Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taft Corporation had after-tax income from continuing operations of $16.1 million for the year. Taft also reported a $2.95 million after-tax loss on the

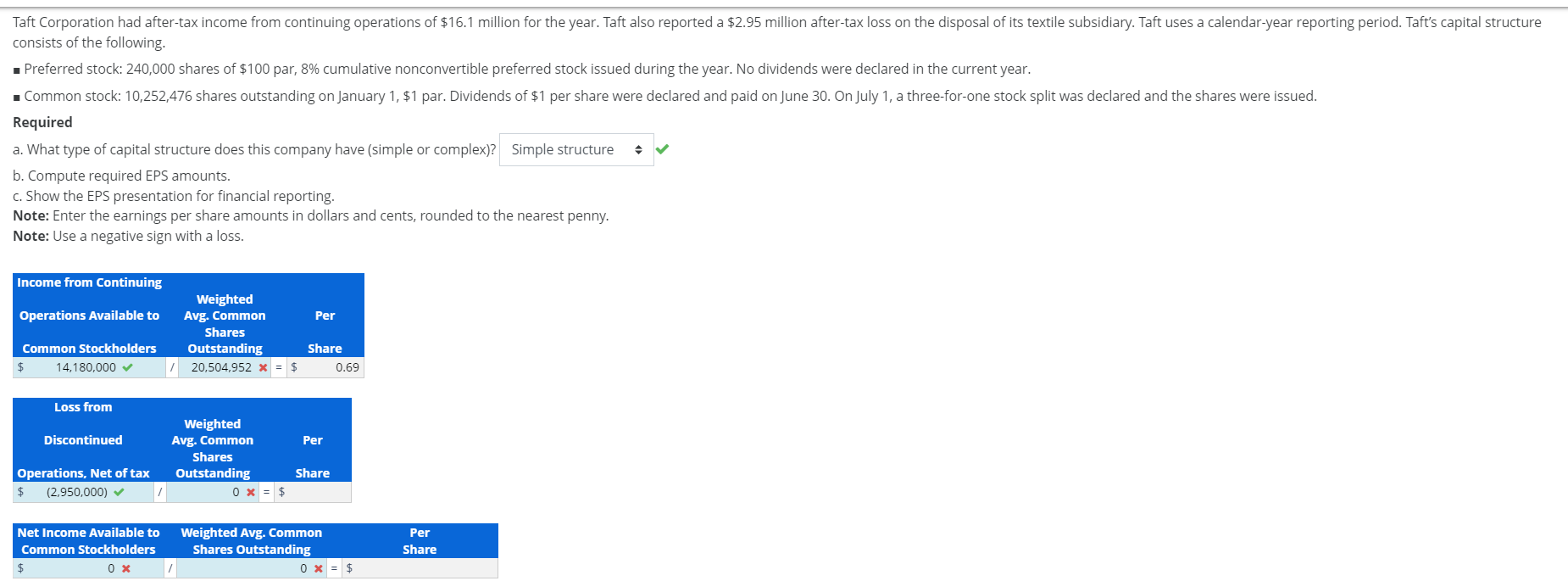

Taft Corporation had after-tax income from continuing operations of $16.1 million for the year. Taft also reported a $2.95 million after-tax loss on the disposal of its textile subsidiary. Taft uses a calendar-year reporting period. Taft's capital structure consists of the following. Preferred stock: 240,000 shares of $100 par, 8% cumulative nonconvertible preferred stock issued during the year. No dividends were declared in the current year. Common stock: 10,252,476 shares outstanding on January 1, $1 par. Dividends of $1 per share were declared and paid on June 30. On July 1, a three-for-one stock split was declared and the shares were issued. Required a. What type of capital structure does this company have (simple or complex)? Simple structure b. Compute required EPS amounts. c. Show the EPS presentation for financial reporting. Note: Enter the earnings per share amounts in dollars and cents, rounded to the nearest penny. Note: Use a negative sign with a loss. Income from Continuing Weighted Operations Available to Avg. Common Shares Per Common Stockholders Outstanding Share $ 20,504,952 x = $ 0.69 14,180,000 Loss from Discontinued Operations, Net of tax $ (2,950,000) Net Income Available to Common Stockholders $ 0 x Weighted Avg. Common Per Shares Outstanding 0x = $ Share Weighted Avg. Common Shares Outstanding Per Share 0 x = $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The company has a simple capital structure because it only has preferred stock and common stock b ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started