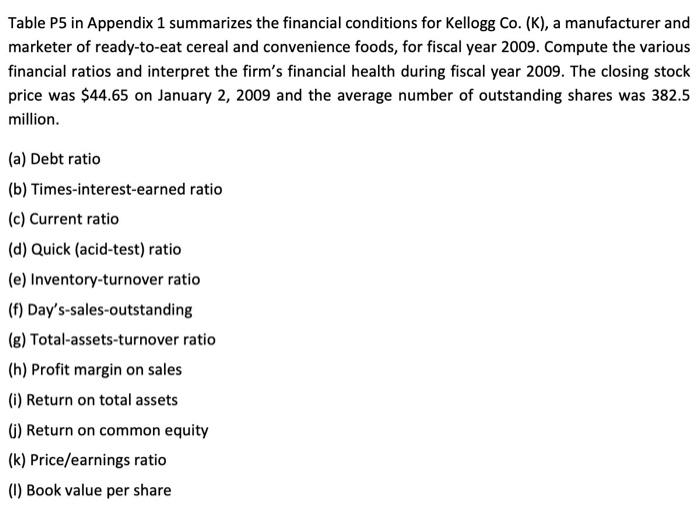

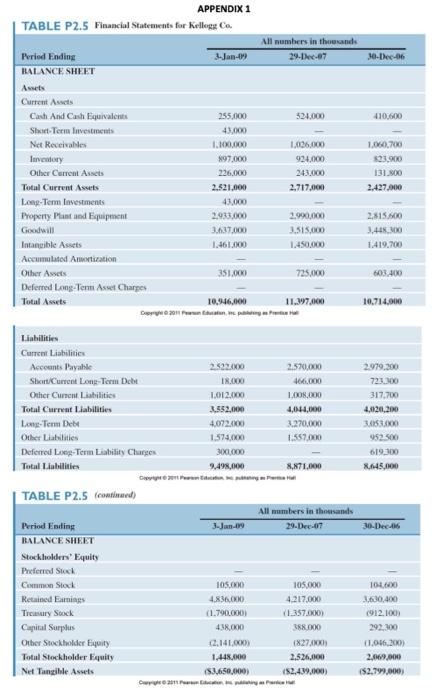

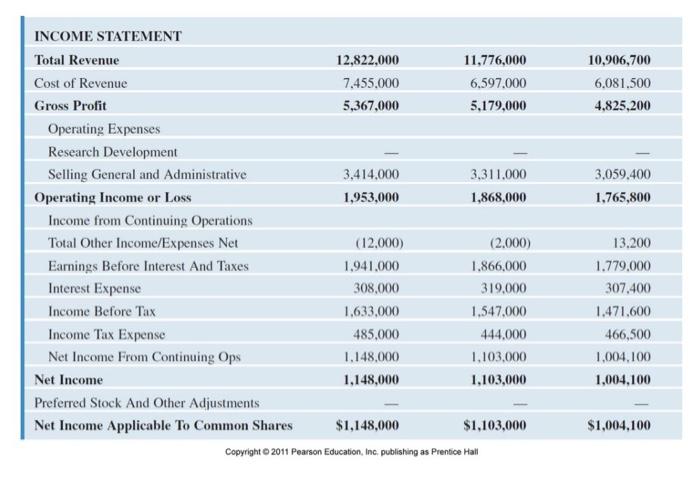

Table P5 in Appendix 1 summarizes the financial conditions for Kellogg Co. (K), a manufacturer and marketer of ready-to-eat cereal and convenience foods, for fiscal year 2009. Compute the various financial ratios and interpret the firm's financial health during fiscal year 2009. The closing stock price was $44.65 on January 2, 2009 and the average number of outstanding shares was 382.5 million. (a) Debt ratio (b) Times-interest-earned ratio (c) Current ratio (d) Quick (acid-test) ratio (e) Inventory-turnover ratio (f) Day's-sales-outstanding (g) Total-assets-turnover ratio (h) Profit margin on sales (i) Return on total assets 6) Return on common equity (k) Price/earnings ratio (1) Book value per share APPENDIX 1 TABLE P2.5 Financial Statements for kellegg Co All numbers in the sand 29.Dec.67 30-Dec-06 524.000 410,600 Period Ending BALANCE SHEET Awes Current Assets Cash And Cash Equivalents 255.000 Shirt Term Investments 43.000 Not Receivables 1.100.000 Inventory 197.000 Other Current Assets 236.000 Total Current Assets 2.521.000 Long-Term Investments 43.000 Property Punt and Equipment 2,933.000 Goodwill 3.63.000 Intangible Assets 1.461.000 Accumulated Artization Other Assets 351.000 Deferred Long-Term Asset Charpes Total Assets 10,946.000 Down 1.006.000 924,000 243.000 2.717.000 1.060,700 23.900 131.800 2.427,000 2.990.000 3.515.000 1.450,000 2.515.00 3,448. MO 1.419.700 725.000 603.400 11.397.000 10.714,000 Liabilities Current Liabilities Accounts Payable Short/Current Long-Term Debt Other Current Liabilities Total Current Liabilities LaTerm Debe Other Liabilities Deferred Long-Term Liability Charger Total Liabilities 2.523,00 THAN V 1,012.000 3.552.000 4,072.00 1.574,000 300.000 9.498,000 2.570,000 466.000 1.000.000 4,044,000 3.270,000 1.557.000 2.979,00 723.00 317.700 4,212,200 33 952 500 619.300 8.645,000 8.871.000 TABLE P2.5 (continued) All members in thousands 29-Dec-07 3-Jan-09 30.Dec.AM Period Ending BALANCE SHEET Stockholders' Equity Preferred Stock Common Stock Retained Emines Trey Sock Capital Surplus Other Stockholder Equity Total Stockholder Equity Net Tangible Assets 105.000 4.836.000 (1.790.000 438.000 2.141.COM 1.448.000 (53650,000) C. 105.000 4.217.000 1.357.000) 188.000 1827XXXI 2,526,000 (52.439.000 101 3,630,400 (912.10 292.300 1.0.06.20) 2,069,000 ($2.799,000 10,906,700 6,081,500 4,825.200 3,059.400 1,765,800 INCOME STATEMENT Total Revenue 12,822,000 11,776,000 Cost of Revenue 7.455.000 6,597,000 Gross Profit 5,367,000 5.179,000 Operating Expenses Research Development Selling General and Administrative 3,414.000 3.311.000 Operating Income or Loss 1,953,000 1,868,000 Income from Continuing Operations Total Other Income/Expenses Net (12,000) (2.000) Earnings Before Interest And Taxes 1.941.000 1.866.000 Interest Expense 308,000 319,000 Income Before Tax 1,633,000 1.547,000 Income Tax Expense 485.000 444.000 Net Income From Continuing Ops 1.148,000 1,103,000 Net Income 1,148,000 1,103,000 Preferred Stock And Other Adjustments Net Income Applicable To Common Shares $1,148,000 $1,103,000 Copyright 2011 Pearson Education, Inc. publishing as Prentice Hall 13.200 1.779.000 307.400 1.471.600 466,500 1,004,100 1,004,100 $1,004,100