Answered step by step

Verified Expert Solution

Question

1 Approved Answer

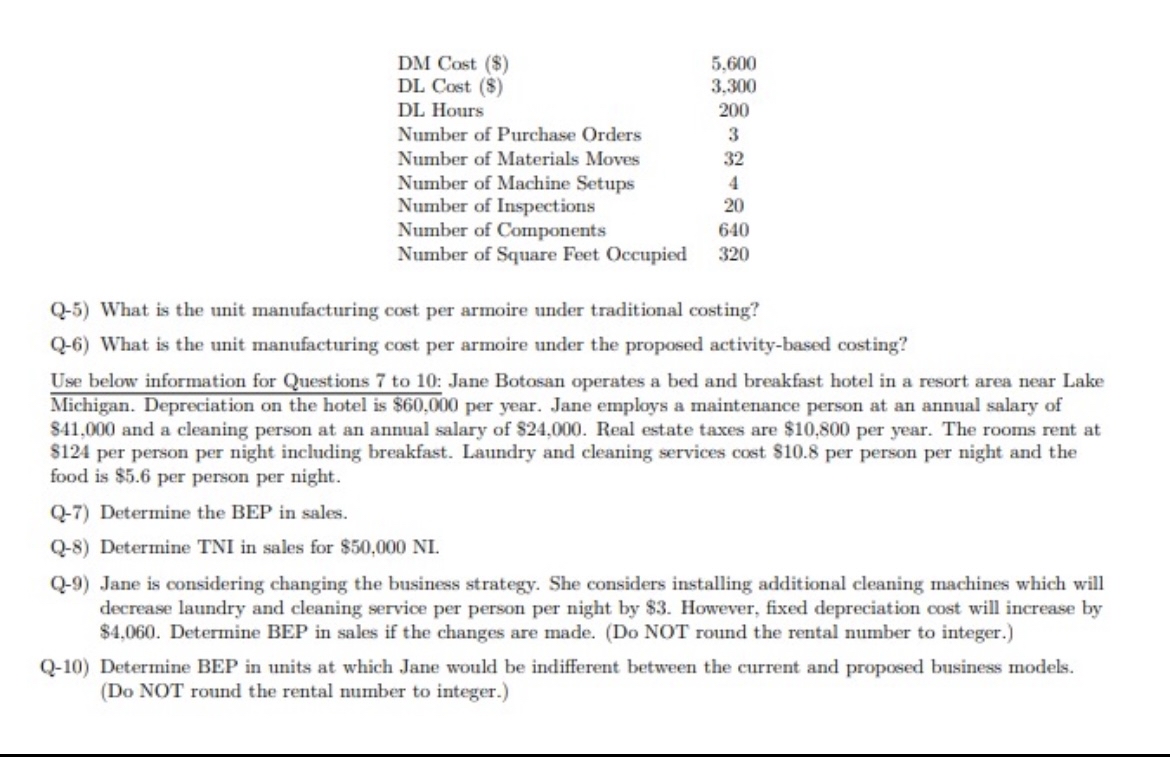

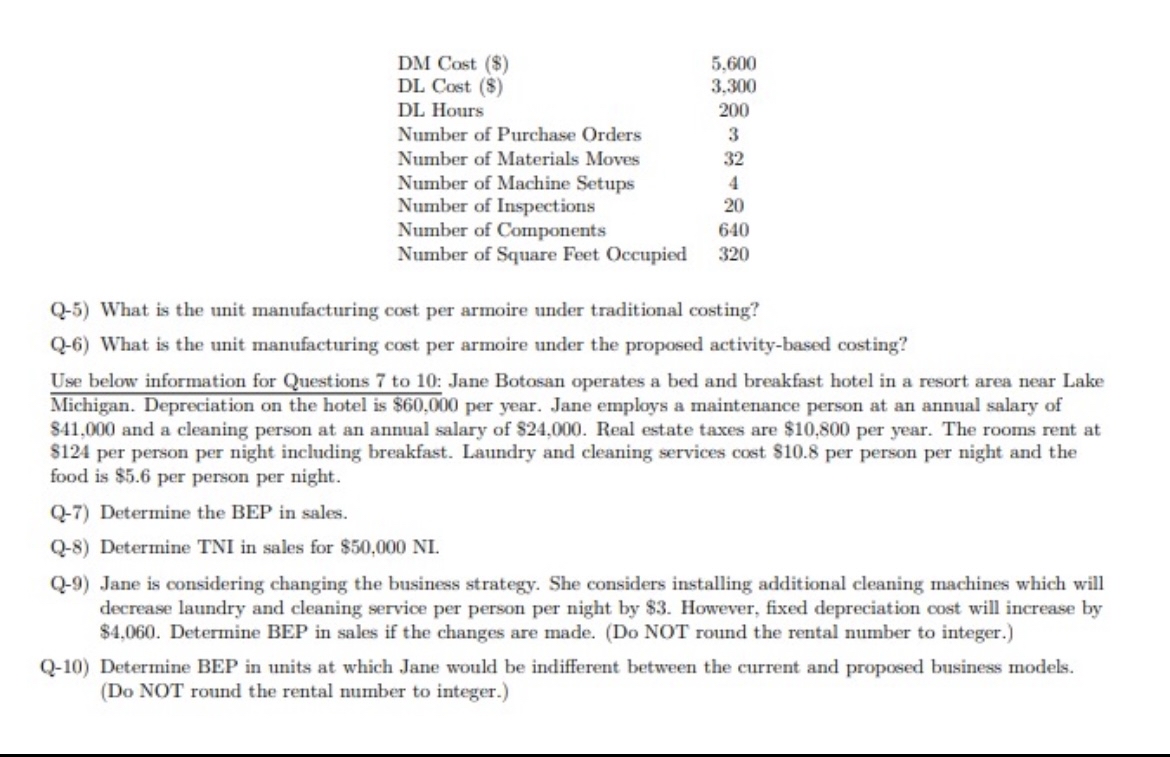

table [ [ DM Cost ( $ ) , 5 , 6 0 0 ] , [ DL Cost ( $ ) , 3

tableDM Cost $DL Cost $DL Hours,Number of Purchase Orders,Number of Materials Moves,Number of Machine Setups,Number of Inspections,Number of Components,Number of Square Feet Occupied,

Q What is the unit manufacturing cost per armoire under traditional costing?

Q What is the unit manufacturing cost per armoire under the proposed activitybased costing?

Use below information for Questions to : Jane Botosan operates a bed and breakfast hotel in a resort area near Lake Michigan. Depreciation on the hotel is $ per year. Jane employs a maintenance person at an annual salary of $ and a cleaning person at an annual salary of $ Real estate taxes are $ per year. The rooms rent at $ per person per night including breakfast. Laundry and cleaning services cost $ per person per night and the food is $ per person per night.

Q Determine the BEP in sales.

Q Determine TNI in sales for $

Q Jane is considering changing the business strategy. She considers installing additional cleaning machines which will decrease laundry and cleaning service per person per night by $ However, fixed depreciation cost will increase by $ Determine BEP in sales if the changes are made. Do NOT round the rental number to integer.

Q Determine BEP in units at which Jane would be indifferent between the current and proposed business models. Do NOT round the rental number to integer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started