Answered step by step

Verified Expert Solution

Question

1 Approved Answer

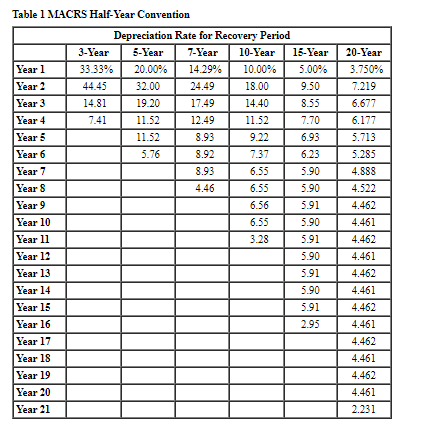

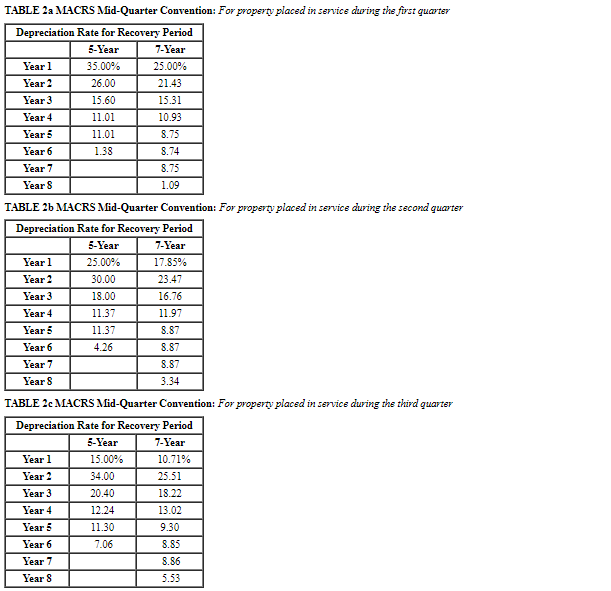

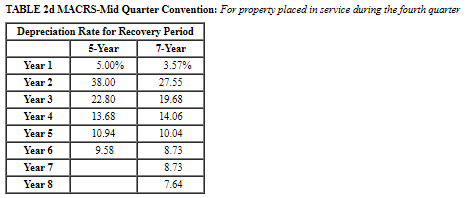

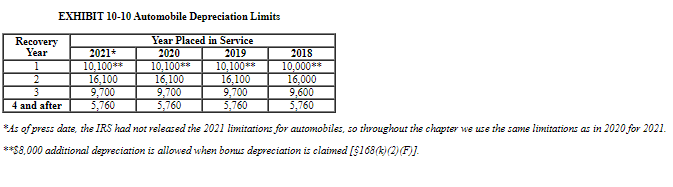

Tables: Exhibit: Required Information [The following information applies to the questions displayed below.] Lina purchased a new car for use in her business during 2021.

Tables:

Tables:

Exhibit:

