Answered step by step

Verified Expert Solution

Question

1 Approved Answer

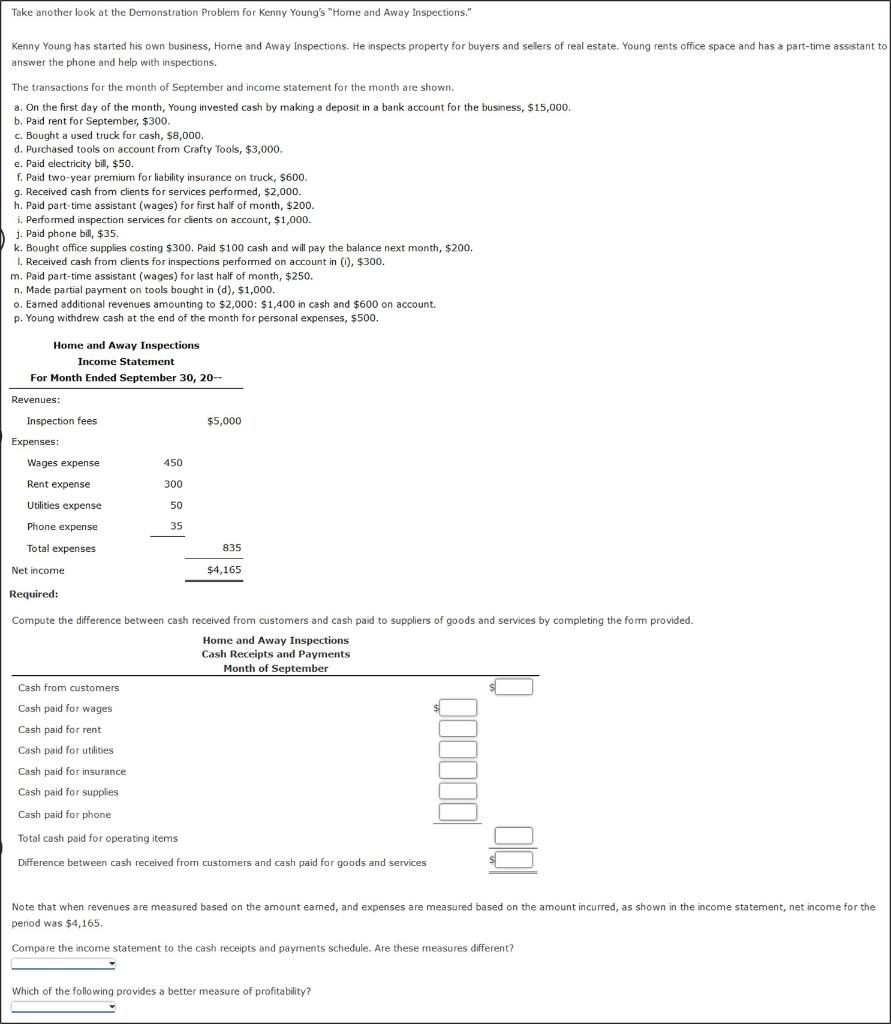

Take another look at the Demonstration Problem for Kenny Young's Home and Away Inspections. Kenny Young has started his own business, Home and Away

Take another look at the Demonstration Problem for Kenny Young's "Home and Away Inspections." Kenny Young has started his own business, Home and Away Inspections. He inspects property for buyers and sellers of real estate. Young rents office space and has a part-time assistant to answer the phone and help with inspections. The transactions for the month of September and income statement for the month are shown. a. On the first day of the month, Young invested cash by making a deposit in a bank account for the business, $15,000. b. Paid rent for September, $300. c. Bought a used truck for cash, $8,000. d. Purchased tools on account from Crafty Tools, $3,000. e. Paid electricity bill, $50. f. Paid two-year premium for liability insurance on truck, $600. g. Received cash from clients for services performed, $2,000. h. Paid part-time assistant (wages) for first half of month, $200. i. Performed inspection services for clients on account, $1,000. j. Paid phone bill, $35. k. Bought office supplies costing $300. Paid $100 cash and will pay the balance next month, $200. I. Received cash from clients for inspections performed on account in (i), $300. m. Paid part-time assistant (wages) for last half of month, $250. n. Made partial payment on tools bought in (d), $1,000. o. Earned additional revenues amounting to $2,000: $1,400 in cash and $600 on account. p. Young withdrew cash at the end of the month for personal expenses, $500. Home and Away Inspections Income Statement For Month Ended September 30, 20-- Revenues: Inspection fees $5,000 Expenses: Wages expense 450 Rent expense 300 50 Utilities expense Phone expense Total expenses Net income Required: 835 $4,165 Compute the difference between cash received from customers and cash paid to suppliers of goods and services by completing the form provided. Home and Away Inspections Cash Receipts and Payments Month of September Cash from customers Cash paid for wages Cash paid for rent Cash paid for utilities Cash paid for insurance Cash paid for supplies Cash paid for phone Total cash paid for operating items Difference between cash received from customers and cash paid for goods and services 00 Note that when revenues are measured based on the amount earned, and expenses are measured based on the amount incurred, as shown in the income statement, net income for the penod was $4,165. Compare the income statement to the cash receipts and payments schedule. Are these measures different? Which of the following provides a better measure of profitability?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started