Tabor Industries produces its product using a single production process. For the month of August, Tabor Industries determined its cost per equivalent unit to be

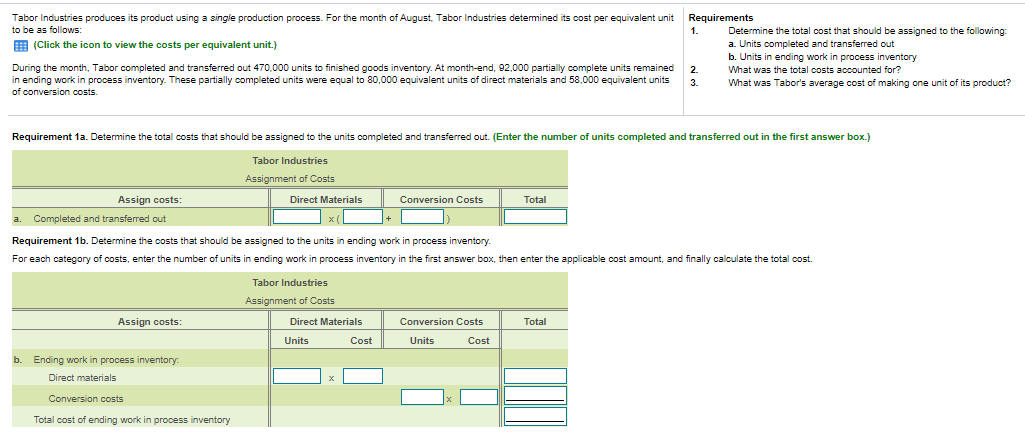

Tabor Industries produces its product using a single production process. For the month of August, Tabor Industries determined its cost per equivalent unit to be as follows:

During the month, Tabor completed and transferred out 470,000 units to finished goods inventory. At month-end, 92,000 partially complete units remained in ending work in process inventory. These partially completed units were equal to 80,000 equivalent units of direct materials and 58,000 equivalent units of conversion costs.

| 1. | Determine the total cost that should be assigned to the following: |

| a. Units completed and transferred out | |

| b. Units in ending work in process inventory | |

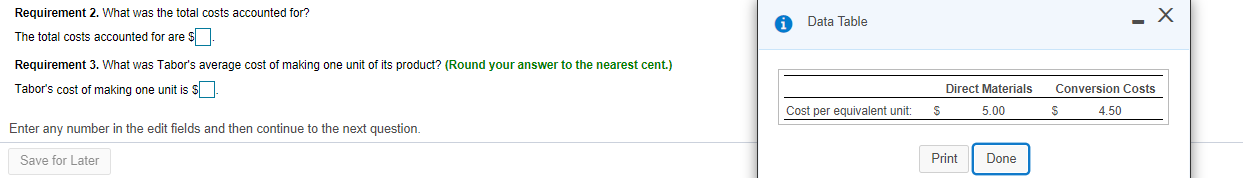

| 2. | What was the total costs accounted for? |

| 3. | What was Tabor's average cost of making one unit of its product? |

Tabor Industries produces its product using a single production process. For the month of August. Tabor Industries determined its cost per equivalent unit to be as follows: (Click the icon to view the costs per equivalent unit.) During the month, Tabor completed and transferred out 470.000 units to finished goods inventory. At month-end, 92.000 partially complete units remained in ending work in process inventory. These partially completed units were equal to 80.000 equivalent units of direct materials and 58,000 equivalent units of conversion costs. Requirements 1. Determine the total cost that should be assigned to the following: a. Units completed and transferred out b. Units in ending work in process inventory What was the total costs accounted for? 3 What was Tabor's average cost of making one unit of its product? Requirement 1a. Determine the total costs that should be assigned to the units completed and transferred out. (Enter the number of units completed and transferred out in the first answer box.) Tabor Industries Assignment of Costs Assign costs: Direct Materials Conversion Costs Total a. Completed and transferred out Requirement 1b. Determine the costs that should be assigned to the units in ending work in process inventory. For each category of costs, enter the number of units in ending work in process inventory in the first answer box, then enter the applicable cost amount, and finally calculate the total cost. Tabor Industries Assignment of Costs Assign costs: Direct Materials Total Conversion Costs Units Cost Units Cost b. Ending work in process inventory Direct materials Conversion costs Total cost of ending work in process inventory Data Table - X Requirement 2. What was the total costs accounted for? The total costs accounted for are $ Requirement 3. What was Tabor's average cost of making one unit of its product? (Round your answer to the nearest cent.) Tabor's cost of making one unit is $ Direct Materials $ 5.00 Conversion Costs S 4.50 Cost per equivalent unit: Enter any number in the edit fields and then continue to the next question. Save for Later Print Done Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started