Take a look at article for help. Thanks!

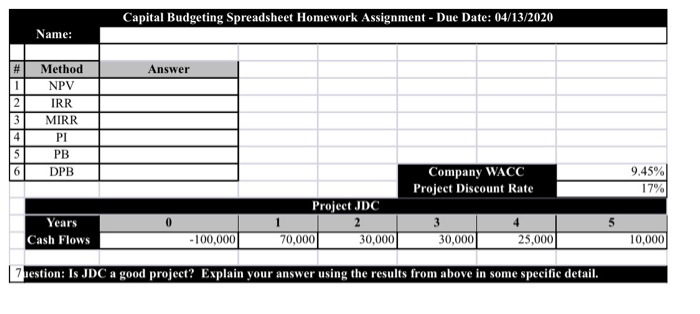

Capital Budgeting Spreadsheet Homework Assignment - Due Date: 04/13/2020 Name: Answer Method NPV IRR MIRR PI PB DPB Company WACC Project Discount Rate 9.45% 17% Years Project JDC - 2 70,000 30,000 5 Cash Flows - 100,000 30,000 25,000 10,000 17 lestion: Is JDC a good project? Explain your answer using the results from above in some specific detail. HOW DO CFOs MAKE CAPITAL BUDGETING AND CAPITAL STRUCTURE DECISIONS? by Jobs Graham and Campbell Harey Duke University e recently conducted a compensive we that and the W current practice of corporate finance, with particular focus on the areas of capital budgeting and capital structure. The survey results enabled us to identify aspects of corporate practice that are consistent with finance theory, as well aspects that are hard to reconcile with wat we beach in our business school today. In presenting the results, we hope that some practitioners will find it worthwhile to serve how other companies operate and perhaps modify their own eactices. It may also be useful for finance academics to consider differences between theory and practices a reason to the theory We solicited response from approximately 4 companies and received 392 completed surveys, representing a wide variety of forms and industries. The survey contained nearly 100 questions and explored both capital budgeting and capital structure decisions in depth. The responses to these questions enabled us to explore whether and how these corporate policies are interrelated. For example, we investigated whether companies that made m e sve u of debt financing also tended to use more sophisticated capital budgeting techniques, perhaps because of their greater need for discipline and precision in the corporate investment process More generally, the design of our survey allowed for a richer under standing of corporate decision-making by analyzing the CFOs responses in the context of various company characteristics, such as size. P/E ratio, leverage, credit rating, dividend policy, and industry. We also looked for systematic relationships between corporate financial choices and manage rial factors, sich as the extent of top management's stock ownership, and the age, tenure, and education of the CEO. By testing whether the responses d he varied statically with the characters SURVEY TECHNIQUES AND SAMPLE wew e to shed light on the implications of CHARACTERISTICS various corporate finance theories that focus on Variables such as a company's riskin Perhaps the most important part of ment opportunities and managements escanch is designing a sense that The results of wea ring in dear and pertinent Webov al steps pertandi ng in the respect to achieve this and Arunding met de to capital huding companies follow acing a dat survey, we cited the dra to p demic theory and discounted cash flow (DC) of academics and practitioners and incorporated