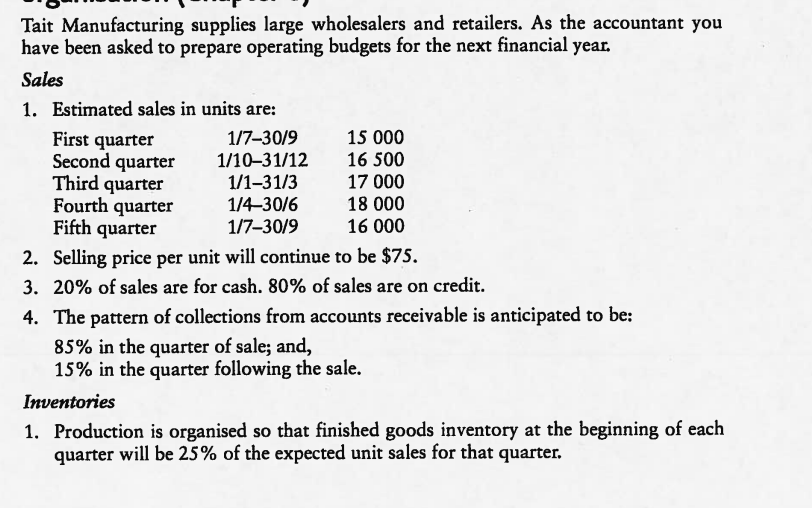

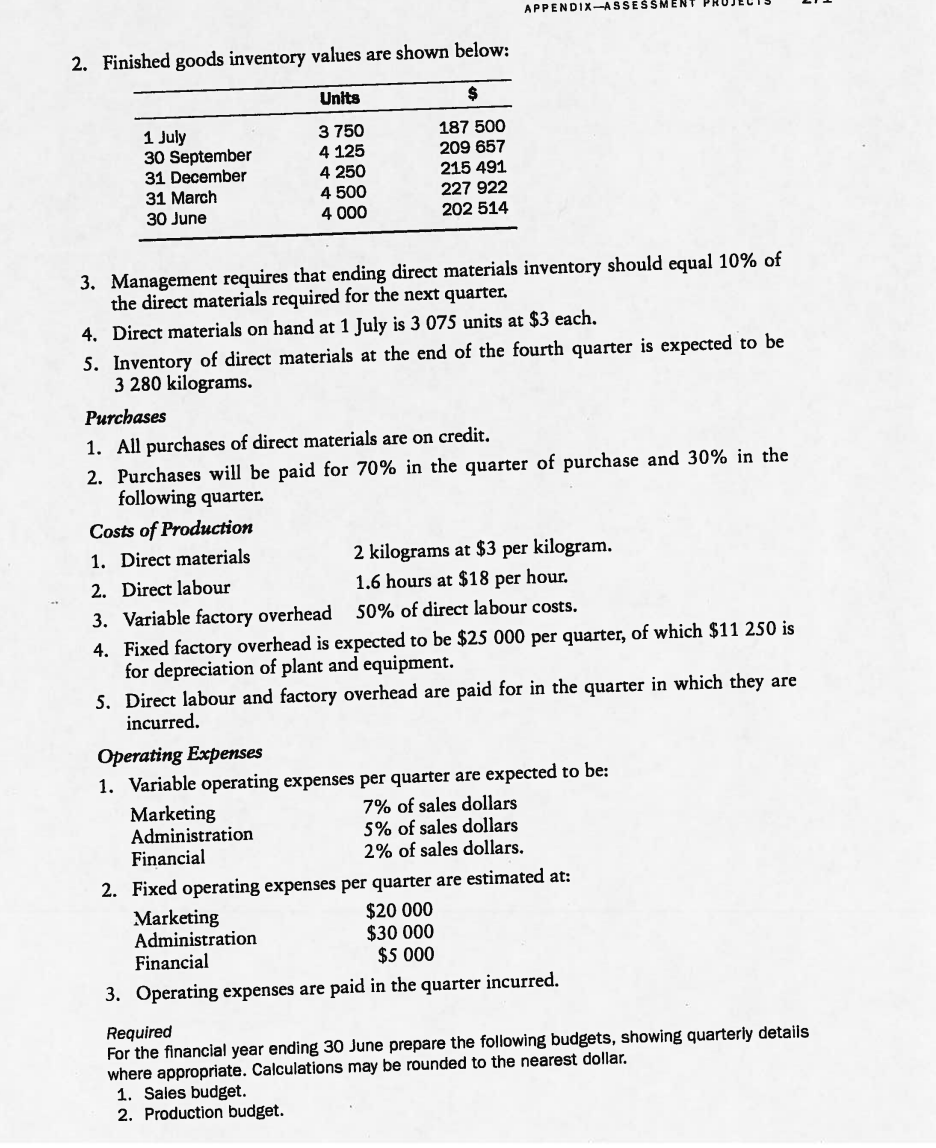

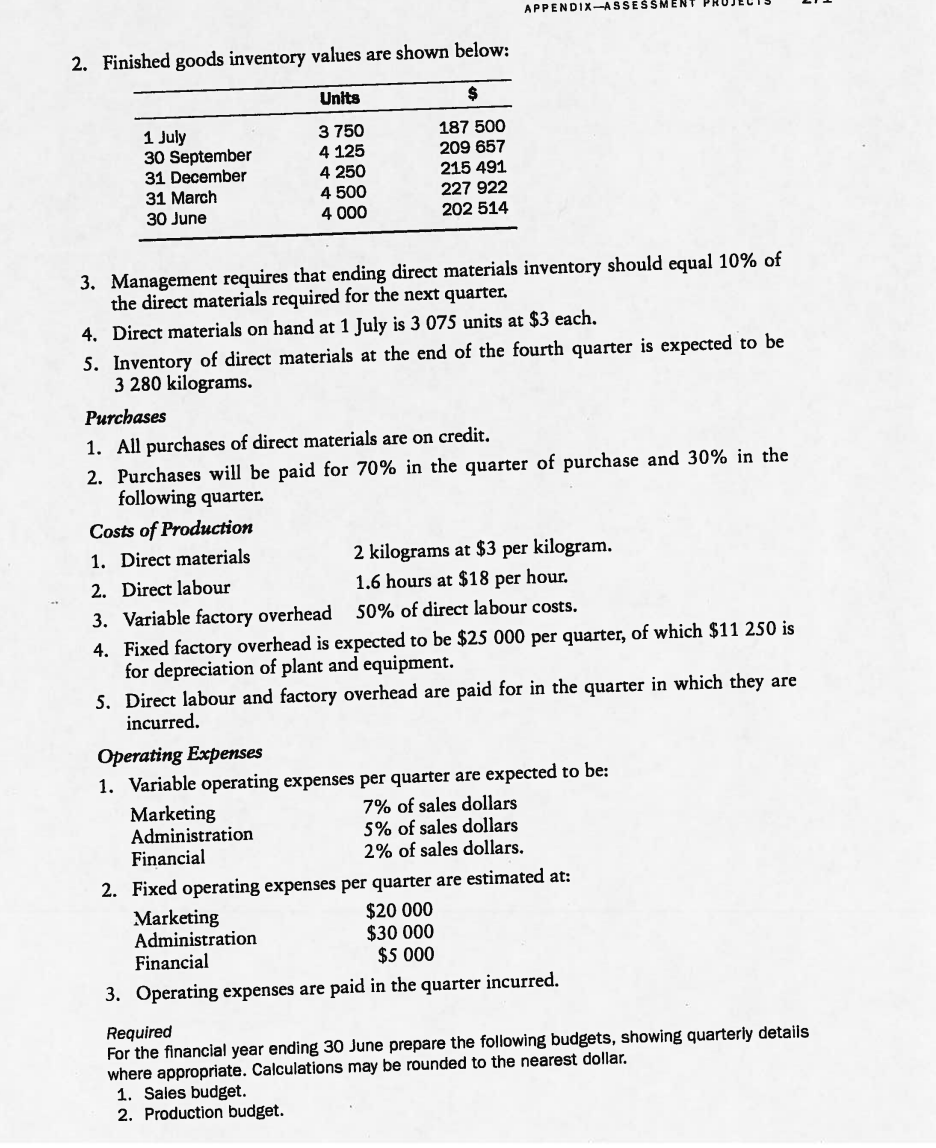

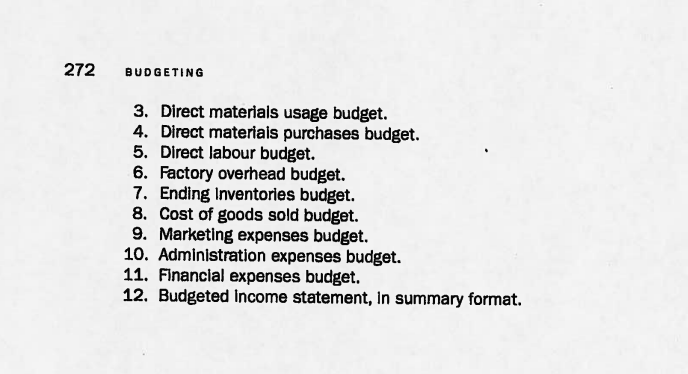

Tait Manufacturing supplies large wholesalers and retailers. As the accountant you have been asked to prepare operating budgets for the next financial year. Sales 1. Estimated sales in units are: First quarter 1/7-30/9 15 000 Second quarter 1/1031/12 16 500 Third quarter 1/1-31/3 17 000 Fourth quarter 1/430/6 18 000 Fifth quarter 1/7-30/9 16 000 2. Selling price per unit will continue to be $75. 3. 20% of sales are for cash. 80% of sales are on credit. 4. The pattern of collections from accounts receivable is anticipated to be: 85% in the quarter of sale; and, 15% in the quarter following the sale. Inventories 1. Production is organised so that finished goods inventory at the beginning of each quarter will be 25% of the expected unit sales for that quarter. APPENDIX-ASSESSM 2. Finished