Answered step by step

Verified Expert Solution

Question

1 Approved Answer

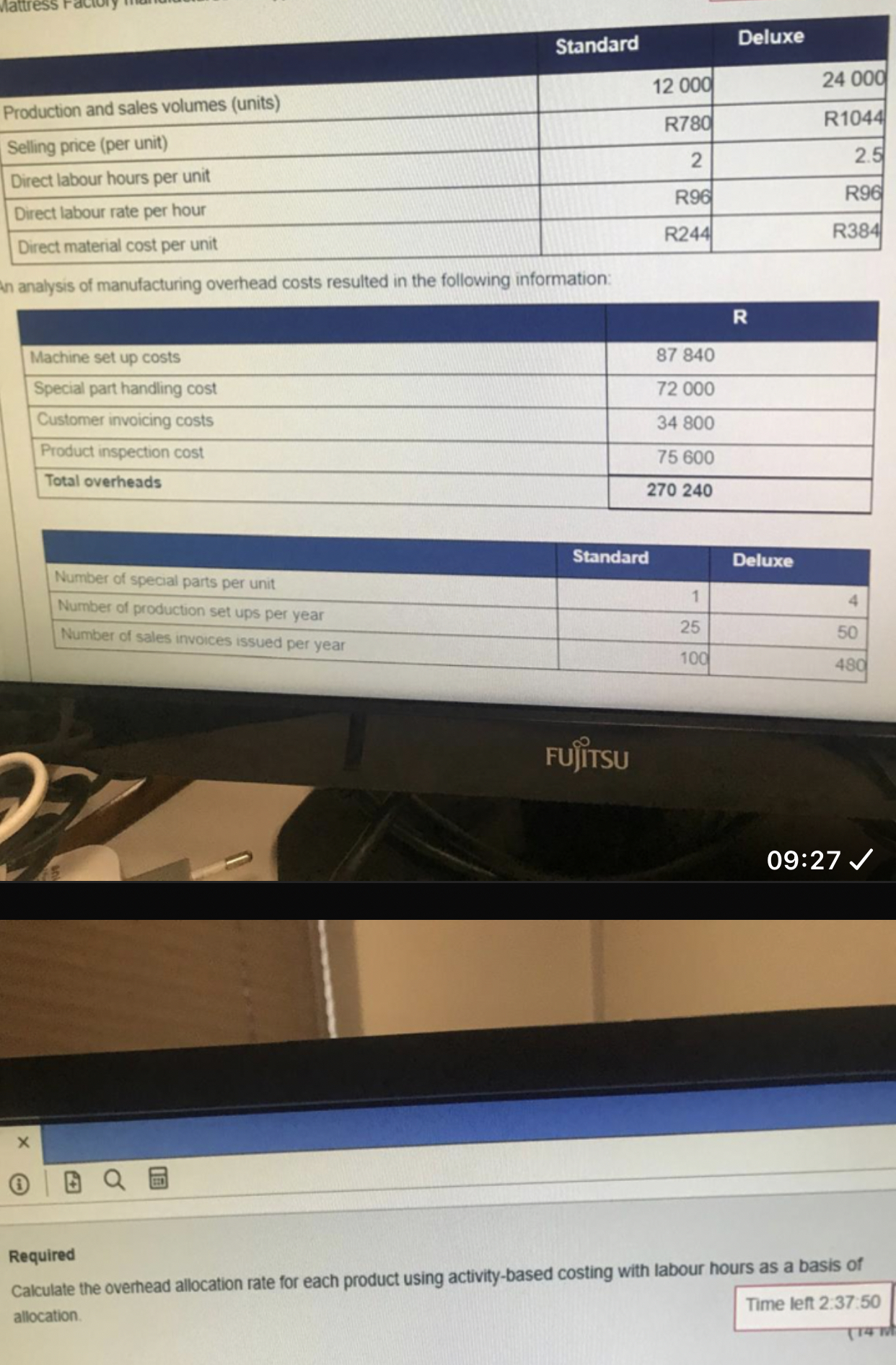

table [ [ , Standard,Deluxe ] , [ Production and sales volumes ( units ) , 1 2 0 0 0 , 2 4

tableStandard,DeluxeProduction and sales volumes unitsSelling price per unitRRDirect labour hours per unit,Direct labour rate per hour,RRDirect material cost per unit,RR

An analysis of manufacturing overhead costs resulted in the following information:

tableRMachine set up costs,Special part handling cost,Customer invoicing costs,Product inspection cost,Total overheads,

tableStandard,DeluxeNumber of special parts per unit,Number of production set ups per year,Number of sales invoices issued per year,

FUjiTSU

:

Required

Calculate the overnead allocation rate for each product using activitybased costing with labour hours as a basis of allocation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started