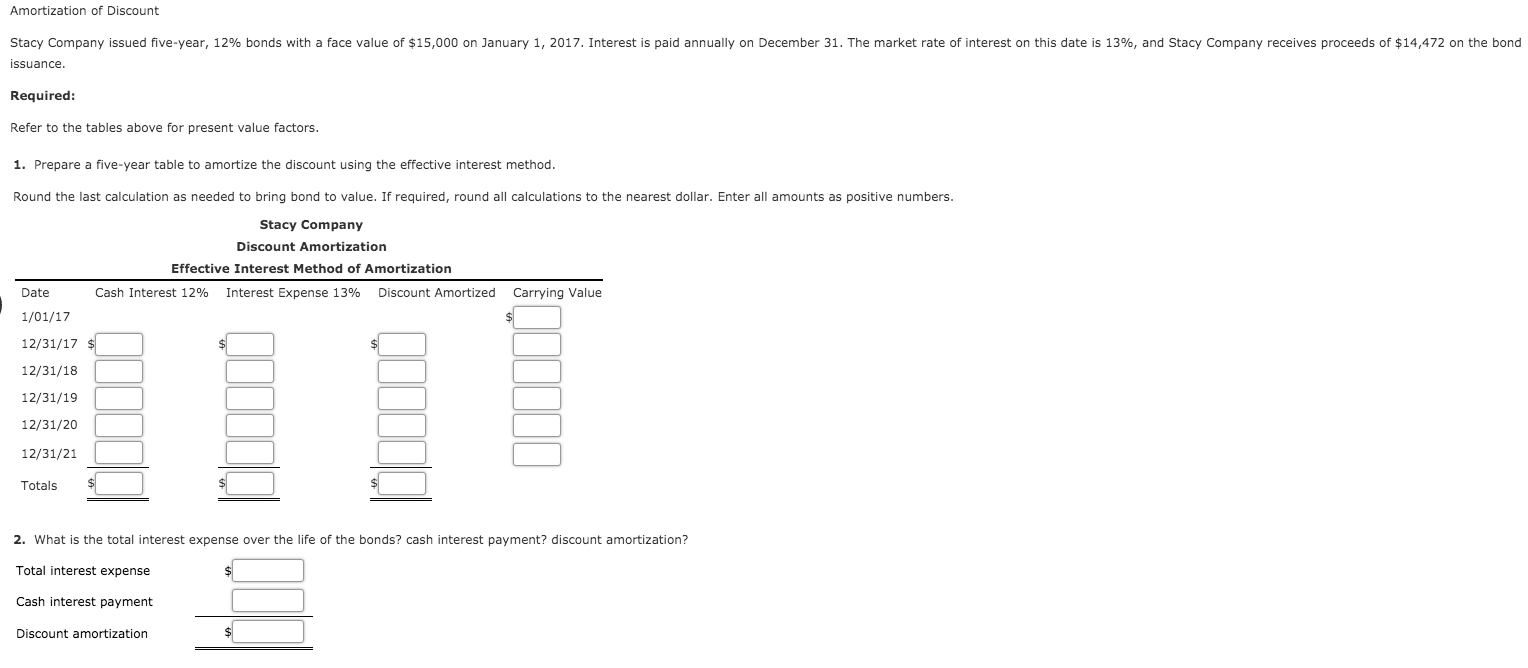

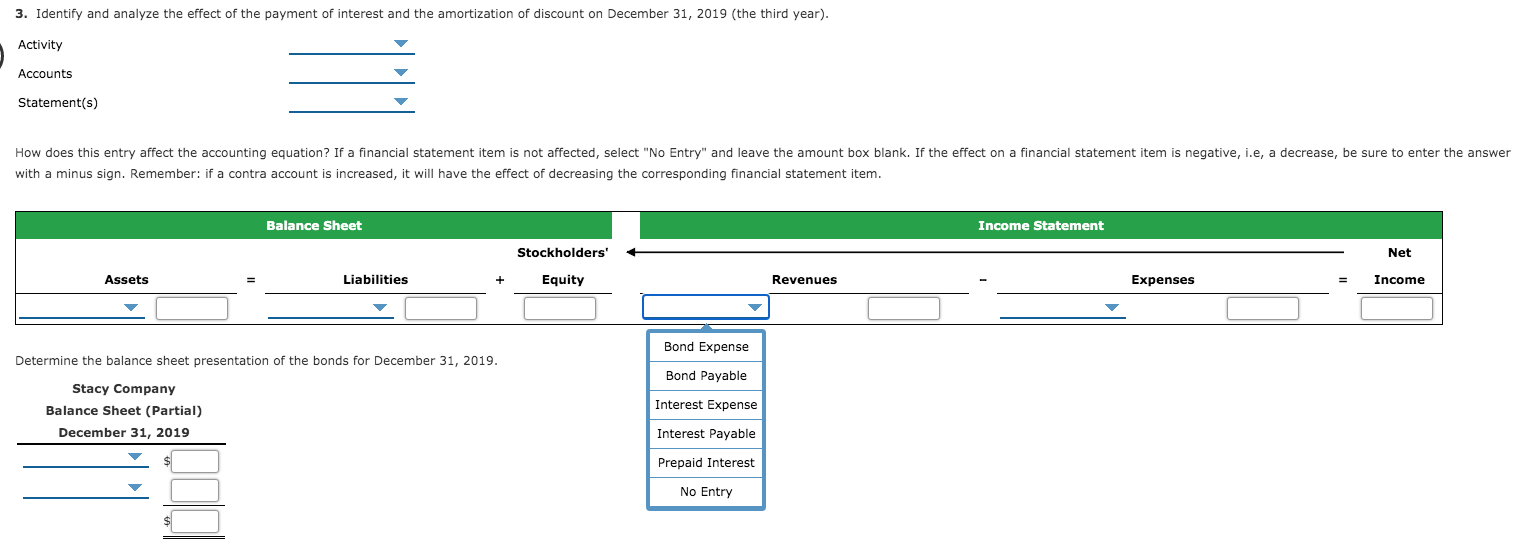

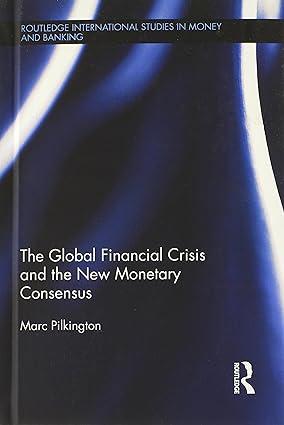

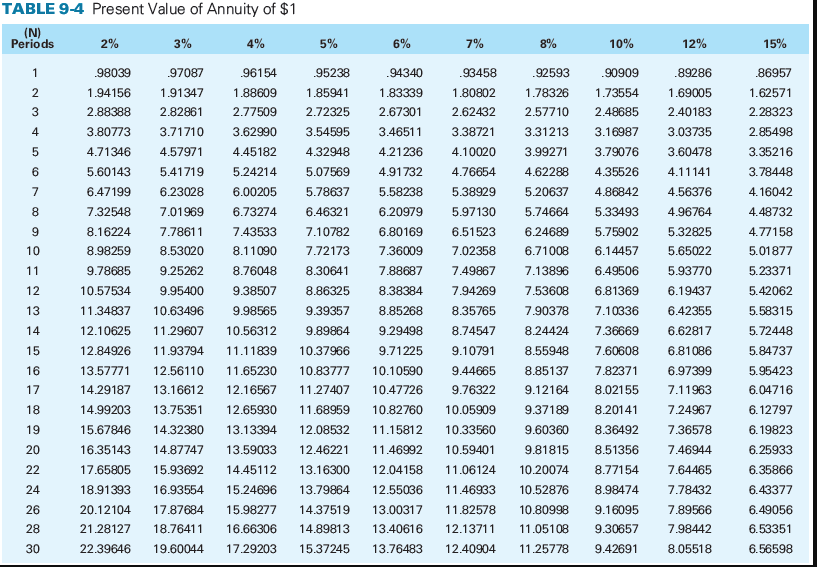

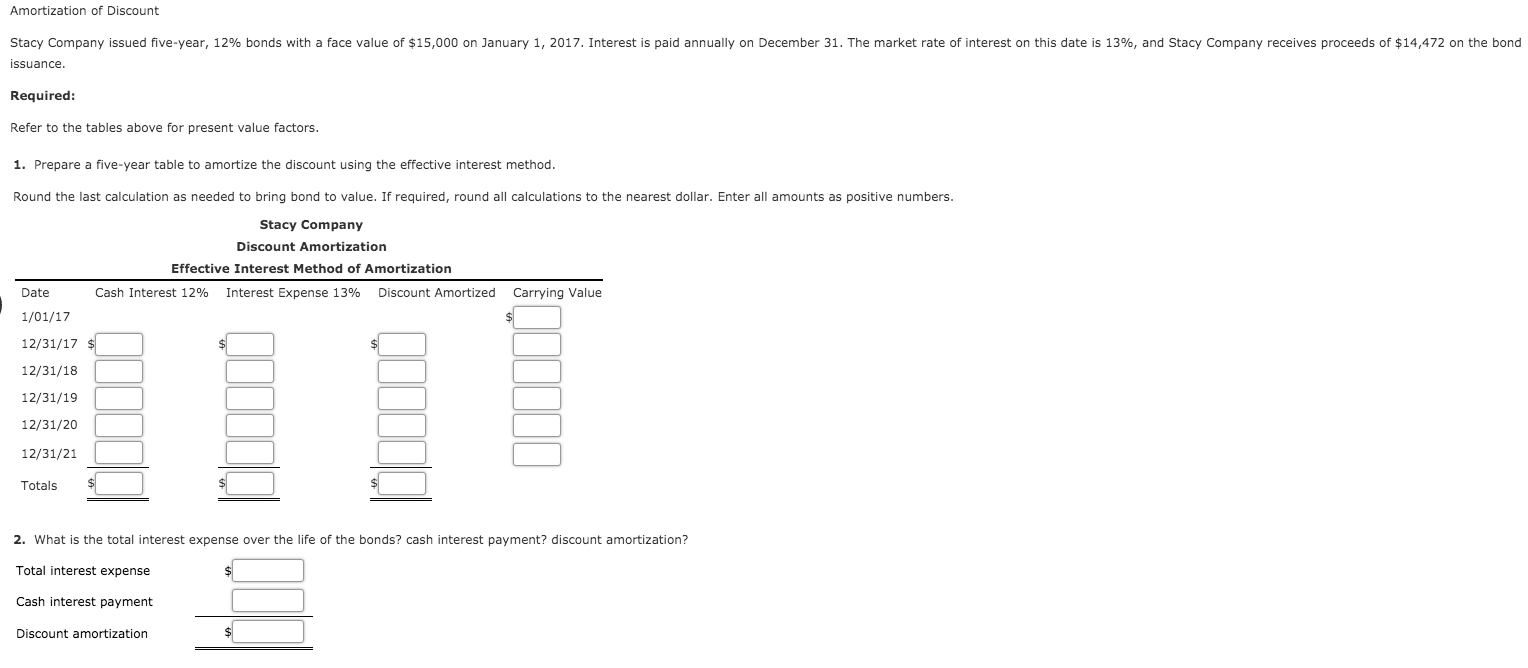

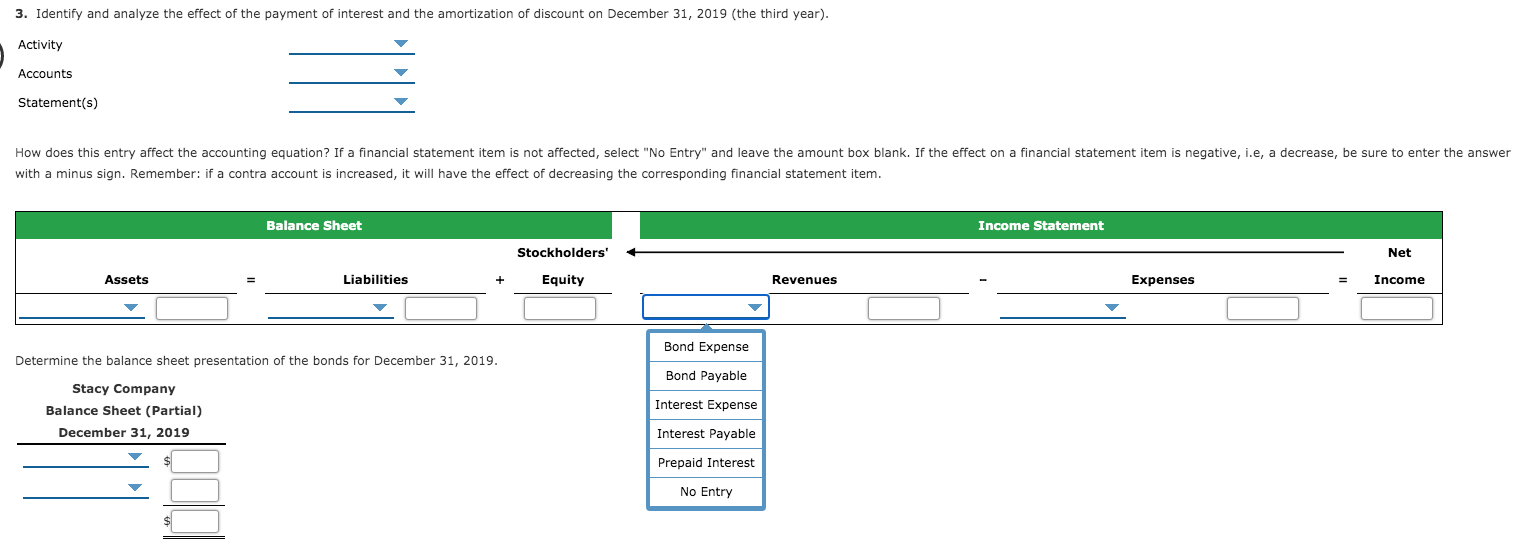

TABLE 9-4 Present Value of Annuity of $1 (N) Periods 2% 3% 4% 5% 6% 7% 8% 10% 12% 15% 1 .98039 .97087 .96154 .95238 .94340 .93458 92593 .90909 .89286 .86957 2 1.94156 1.91347 1.88609 1.85941 1.83339 1.80802 1.78326 1.73554 1.69005 1.62571 3 2.88388 2.82861 2.77509 2.72325 2.67301 2.62432 2.57710 2.48685 2.40183 2.28323 4 3.80773 3.71710 3.62990 3.54595 3.46511 3.38721 3.31213 3.16987 3.03735 2.85498 5 4.71346 4.57971 4.45182 4.32948 4.21236 4.10020 3.99271 3.79076 3.60478 3.35216 6 5.60143 5.41719 5.24214 5.07569 4.91732 4.76654 4.62288 4.35526 4.11141 3.78448 7 6.47199 6.23028 6.00205 5.78637 5.58238 5.38929 5.20637 4.86842 4.56376 4.16042 8 7.32548 7.01969 6.73274 6.46321 6.20979 5.97130 5.74664 5.33493 4.96764 4.48732 9 8.16224 7.78611 7.43533 7.10782 6.80169 6.51523 6.24689 5.75902 5.32825 4.77158 10 8.98259 8.53020 8.11090 7.72173 7.36009 7.02358 6.71008 6.14457 5.65022 5.01877 11 9.78685 9.25262 8.76048 8.30641 7.88687 7.49867 7.13896 6.49506 5.93770 5.23371 12 