Tablet Company is looking to set up a wholly owned subsidiary firm, which will sell cheap, rugged computers in developing countries. The debt schedule

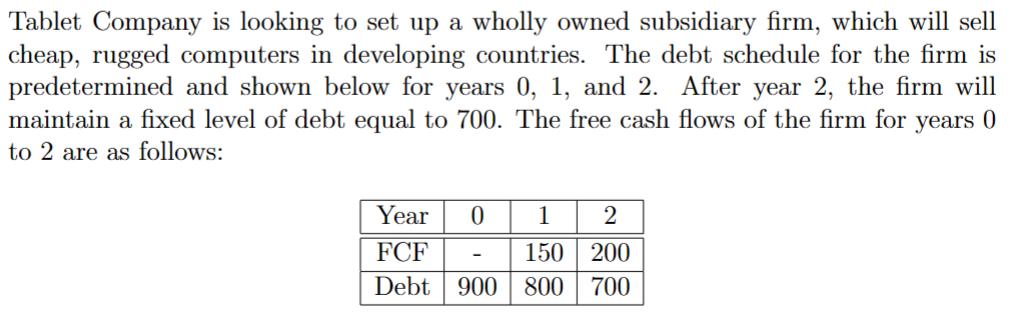

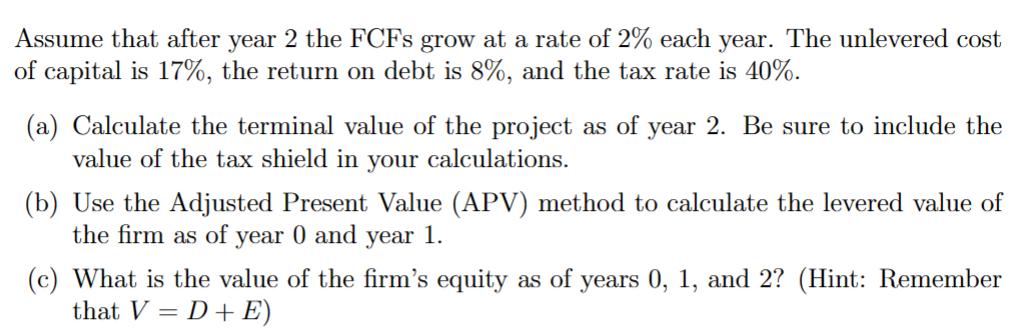

Tablet Company is looking to set up a wholly owned subsidiary firm, which will sell cheap, rugged computers in developing countries. The debt schedule for the firm is predetermined and shown below for years 0, 1, and 2. After year 2, the firm will maintain a fixed level of debt equal to 700. The free cash flows of the firm for years 0 to 2 are as follows: Year 0 FCF 150 200 Debt 900 800 700 1 2 Assume that after year 2 the FCFs grow at a rate of 2% each year. The unlevered cost of capital is 17%, the return on debt is 8%, and the tax rate is 40%. (a) Calculate the terminal value of the project as of year 2. Be sure to include the value of the tax shield in your calculations. (b) Use the Adjusted Present Value (APV) method to calculate the levered value of the firm as of year 0 and year 1. (c) What is the value of the firm's equity as of years 0, 1, and 2? (Hint: Remember that V = D + E) 5. Consider Tablet Company again, but suppose Tablet announced that will aim to have a certain leverage ratio instead of a predetermined debt schedule. Thus, its free cash flows and leverage ratio are as follows: Year 1 2 FCF 150 200 D/V 50% 55% 60% 0 It announces that it intends to keep its leverage ratio at 60% after year 2. Assume that after year 2 the FCFs grow at a rate of 2% each year. The unlevered cost of capital is 17%, the return on debt is constant at 8%, and the tax rate is 40%. (a) Calculate the cost of equity for years 0, 1, and 2. (b) the after-tax WACC for years 0, 1, and 2. (c) Calculate the total value of the firm using the after-tax WACC method for years 0, 1, and 2.

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the terminal value of the project as of year 2 we need to consider the perpetuity of free cash flows beyond year 2 and the tax shield The free cash flow FCF in year 2 is 200 Since the F...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started