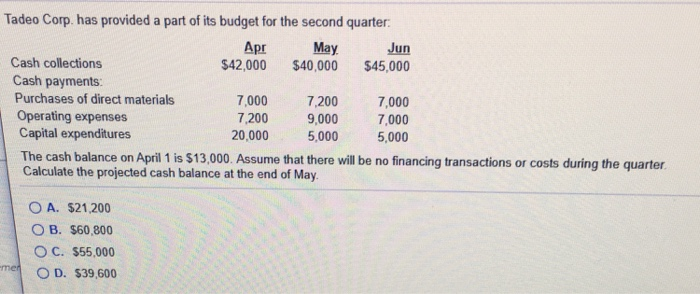

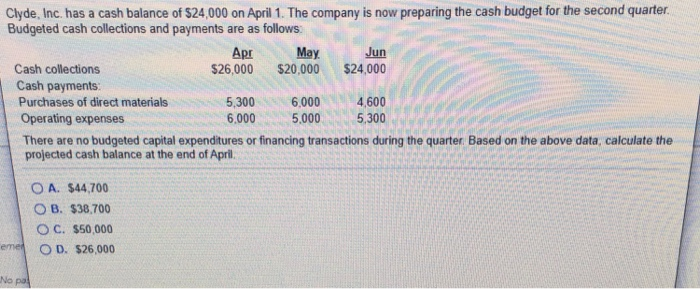

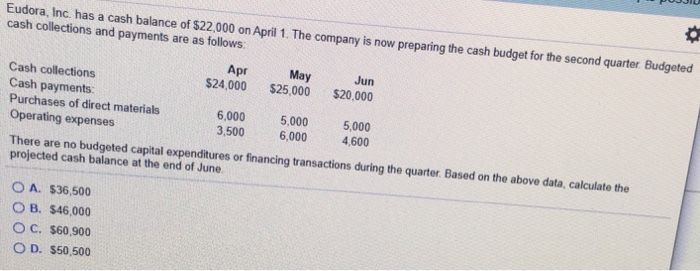

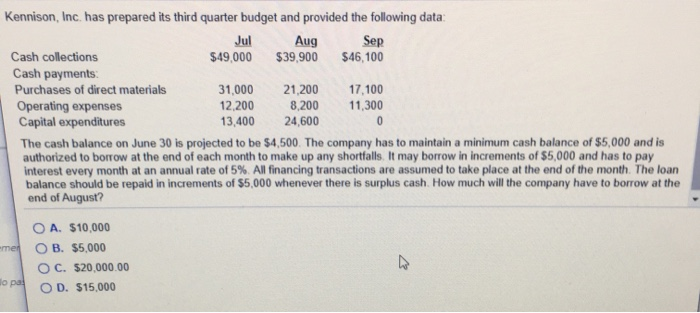

Tadeo Corp, has provided a part of its budget for the second quarter Apr May. Jun Cash collections $42,000 $40,000 $45,000 Cash payments: Purchases of direct materials 7,000 7,200 7,000 Operating expenses 7,200 9,000 7,000 Capital expenditures 20,000 5,000 5,000 The cash balance on April 1 is $13,000. Assume that there will be no financing transactions or costs during the quarter Calculate the projected cash balance at the end of May. O A. $21.200 OB. $60,800 OC. $55,000 OD. $39,600 Clyde, Inc. has a cash balance of $24,000 on April 1. The company is now preparing the cash budget for the second quarter. Budgeted cash collections and payments are as follows: Apr May. Jun Cash collections $26,000 $20,000 $24,000 Cash payments Purchases of direct materials 5,300 6,000 4600 Operating expenses 6.000 5,000 5,300 There are no budgeted capital expenditures or financing transactions during the quarter. Based on the above data, calculate the projected cash balance at the end of April O A. $44.700 OB. $38.700 OC. $50,000 OD. $26,000 No po Eudora, Inc. has a cash balance of $22,000 on April 1. The company is now preparing the cash budget for the second quarter. Budgeted cash collections and payments are as follows: Apr May Jun Cash collections $24,000 $25,000 $20,000 Cash payments: Purchases of direct materials 6,000 5,000 5,000 Operating expenses 3,500 6.000 4.600 There are no budgeted capital expenditures or financing transactions during the quarter. Based on the above data, calculate the projected cash balance at the end of June. O A. $36,500 O B. 546,000 OC. $60,900 Kennison, Inc. has prepared its third quarter budget and provided the following data: Jul Aug Sep Cash collections $49,000 $39,900 $46, 100 Cash payments: Purchases of direct materials 31,000 21,200 17,100 Operating expenses 12,200 8,200 11,300 Capital expenditures 13.400 24,600 The cash balance on June 30 is projected to be $4,500. The company has to maintain a minimum cash balance of $5,000 and is authorized to borrow at the end of each month to make up any shortfalls. It may borrow in increments of $5,000 and has to pay Interest every month at an annual rate of 5%. All financing transactions are assumed to take place at the end of the month. The loan balance should be repaid in increments of $5,000 whenever there is surplus cash. How much will the company have to borrow at the end of August? emer O A. $10,000 OB. $5,000 OC. $20,000.00 OD. $15,000 lo pa