10.57534 9.95400 9.38507 8.86325 8.38384 7.94269 7.53608 6.81369 6.19437 5.42062 13 11.34837 10.63496 9.98565 9.39357 8.85268 8.35765 7.90378 7.10336 6.42355 5.58315 14 12.10625 11.29607 10.56312 9.89864 9.29498 8.74547 8.24424 7.36669 6.62817 5.72448 15 12.84926 11.93794 11.11839 10.37966 9.71225 9.10791 8.55948 7.60608 6.81086 5.84737 16 13.57771 12.56110 11.65230 10.83777 10.10590 9.44665 8.85137 7.82371 6.97399 5.95423 17 14.29187 13.16612 12.16567 11.27407 10.47726 9.76322 9.12164 8.02155 7.11963 6.04716 18 14.99203 13.75351 12.65930 11.68959 10.82760 10.05909 9.37189 8.20141 7.24967 6.12797 19 15.67846 14.32380 13.13394 12.08532 11.15812 10.33560 9.60360 8.36492 7.36578 6.19823 20 16.35143 14.87747 13.59033 12.46221 11.46992 10.59401 9.81815 8.51356 7.46944 6.25933 22 17.65805 15.93692 14.45112 13.16300 12.04158 11.06124 10.20074 8.77154 7.64465 6.35866 24 18.91393 16.93554 15.24696 13.79864 12.55036 11.46933 10.52876 8.98474 7.78432 6.43377 26 20.12104 17.87684 15.98277 14.37519 13.00317 11.82578 10.80998 9.16095 7.89566 6.49056 28 21.28127 18.76411 16.66306 14.89813 13.40616 12.13711 11.05108 9.30657 7.98442 6.53351 30 22.39646 19.60044 17.29203 15.37245 13.76483 12.40904 11.25778 9.42691 8.05518 6.56598 TABLE 