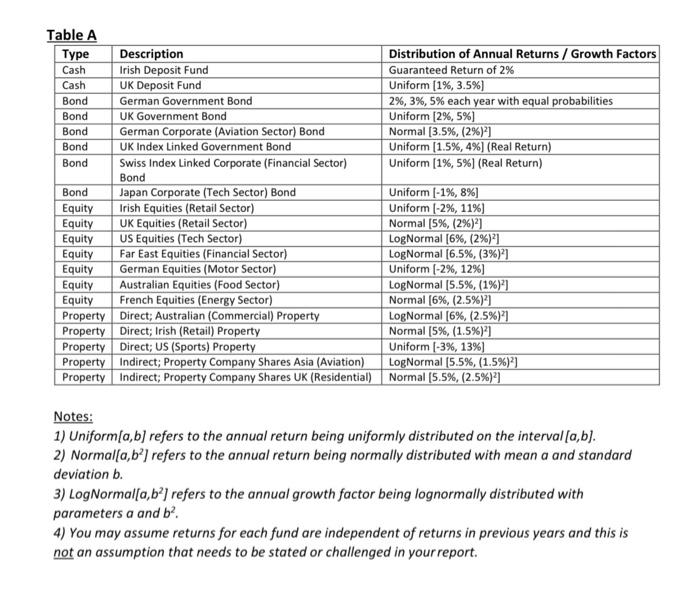

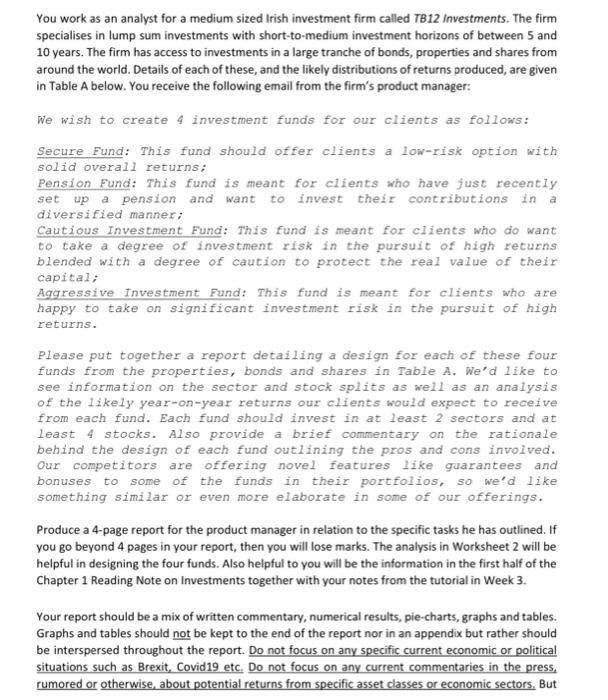

Table A Type Description Distribution of Annual Returns / Growth Factors Cash Irish Deposit Fund Guaranteed Return of 2% Cash UK Deposit Fund Uniform (1%, 3.5%) Bond German Government Bond 2%, 3%, 5% each year with equal probabilities Bond UK Government Bond Uniform (2%,5%) Bond German Corporate (Aviation Sector) Bond Normal (3.5%, (2%)] Bond UK Index Linked Government Bond Uniform (1.5%, 4%) (Real Return) Bond Swiss Index Linked Corporate Financial Sector) Uniform [1%,5%) (Real Return) Bond Bond Japan Corporate (Tech Sector) Bond Uniform [-1%, 8%] Equity Irish Equities (Retail Sector) Uniform (-2%, 11%) Equity UK Equities (Retail Sector) Normal [5%, (2%)1 Equity US Equities (Tech Sector) LogNormal [6%, (2%)') Equity Far East Equities (Financial Sector) LogNormal (6.5%, (3%)1 Equity German Equities (Motor Sector) Uniform (-2%, 12%] Equity Australian Equities (Food Sector) LogNormal [5.5%, (1%)'] Equity French Equities (Energy Sector) Normal [6%, (2.5%)') Property Direct; Australian (Commercial) Property LogNormal [6%, (2.5%)*1 Property Direct; Irish (Retail) Property Normal [5%, (1.5%) 1 Property Direct; US (Sports) Property Uniform (-3%, 13%) Property Indirect; Property Company Shares Asia (Aviation) LogNormal (5.5%, (1.5%)*) Property Indirect; Property Company Shares UK (Residential) Normal (5.5%, (2.5%)?) Notes: 1) Uniform(a,b) refers to the annual return being uniformly distributed on the interval [a,b). 2) Normal(a,b) refers to the annual return being normally distributed with mean a and standard deviation b. 3) LogNormalfa,b) refers to the annual growth factor being lognormally distributed with parameters a and b? 4) You may assume returns for each fund are independent of returns in previous years and this is not an assumption that needs to be stated or challenged in your report You work as an analyst for a medium sized Irish investment firm called T812 Investments. The firm specialises in lump sum investments with short-to-medium investment horizons of between 5 and 10 years. The firm has access to investments in a large tranche of bonds, properties and shares from around the world. Details of each of these, and the likely distributions of returns produced, are given in Table A below. You receive the following email from the firm's product manager: We wish to create 4 investment funds for our clients as follows: Secure Fund: This fund should offer clients a low-risk option with solid overall returns; Pension Fund: This fund is meant for clients who have just recently set up a pension and want to invest their contributions in a diversified manner; Cautious Investment Fund: This fund is meant for clients who do want to take a degree of investment risk in the pursuit of high returns blended with a degree of caution to protect the real value of their capital; Aggressive Investment Fund: This fund is meant for clients who are happy to take on significant investment risk in the pursuit of high returns. Please put together a report detailing a design for each of these four funds from the properties, bonds and shares in Table A. We'd like to see information on the sector and stock splits as well as an analysis of the likely year-on-year returns our clients would expect to receive from each fund. Each fund should invest in at least 2 sectors and at least 4 stocks. Also provide a brief commentary on the rationale behind the design of each fund outlining the pros and cons involved. Our competitors are offering novel features like guarantees and bonuses to some of the funds in their portfolios, so we'd like something similar or even more elaborate in some of our offerings. Produce a 4-page report for the product manager in relation to the specific tasks he has outlined. If you go beyond 4 pages in your report, then you will lose marks. The analysis in Worksheet 2 will be helpful in designing the four funds. Also helpful to you will be the information in the first half of the Chapter 1 Reading Note on Investments together with your notes from the tutorial in Week 3. Your report should be a mix of written commentary, numerical results, pie-charts, graphs and tables. Graphs and tables should not be kept to the end of the report nor in an appendix but rather should be interspersed throughout the report. Do not focus on any specific current economic or political situations such as Brexit, Covid19 etc. Do not focus on any current commentaries in the press, rumored or otherwise, about potential returns from specific