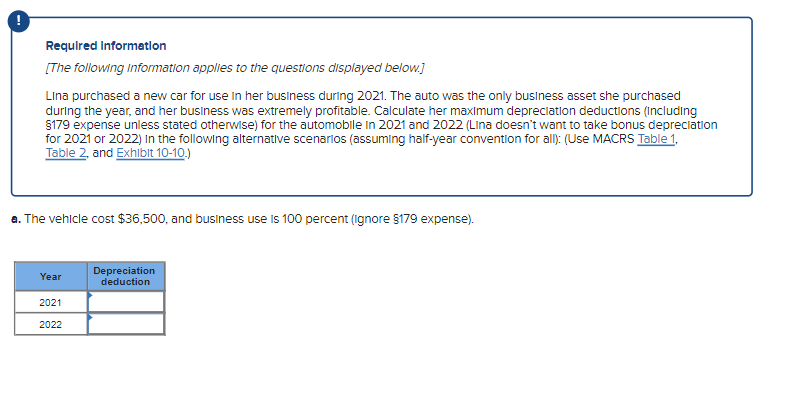

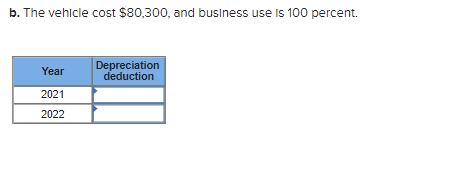

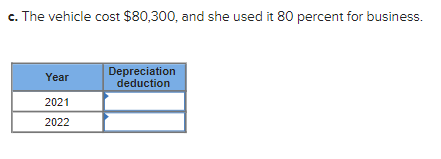

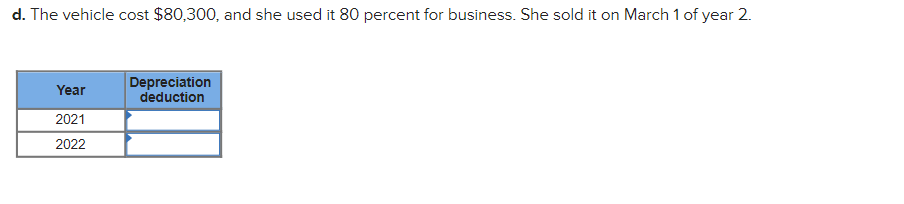

Required Information [The following information applies to the questions displayed below.] Lina purchased a new car for use in her business during 2021. The auto was the only business asset she purchased during the year, and her business was extremely profitable. Calculate her maximum depreciation deductions (including 179 expense unless stated otherwise) for the automobile in 2021 and 2022 (Lina doesn't want to take bonus depreciation for 2021 or 2022) In the following alternative scenarios (assuming half-year convention for all): (Use MACRS Table 1, Table 2, and Exhibit 10-10.) a. The vehicle cost $36,500, and business use is 100 percent (ignore 179 expense). Year 2021 2022 Depreciation deduction b. The vehicle cost $80,300, and business use is 100 percent. Year 2021 2022 Depreciation deduction c. The vehicle cost $80,300, and she used it 80 percent for business. Year 2021 2022 Depreciation deduction d. The vehicle cost $80,300, and she used it 80 percent for business. She sold it on March 1 of year 2. Year 2021 2022 Depreciation deduction Table 1 MACRS Half-Year Convention Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15 Year 16 Year 17 Year 18 Year 19 Year 20 Year 21 Depreciation Rate for Recovery Period 3-Year 5-Year 7-Year 10-Year 15-Year 20.00% 14.29% 10.00% 5.00% 32.00 18.00 9.50 19.20 14.40 8.55 11.52 7.70 9.22 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 33.33% 44.45 14.81 7.41 11.52 11.52 5.76 24.49 17.49 12.49 8.93 8.92 8.93 4.46 7.37 6.55 6.55 6.56 6.55 3.28 20-Year 3.750% 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter Depreciation Rate for Recovery Period 5-Year 7-Year 35.00% 25.00% 26.00 21.43 15.60 15.31 11.01 10.93 11.01 8.75 1.38 8.74 8.75 1.09 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 TABLE 26 MACRS Mid-Quarter Convention: For property placed in service during the second quarter Depreciation Rate for Recovery Period 5-Year 7-Year 25.00% 17.85% 30.00 23.47 18.00 11.37 11.37 4.26 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 16.76 11.97 8.87 8.87 8.87 3.34 TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter Depreciation Rate for Recovery Period 5-Year 7-Year 15.00% 10.71% 34.00 25.51 20.40 18.22 12.24 13.02 11.30 7.06 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 9.30 8.85 8.86 5.53 TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter Depreciation Rate for Recovery Period 5-Year 7-Year Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 5.00% 38.00 22.80 13.68 10.94 9.58 3.57% 27.55 19.68 14.06 10.04 8.73 8.73 7.64 EXHIBIT 10-10 Automobile Depreciation Limits Year Placed in Service 2019 10,100** 16,100 9,700 5,760 Recovery Year 1 2 3 4 and after 2021* 10,100** 16,100 9,700 5.760 2020 10,100** 16,100 9,700 5,760 2018 10,000** 16,000 9,600 5.760 *As of press date, the IRS had not released the 2021 limitations for automobiles, so throughout the chapter we use the same limitations as in 2020 for 2021. **$8,000 additional depreciation is allowed when bonus depreciation is claimed [168 (k) (2) (F)]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started