Answered step by step

Verified Expert Solution

Question

1 Approved Answer

table [ [ NE Company ] , [ GENERAL LEDGER ] , [ Account Name, table [ [ G / L Account ]

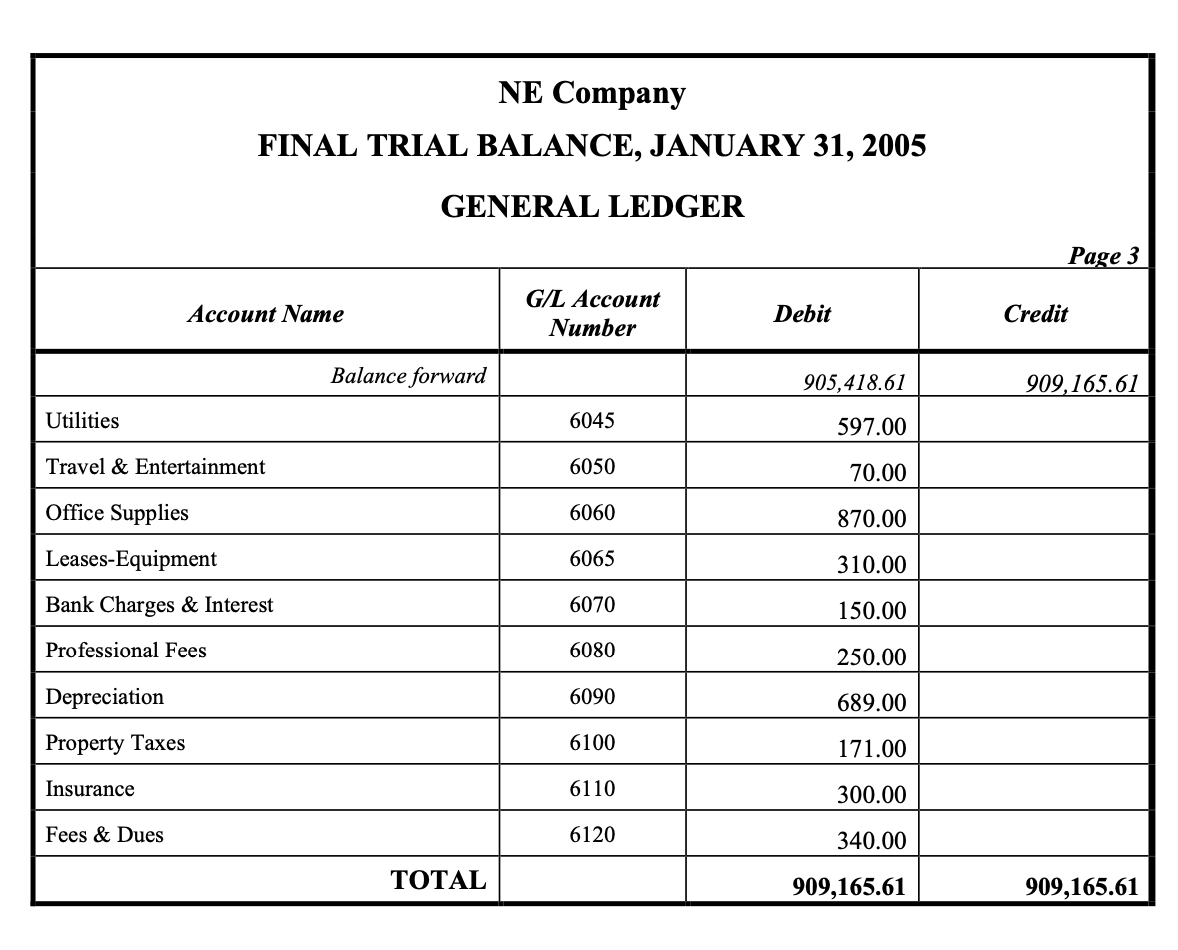

tableNE CompanyGENERAL LEDGERAccount Name,tableGL AccountNumberDebit,Cage Balance forward,,UtilitiesTravel & Entertainment,Office Supplies,LeasesEquipment,Bank Charges & Interest,Professional Fees,DepreciationProperty Taxes,InsuranceFees & Dues,,tabletableFINAL TRIAL BtableE CompanLANCE JERAL LEDtableRY Page Account Name,tableGL AccountNumberDebit,CreditPetty Cash,BankAccounts Receivable,InventoryPrepaid Expenses,LandBuildingsAccumulated DepreciationBuildings,EquipmentAccumulated DepreciationEquipment,AutomotiveAccumulated DepreciationAutomotive,Accounts Payable,Accrued Expenses,Bank Loans Payable,Employment Insurance Payable,CPP Payable,Employees Income Tax Payable,Employees Health Care Payable,Balance forward,, NE Company

FINAL TRIAL BALANCE, JANUARY GENERAL LEDGER

Page

tableAccount Name,tableGL AccountNumberDebit,CreditBalance forward,,Provincial Sales Tax Payable,GST Input Tax Credits Receivable,GST Payable,Payroll Clearing,LongTerm Debt,Sally Gosling, Capital,Sally Gosling, Drawings,SalesSales Returns & Allowances,Sales Discounts,Interest Revenue,PurchasesPurchase Returns & Allowances,Purchase Discounts,Salaries and Wages,Employers Payroll Deductions,RentRepairs & Maintenance,Balance forward,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started