9-2 Present Value of $1 (N) Periods 2% 3% 4% 5% 6% 7% 8% 10% 12% 15% 1 .98039 .97087 .96154 .95238 .94340 93458 .92593 .90909 .89286 .86957 2 .96117 .94260 .92456 .90703 .89000 .87344 .85734 .82645 ..79719 .75614 3 .94232 .91514 88900 .86384 .83962 .81630 .79383 .75131 .71178 .65752 4 .92385 .88849 .85480 .82270 .79209 .76290 .73503 .68301 .63552 .57175 5 .90573 .86261 .82193 .78353 .74726 .71299 .68058 .62092 .56743 49718 6 .88797 .83748 .79031 74622 .70496 .66634 .63017 .56447 .50663 43233 7 .87056 .81309 .75992 .71068 .66506 .62275 .58349 .51316 45235 .37594 00 .85349 .78941 .73069 .67684 .62741 .58201 .54027 46651 40388 .32690 9 .83676 .76642 .70259 .64461 .59190 .54393 -50025 .42410 .36061 28426 10 .82035 .74409 .67556 .61391 .55839 .50835 46319 .38554 .32197 24718 11 .80426 .72242 .64958 58468 .52679 47509 .42888 35049 .28748 21494 12 .78849 .70138 .62480 .55684 49697 44401 .39711 .31863 .25668 .18691 13 .77303 .68095 .60057 .53032 46884 .41496 .36770 28966 .22917 .16253 14 .75788 .66112 .57748 .50507 44230 .38782 .34046 26333 20462 .14133 15 .74301 .64186 .55526 48102 41727 .36245 31524 23939 .18270 .12289 16 .72845 .62317 .53391 45811 39365 .33873 .29189 .21763 .16312 .10686 17 .71416 .60502 .51337 43630 37136 .31657 27027 .19784 .14564 .09293 18 .70016 .58739 49363 41552 35034 .29586 25025 . 