Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Table Tools Mallings Review View Layout A E 21 T B A- Albca Aalbcd AaBbc Aabe AaB Normal No Spact. Heading Heading 2 Teile -

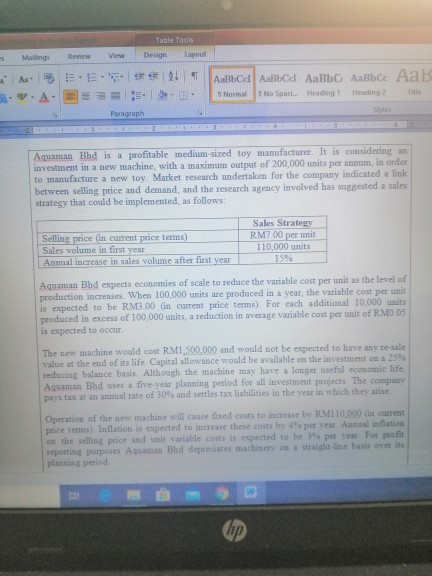

Table Tools Mallings Review View Layout A E 21 T B A- Albca Aalbcd AaBbc Aabe AaB Normal No Spact. Heading Heading 2 Teile - 3 Paragraph Aquaman Bhd is a profitable medium-sized toy manufacturer. It is considering an investment in a new machine, with a maximum output of 200,000 units per annum, in order to manufacture a new toy. Market research undertaken for the company indicated a link between selling price and demand, and the research agency involved has suggested a sales strategy that could be implemented, as follows: Selling price (in current price terms) Sales volume in first year Annual increase in sales volume after first year Sales Strategy RM7.00 per unit 110,000 units 15% Aquaman Bhd expects economies of scale to reduce the variable cost per unit as the level of production increases. When 100,000 units are produced in a year, the variable cost per unit is expected to be RM300 (in current price terms). For cach additional 10.000 units produced in excess of 100,000 units, a reduction in average variable cost per unit of RM0.05 is expected to occur The new machine would cost RM1,500,000 and would not be expected to have any re-sale value at the end of its life. Capital allowance would be available on the investment on a 25 reducing balance basis. Although the machine may have a longer useful economic life, Aquaman Bhd is a five-year planning period for all investment projects. The company pavstax stan annual rate of 30% and settles tax liabilities in the year in which they arise Operation of the new machine will cause fixed costs to increase by RM110,000 in current price tems) Inflation is expected to increase these costs by per vest Annual inflation on the selling price and unit variable costs is expected to be per year For profit reporting purposes Aquaman Bhd depreciates machinery on a straight line basis over its planning period value at the end of its inte. Capital allowance would be available on the investment on a 2070 reducing balance basis. Although the machine may have a longer useful economic life, Aquaman Bhd uses a five-year planning period for all investment projects. The company pays tax at an annual rate of 30% and settles tax liabilities in the year in which they arise. Operation of the new machine will cause fixed costs to increase by RM110.000 (in current price terms). Inflation is expected to increase these costs by 4% per year. Annual inflation on the selling price and unit variable costs is expected to be 3% per year. For profit reporting purposes Aquaman Bhd depreciates machinery on a straight-line basis over its planning period. Aquaman Bhd has an average cost of capital of 10% in money terms Required: a) Calculate the net present value and accounting rate of return of the planned investment project. b) Research has that the found that the assessment of cash flows requires immense understanding of the investment before it is implemented (Puwanenthiren, 2018). Evaluate this statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started