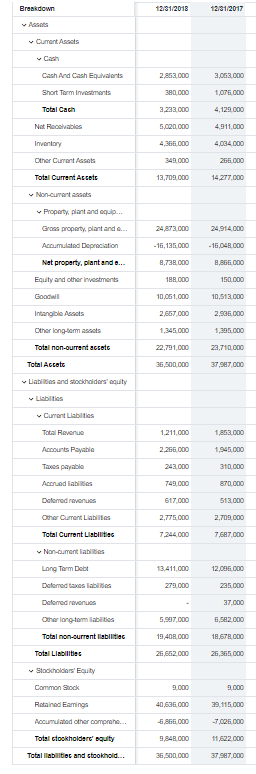

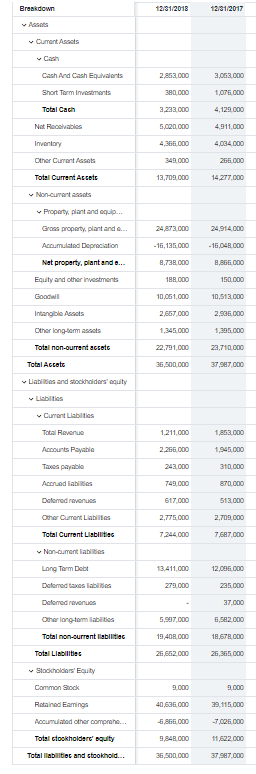

TAKALLOSER LOOK CALCULATING 3M's COST OF CAPITAL Use online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. in this chapter, we described how to estimate a company's WACC, which is the weighted average of its costs of deh preferred stock, and common equity. Most of the data we need to do this can be found to do this can be found from various data sources on the Internet. Here we walk through the steps used to calculate Minnesota Mining & Manufacturing S (MMM) WACC DISCUSSION QUESTIONS 1. As a first step, we need to estimate what percentage of MMM's capital comes from debt, preferred stock and common equity. This information can be found on the firm's latest annual balance sheet. (As of year end 2014 MMM had no preferred stock.) Total debt includes all interest-bearing debt and is the sum of short-term debt and long-term debt. a. Recall that the weights used in the WACC are based on the company's target capital structure. If we assume that the company wants to maintain the same mix of capital that it currently has on its balance sheet, what weights should you use to estimate the WACC for MMM? b. Find MMM's market capitalization, which is the market value of its common equity. Using the sum of its short, term debt and long-term debt from the balance sheet (we assume that the market value of its debt equals 15 book value) and its market capitalization, recalculate the firm's debt and common equity weights to be used in the WACC equation. These weights are approximations of market value weights. Be sure not to include accruals in the debt calculation 2. Once again we can use the CAPM to estimate MMM's cost of equity. From the Internet, you can find a number Breakdown 12/31/2013 12/31/2017 Current Ascots Cash And Cash Equivalents 2,863.000 3,063.000 Short Term investments 380.000 1,075,000 Tcal Ca 3.233.000 4,129.000 Not Receivables 5,020.000 4.911,000 Inventory 4,360.000 4,034.000 Other Current Assets 349.000 266,000 Total Current Accats 13,709,000 14.277.000 Non-cumonassos Property, plant and equip... Gross property, plant and e... 24,914.000 Accumulated Depreciation - 16,135.000 Nat property, plant and e... 8.738.000 3,866.000 Equity and other investments 188,000 150.000 Goodwil 10.061.000 10.513.000 Intangible Assets 2,657.000 2.935.000 Other long-term assets 1,345,000 1.300.000 Total non-current accets 22,791.000 23.710.000 Total Accett 36,500,000 37,987.000 Liabilities and stockholders' equity Llabilities Current Liabilities Total Revenue 1,211,000 1,853,000 Accounts Payable 2265.000 1.945,000 Taxes payable 243.000 310,000 Accuelas 749,000 870.000 Deferred revenues 617.000 513.000 Other Current L ife 2.775.000 2.709.000 Total Current Liabilities 7.244.000 7,687,000 Non.current la Long Term Debt 13.411.000 12.095.000 Deferred taxes labios 279.000 25 000 Deferred revenues 37,000 Other long-term labies SOT 000 6,512.000 Total non-current liabilities 19,408.000 18,678,000 Total Liabilities 25,662.000 26,365.000 Stockholders' Equity Common Stock 9.000 9.000 Rotana Ramings 40,636.000 39.115.000 Accumulated other comprehe... 5.866000 -7.025.000 Total tookholders' equity 9,848.000 11,622.000 Total liabilities and stockhold... 