Answered step by step

Verified Expert Solution

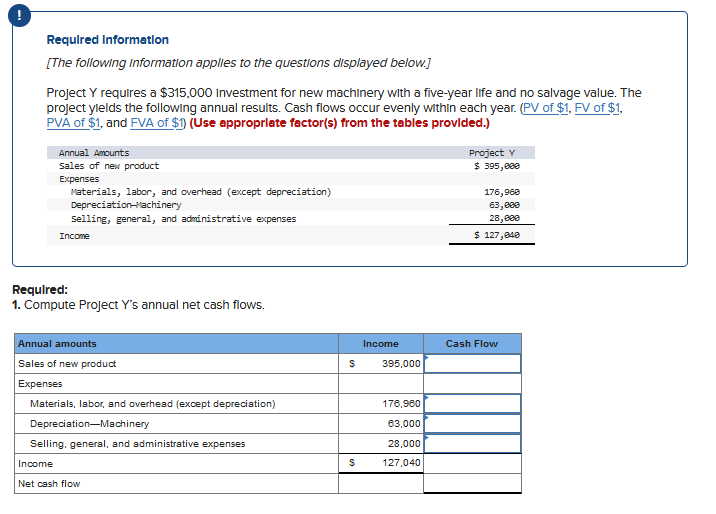

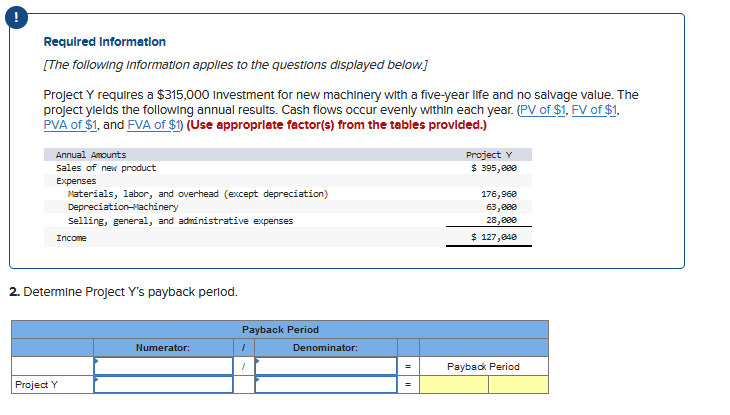

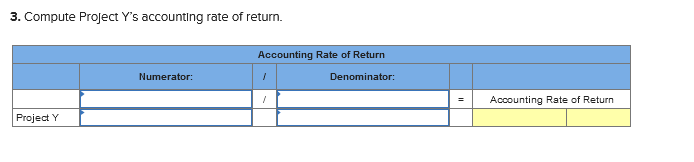

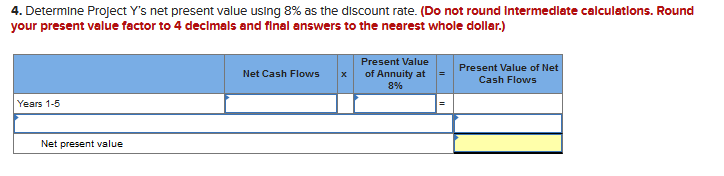

Question

1 Approved Answer

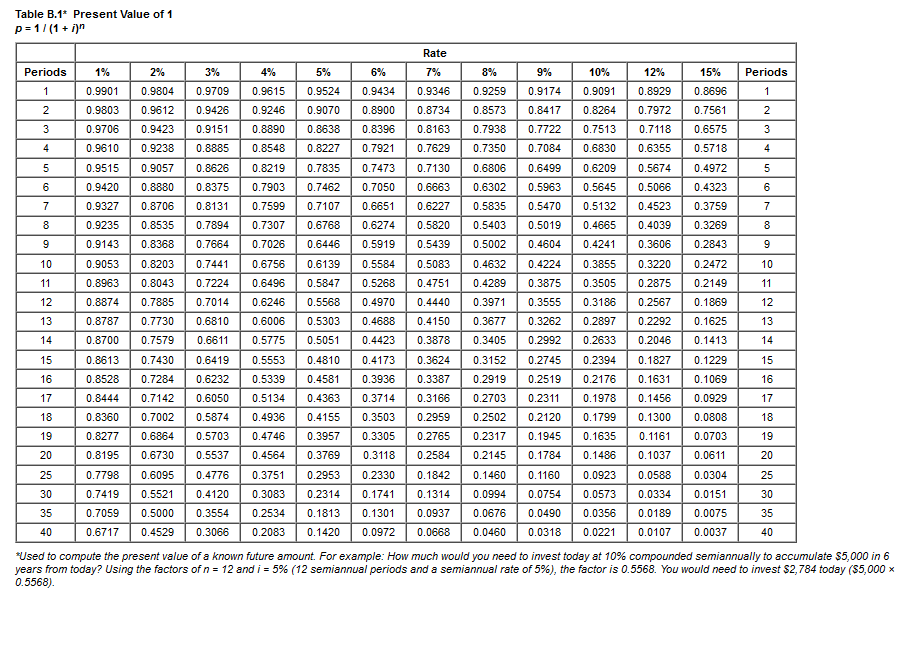

Table B.1* Present Value of 1 [ p=1 /(1+i)^{n} ] *Used to compute the present value of a known future amount. For example: How much

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started