Question

Take into account the investment with the following cashflowss: a) Do a Graphical Analysis to identify the roots for the equation NPW(i)=0. Plot the NPW(i)

Take into account the investment with the following cashflowss:

a) Do a Graphical Analysis to identify the roots for the equation NPW(i)=0. Plot the NPW(i) for a reasonably large range of interest rates. Interpret the graph. Roots exist? What can you say about the rate of return of this project?

b) Apply Modified Internal Rate of Return (MIRR) method using an external financing rate of 6% and an external investing rate of 12%. Is the project attractive if MARR is 12%? Compute MIRR analytically first, then verify your answer using MIRR function of Excel (MIRR(CF0-CFn, external financing rate, external investing rate)).

c) Apply External Rate of Return (ERR) method using MARR of 12%. Is the project attractive?

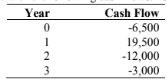

Year 0 1 2 3 Cash Flow -6,500 19,500 -12,000 -3,000 Year 0 1 2 3 Cash Flow -6,500 19,500 -12,000 -3,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started