goods inventory values are shown below: Units $ 1 July 30 September 31 December 31 March 30 June 3 750 4 125 4 250 4 500 4 000 187 500 209 657 215 491 227 922 202 514 3. Management requires that ending direct materials inventory should equal 10% of the direct materials required for the next quarter. 4. Direct materials on hand at 1 July is 3 075 units at $3 each. 5. Inventory of direct materials at the end of the fourth quarter is expected to be 3 280 kilograms. Purchases 1. All purchases of direct materials are on credit. 2. Purchases will be paid for 70% in the quarter of purchase and 30% in the following quarter. Costs of Production 1. Direct materials 2 kilograms at $3 per kilogram. 2. Direct labour 1.6 hours at $18 per hour. 3. Variable factory overhead 50% of direct labour costs. 4. Fixed factory overhead is expected to be $25 000 per quarter, of which $11 250 is for depreciation of plant and equipment. 5. Direct labour and factory overhead are paid for in the quarter in which they are incurred. Operating Expenses 1. Variable operating expenses per quarter are expected to be: Marketing 7% of sales dollars Administration 5% of sales dollars Financial 2% of sales dollars. 2. Fixed operating expenses per quarter are estimated at: Marketing $20 000 Administration $30 000 Financial $5 000 3. Operating expenses are paid in the quarter incurred. Required For the financial year ending 30 June prepare the following budgets, showing quarterly details where appropriate. Calculations may be rounded to the nearest dollar. 1. Sales budget. 2. Production budget. 272 BUDGETING 3. Direct materials usage budget. 4. Direct materiais purchases budget. 5. Direct labour budget. 6. Factory overhead budget. 7. Ending Inventories budget. 8. Cost of goods sold budget. 9. Marketing expenses budget. 10. Administration expenses budget. 11. Financial expenses budget. 12. Budgeted Income statement, in summary format