Answered step by step

Verified Expert Solution

Question

1 Approved Answer

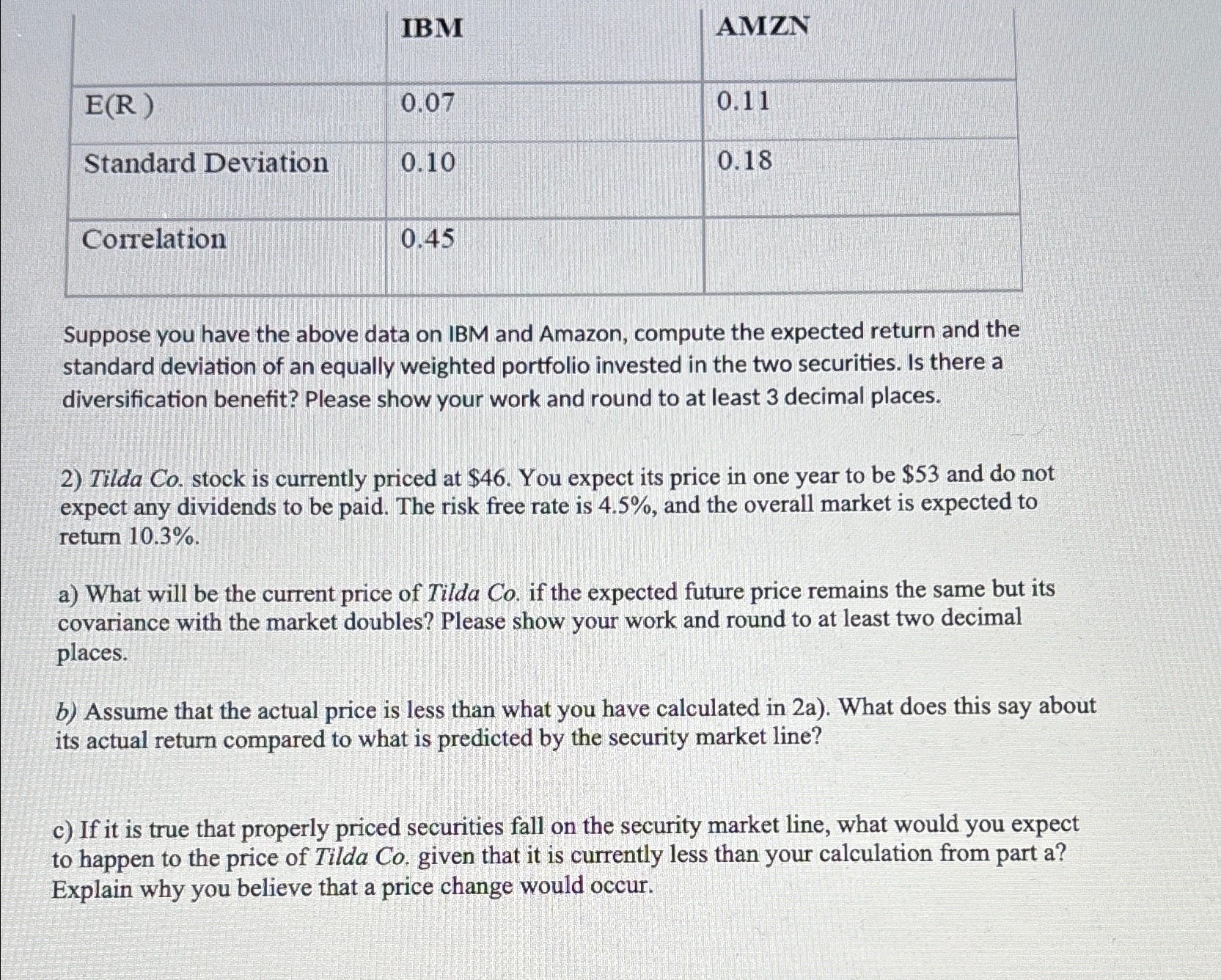

table [ [ , IBM,AMZN ] , [ E ( R ) , 0 . 0 7 , 0 . 1 1 ] ,

tableIBM,AMZNERStandard Deviation,Correlation

Suppose you have the above data on IBM and Amazon, compute the expected return and the standard deviation of an equally weighted portfolio invested in the two securities Is there a diversification benefit? Please show your work and round to at least decimal places.

Tilda Co stock is currently priced at $ You expect its price in one year to be $ and do not expect any dividends to be paid. The risk free rate is and the overall market is expected to return

a What will be the current price of Tilda Co if the expected future price remains the same but its covariance with the market doubles? Please show your work and round to at least two decimal places.

b Assume that the actual price is less than what you have calculated in a What does this say about its actual return compared to what is predicted by the security market line?

c If it is true that properly priced securities fall on the security market line, what would you expect to happen to the price of Tilda Co given that it is currently less than your calculation from part a Explain why you believe that a price change would occur.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started