36,500,000 37,907,000 TAKALLOSER LOOK CALCULATING 3M's COST OF CAPITAL Use online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions. in this chapter, we described how to estimate a company's WACC, which is the weighted average of its costs of deh preferred stock, and common equity. Most of the data we need to do this can be found to do this can be found from various data sources on the Internet. Here we walk through the steps used to calculate Minnesota Mining & Manufacturing S (MMM) WACC DISCUSSION QUESTIONS 1. As a first step, we need to estimate what percentage of MMM's capital comes from debt, preferred stock and common equity. This information can be found on the firm's latest annual balance sheet. (As of year end 2014 MMM had no preferred stock.) Total debt includes all interest-bearing debt and is the sum of short-term debt and long-term debt. a. Recall that the weights used in the WACC are based on the company's target capital structure. If we assume that the company wants to maintain the same mix of capital that it currently has on its balance sheet, what weights should you use to estimate the WACC for MMM? b. Find MMM's market capitalization, which is the market value of its common equity. Using the sum of its short, term debt and long-term debt from the balance sheet (we assume that the market value of its debt equals 15 book value) and its market capitalization, recalculate the firm's debt and common equity weights to be used in the WACC equation. These weights are approximations of market value weights. Be sure not to include accruals in the debt calculation 2. Once again we can use the CAPM to estimate MMM's cost of equity. From the Internet, you can find a number Breakdown 12/31/2013 12/31/2017 Current Ascots Cash And Cash Equivalents 2,863.000 3,063.000 Short Term investments 380.000 1,075,000 Tcal Ca 3.233.000 4,129.000 Not Receivables 5,020.000 4.911,000 Inventory 4,360.000 4,034.000 Other Current Assets 349.000 266,000 Total Current Accats 13,709,000 14.277.000 Non-cumonassos Property, plant and equip... Gross property, plant and e... 24,914.000 Accumulated Depreciation - 16,135.000 Nat property, plant and e... 8.738.000 3,866.000 Equity and other investments 188,000 150.000 Goodwil 10.061.000 10.513.000 Intangible Assets 2,657.000 2.935.000 Other long-term assets 1,345,000 1.300.000 Total non-current accets 22,791.000 23.710.000 Total Accett 36,500,000 37,987.000 Liabilities and stockholders' equity Llabilities Current Liabilities Total Revenue 1,211,000 1,853,000 Accounts Payable 2265.000 1.945,000 Taxes payable 243.000 310,000 Accuelas 749,000 870.000 Deferred revenues 617.000 513.000 Other Current L ife 2.775.000 2.709.000 Total Current Liabilities 7.244.000 7,687,000 Non.current la Long Term Debt 13.411.000 12.095.000 Deferred taxes labios 279.000 25 000 Deferred revenues 37,000 Other long-term labies SOT 000 6,512.000 Total non-current liabilities 19,408.000 18,678,000 Total Liabilities 25,662.000 26,365.000 Stockholders' Equity Common Stock 9.000 9.000 Rotana Ramings 40,636.000 39.115.000 Accumulated other comprehe... 5.866000 -7.025.000 Total tookholders' equity 9,848.000 11,622.000 Total liabilities and stockhold... 36,500,000 37,907,000