Answered step by step

Verified Expert Solution

Question

1 Approved Answer

table [ [ Balance Sheet items, 2 0 1 8 , 2 0 1 7 , Income Statement items, 2 0 1 8 ,

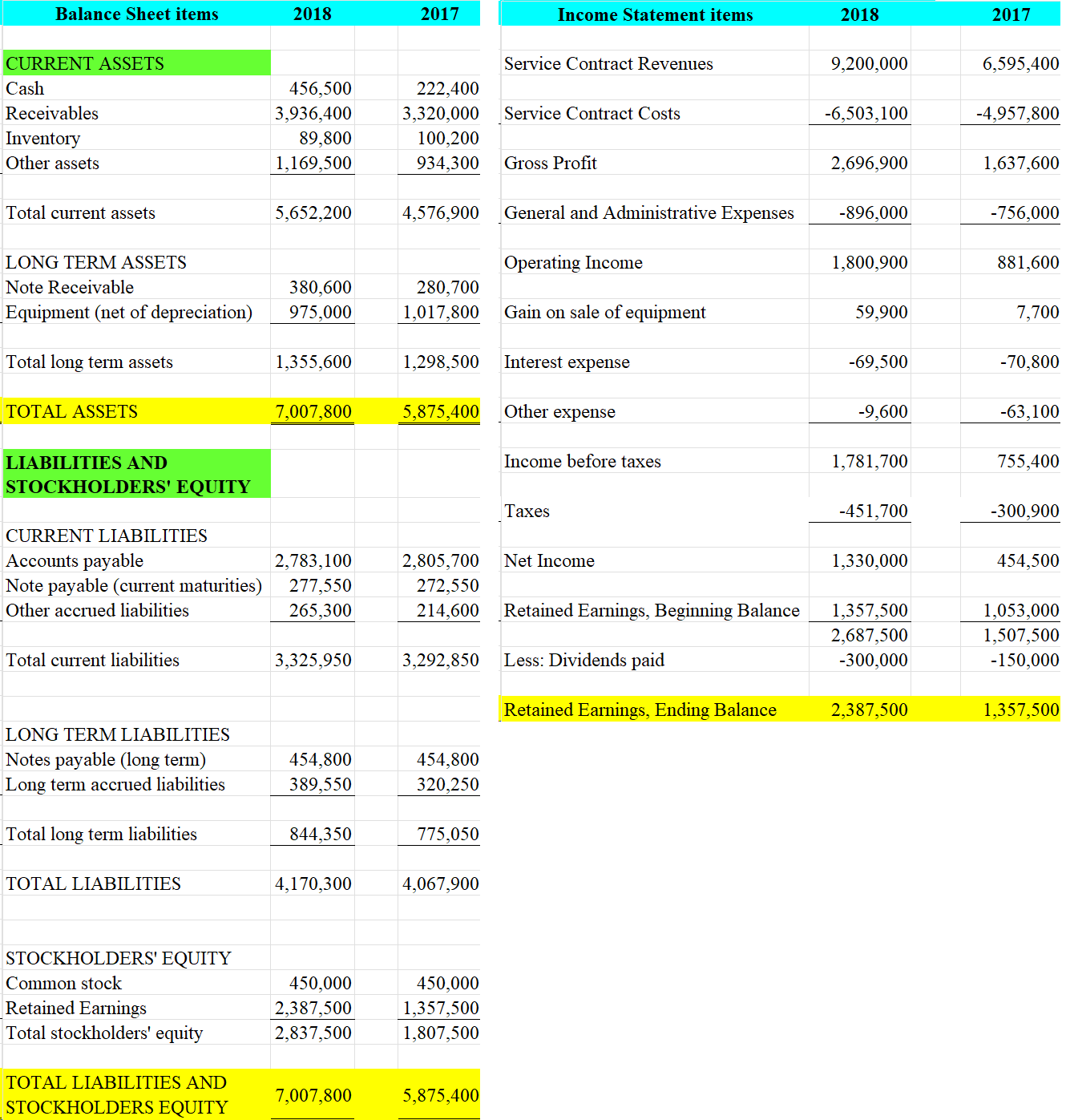

tableBalance Sheet items,Income Statement items,CURRENT ASSETS,,,Service Contract Revenues, Case Study Comic book sales have hit record highs due to the volume of comic bookbased movies achieving great success. With each new movie and character announcement, collectors and investors feed off the speculation. Many collectors send their books for grading, certification, and encapsulation to protect their investments. The Exceptional Service Grading Company provides those services and wants to expand to assessing other publication formats, such as certifying large magazines and movie posters. What is the companys financial position? Please refer to the income statement and balance sheet for the Exceptional Service Grading Company available here. Using the learning resources provided in the Reading Assignment, perform a financial ratio analysis of the company using the following ratios: Gross profit margin Current ratio Debt ratio Locate two other ratios to calculate. Define them and explain their purpose and how they add value to your analysis. Select significant lines from the financial statements and provide an observation of their trends. For example, if the account is increasing or decreasing in value, what would that indicate? Draw some conclusions based on your observations. For example: Is there any viability for a new project? Why do you think the assets of the company went up from to What implications does this have? What followup questions do you have to ask the companys management? Logically support your observations. Explain the limitations when using ratio analysis of financial statements. In this paper, please include the following: Provide the correct values for the calculations Explain your approach to the problem. Support your approach with references, and execute your approach. Provide an answer to the case study questions with a recommendation.

tableBalance Sheet items,Income Statement items,CURRENT ASSETS,,,Service Contract Revenues,

Case Study

Comic book sales have hit record highs due to the volume of comic bookbased movies achieving great success. With each new movie and character announcement, collectors and investors feed off the speculation. Many collectors send their books for grading, certification, and encapsulation to protect their investments. The Exceptional Service Grading Company provides those services and wants to expand to assessing other publication formats, such as certifying large magazines and movie posters.

What is the companys financial position? Please refer to the income statement and balance sheet for the Exceptional Service Grading Company available here. Using the learning resources provided in the Reading Assignment, perform a financial ratio analysis of the company using the following ratios:

Gross profit margin

Current ratio

Debt ratio

Locate two other ratios to calculate. Define them and explain their purpose and how they add value to your analysis.

Select significant lines from the financial statements and provide an observation of their trends. For example, if the account is increasing or decreasing in value, what would that indicate?

Draw some conclusions based on your observations. For example:

Is there any viability for a new project?

Why do you think the assets of the company went up from to

What implications does this have?

What followup questions do you have to ask the companys management?

Logically support your observations. Explain the limitations when using ratio analysis of financial statements.

In this paper, please include the following:

Provide the correct values for the calculations

Explain your approach to the problem.

Support your approach with references, and execute your approach.

Provide an answer to the case study questions with a recommendation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started