17986 .13004 .08081 19 .68643 -57029 47464 .39573 33051 27651 23171 .16351 .11611 .07027 20 .67297 .55368 45639 .37689 31180 .25842 .21455 14864 .10367 .06110 22 .64684 .52189 .42196 34185 27751 22571 .18394 .12285 .08264 .04620 24 .62172 49193 39012 31007 24698 .19715 .15770 .10153 .06588 .03493 26 .59758 .46369 36069 28124 21981 .17220 .13520 .08391 .05252 .02642 28 .57437 43708 .33348 25509 .19583 . 15040 .11591 .06934 .04187 .01997 30 .55207 41199 .30832 23138 17411 .13137 .09938 05731 .03338 .01510 Amortization of Discount Stacy Company issued five-year, 12% bonds with a face value of $15,000 on January 1, 2017. Interest is paid annually on December 31. The market rate of interest on this date is 13%, and Stacy Company receives proceeds of $14,472 on the bond issuance. Required: Refer to the tables above for present value factors. 1. Prepare a five-year table to amortize the discount using the effective interest method. Round the last calculation as needed to bring bond to value. If required, round all calculations to the nearest dollar. Enter all amounts as positive numbers. Stacy Company Discount Amortization Effective Interest Method of Amortization Date Cash Interest 12% Interest Expense 13% Discount Amortized Carrying Value 1/01/17 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21 Totals 2. What is the total interest expense over the life of the bonds? cash interest payment? discount amortization? Total interest expense Cash interest payment Discount amortization 3. Identify and analyze the effect of the payment of interest and the amortization of discount on December 31, 2019 (the third year). Activity Accounts Statement(s) How does this entry affect the accounting equation? If a financial statement item is not affected, select "No Entry" and leave the amount box blank. If the effect on a financial statement item is negative, i.e, a decrease, be sure to enter the answer with a minus sign. Remember: if a contra account is increased, it will have the effect of decreasing the corresponding financial statement item. Balance Sheet Income Statement Stockholders' Net Assets Liabilities + Equity Revenues Expenses Income Bond Expense Determine the balance sheet presentation of the bonds for December 31, 2019. Bond Payable Stacy Company Interest Expense Balance Sheet (Partial) December 31, 2019 Interest Payable Prepaid Interest No Entry