asset classes or economic sectors. But Table A Type Description Distribution of Annual Returns / Growth Factors Cash Irish Deposit Fund Guaranteed Return of 2% Cash UK Deposit Fund Uniform (1%, 3.5%) Bond German Government Bond 2%, 3%, 5% each year with equal probabilities Bond UK Government Bond Uniform (2%,5%) Bond German Corporate (Aviation Sector) Bond Normal (3.5%, (2%)] Bond UK Index Linked Government Bond Uniform (1.5%, 4%) (Real Return) Bond Swiss Index Linked Corporate Financial Sector) Uniform [1%,5%) (Real Return) Bond Bond Japan Corporate (Tech Sector) Bond Uniform [-1%, 8%] Equity Irish Equities (Retail Sector) Uniform (-2%, 11%) Equity UK Equities (Retail Sector) Normal [5%, (2%)1 Equity US Equities (Tech Sector) LogNormal [6%, (2%)') Equity Far East Equities (Financial Sector) LogNormal (6.5%, (3%)1 Equity German Equities (Motor Sector) Uniform (-2%, 12%] Equity Australian Equities (Food Sector) LogNormal [5.5%, (1%)'] Equity French Equities (Energy Sector) Normal [6%, (2.5%)') Property Direct; Australian (Commercial) Property LogNormal [6%, (2.5%)*1 Property Direct; Irish (Retail) Property Normal [5%, (1.5%) 1 Property Direct; US (Sports) Property Uniform (-3%, 13%) Property Indirect; Property Company Shares Asia (Aviation) LogNormal (5.5%, (1.5%)*) Property Indirect; Property Company Shares UK (Residential) Normal (5.5%, (2.5%)?) Notes: 1) Uniform(a,b) refers to the annual return being uniformly distributed on the interval [a,b). 2) Normal(a,b) refers to the annual return being normally distributed with mean a and standard deviation b. 3) LogNormalfa,b) refers to the annual growth factor being lognormally distributed with parameters a and b? 4) You may assume returns for each fund are independent of returns in previous years and this is not an assumption that needs to be stated or challenged in your report You work as an analyst for a medium sized Irish investment firm called T812 Investments. The firm specialises in lump sum investments with short-to-medium investment horizons of between 5 and 10 years. The firm has access to investments in a large tranche of bonds, properties and shares from around the world. Details of each of these, and the likely distributions of returns produced, are given in Table A below. You receive the following email from the firm's product manager: We wish to create 4 investment funds for our clients as follows: Secure Fund: This fund should offer clients a low-risk option with solid overall returns; Pension Fund: This fund is meant for clients who have just recently set up a pension and want to invest their contributions in a diversified manner; Cautious Investment Fund: This fund is meant for clients who do want to take a degree of investment risk in the pursuit of high returns blended with a degree of caution to protect the real value of their capital; Aggressive Investment Fund: This fund is meant for clients who are happy to take on significant investment risk in the pursuit of high returns. Please put together a report detailing a design for each of these four funds from the properties, bonds and shares in Table A. We'd like to see information on the sector and stock splits as well as an analysis of the likely year-on-year returns our clients would expect to receive from each fund. Each fund should invest in at least 2 sectors and at least 4 stocks. Also provide a brief commentary on the rationale behind the design of each fund outlining the pros and cons involved. Our competitors are offering novel features like guarantees and bonuses to some of the funds in their portfolios, so we'd like something similar or even more elaborate in some of our offerings. Produce a 4-page report for the product manager in relation to the specific tasks he has outlined. If you go beyond 4 pages in your report, then you will lose marks. The analysis in Worksheet 2 will be helpful in designing the four funds. Also helpful to you will be the information in the first half of the Chapter 1 Reading Note on Investments together with your notes from the tutorial in Week 3. Your report should be a mix of written commentary, numerical results, pie-charts, graphs and tables. Graphs and tables should not be kept to the end of the report nor in an appendix but rather should be interspersed throughout the report. Do not focus on any specific current economic or political situations such as Brexit, Covid19 etc. Do not focus on any current commentaries in the press, rumored or otherwise, about potential returns from specific asset classes or economic sectors. But