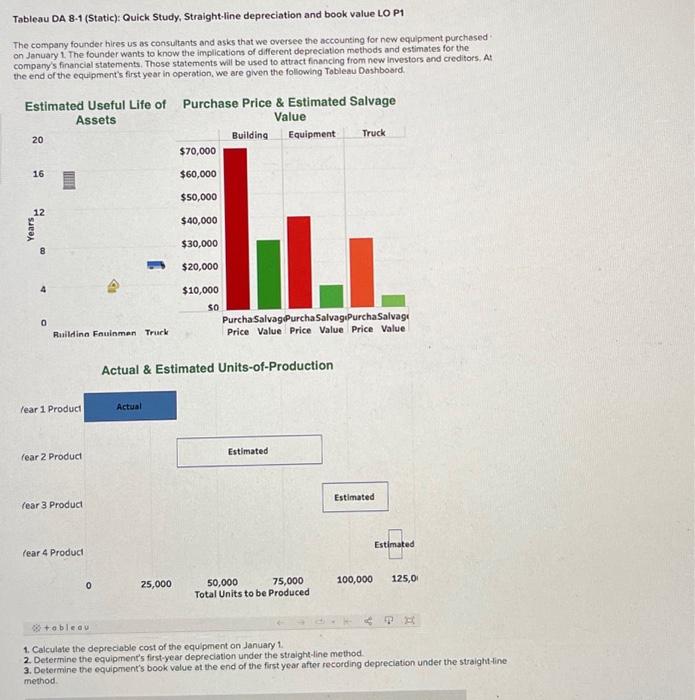

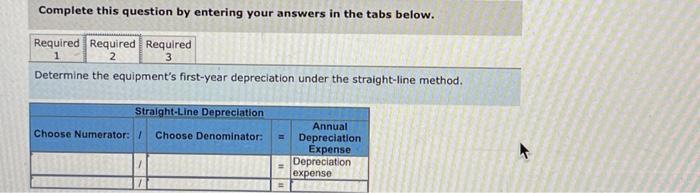

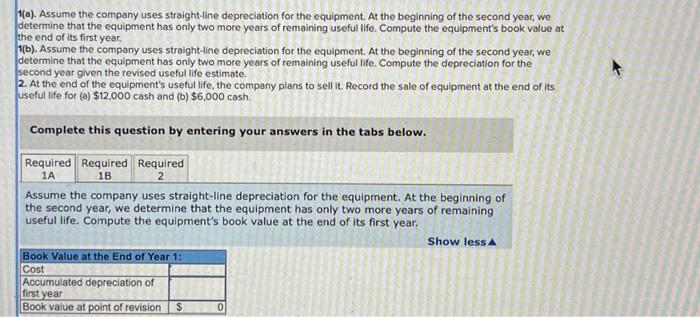

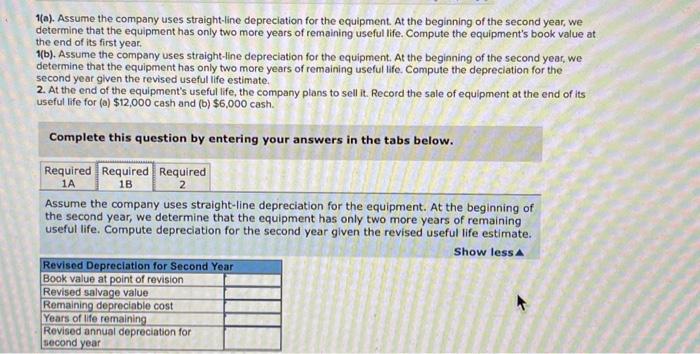

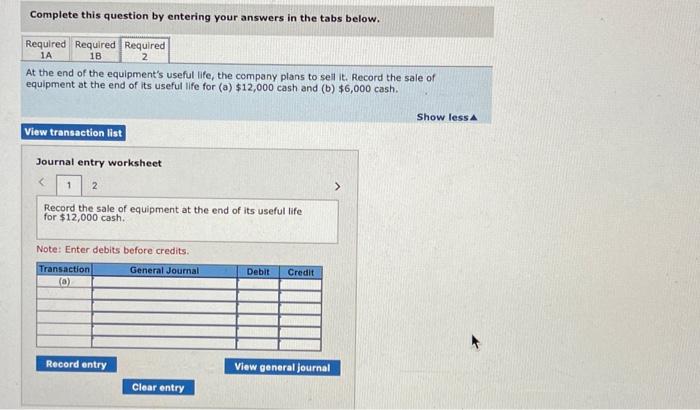

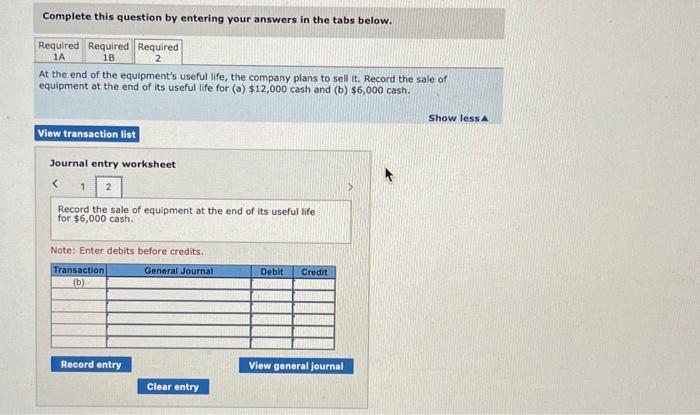

Tableau DA 8-1 (Static): Quick Study, Straight-line depreciation and book value LO P1 The company founder hires us as consultants and asks that we oversee the accounting for new equipment purchased . on January 1 . The founder wants to know the implications of different depreciation mothods and estimates for the company's financial statements. Those statements will be used to attuact financing from new investors and creditors, At the end of the equipment's first year in operation, we are given the following Tobleau Doshboard. Actual \& Estimated Units-of-Production lear 1 Product (ear 2 Product (ear 3 Product lear 4 Product Estimated 0 25,000 50,000 75,000100,000 125,0 Total Units to be Produced 36+ableav 1. Calculate the depreciable cost of the equipment on January 1 2. Determine the equipment's first-year depreciation under the straight-line method: 3. Determine the equipment's book value at the end of the first year after recording depreciation under the straight-line method. 1. Calculate the depreciable cost of the equipment on January 1 . 2. Determine the equipment's first-year depreciation under the straight-line method. 3. Determine the equipment's book value at the end of the first year after recording depreciation under the straight-line method. Complete this question by entering your answers in the tabs below. Calculate the depredable cost of the equipment on January 1. Complete this question by entering your answers in the tabs below. Determine the equipment's first-year depreciation under the straight-line method. Complete this question by entering your answers in the tabs below. Determine the equipment's book value at the end of the first year after recording depreciation under the straight-line method. 1(a). Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the equipment's book value at the end of its first year. V(b). Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the depreciation for the second year given the revised useful life estimate. 2. At the end of the equipment's useful life, the company plans to sell it. Record the sale of equipment at the end of its useful life for (a) $12,000 cash and (b) $6,000 cash. Complete this question by entering your answers in the tabs below. Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the equipment's book value at the end of its first year. 1(a). Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the equipment's book value at the end of its first year. 1(b). Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute the depreciation for the second year given the revised useful life estimate. 2. At the end of the equipment's useful life, the company plans to sell it. Record the sale of equipment at the end of its useful life for (a) $12,000 cash and (b) $6,000 cash. Complete this question by entering your answers in the tabs below. Assume the company uses straight-line depreciation for the equipment. At the beginning of the second year, we determine that the equipment has only two more years of remaining useful life. Compute depreciation for the second year given the revised useful life estimate. Complete this question by entering your answers in the tabs below. At the end of the equipment's useful life, the company plans to sell it. Record the sale of equipment at the end of its usefullife for (a) $12,000 cash and (b) $6,000 cash. Show less Journal entry worksheet Record the sale of equipment at the end of its useful life for $12,000 cash. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. At the end of the equipment's useful life, the company plans to sell it. Record the sale of equipment at the end of its useful life for (a) $12,000 cash and (b) $6,000 cash. Show less. Journal entry worksheet Record the sale of equipment at the end of its useful life for $6,000 cash. Note: Enter debits before credits