Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Take me to the text Equipment was purchased on January 1,2020 for $70,000. The asset is expected to last for four years, at which time

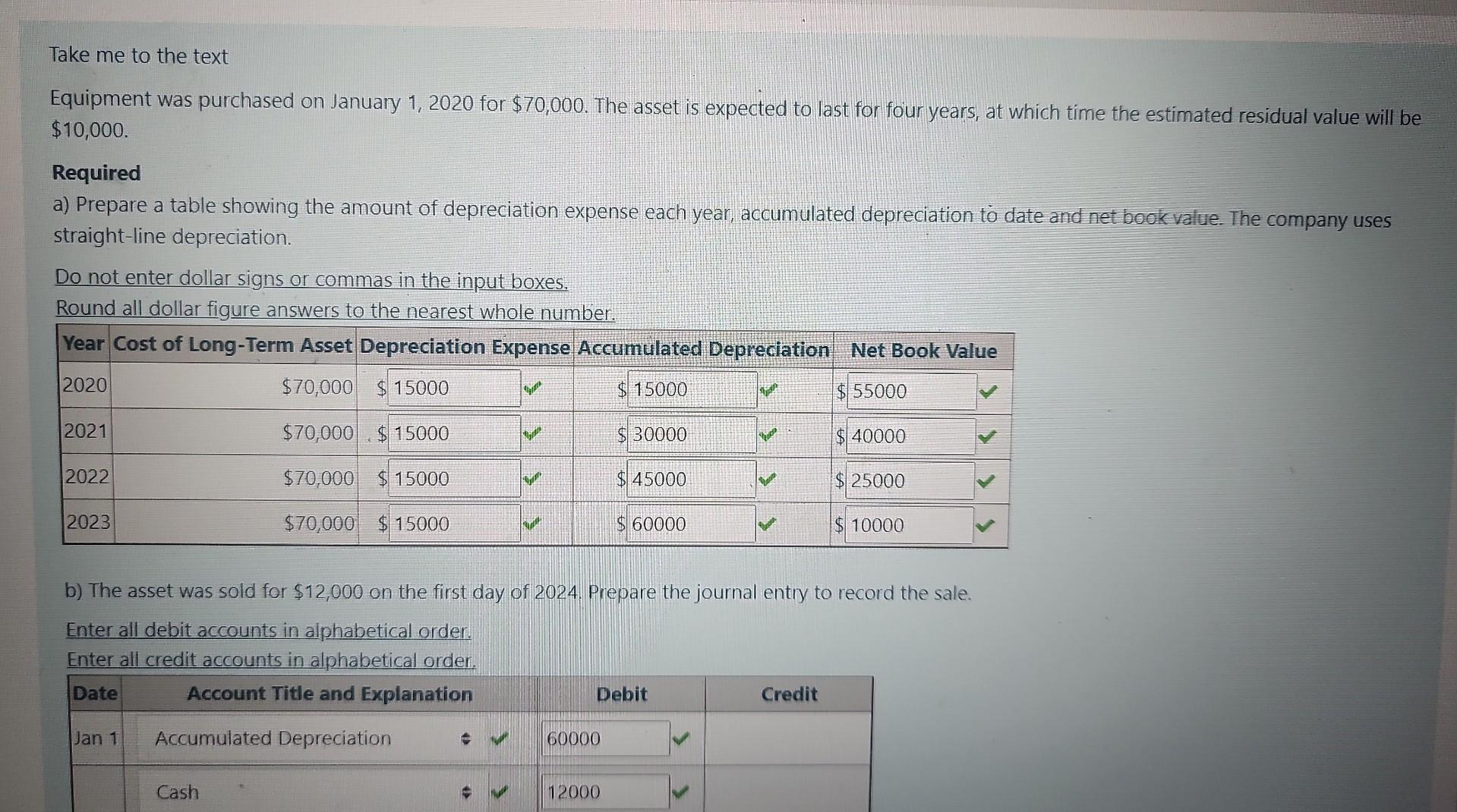

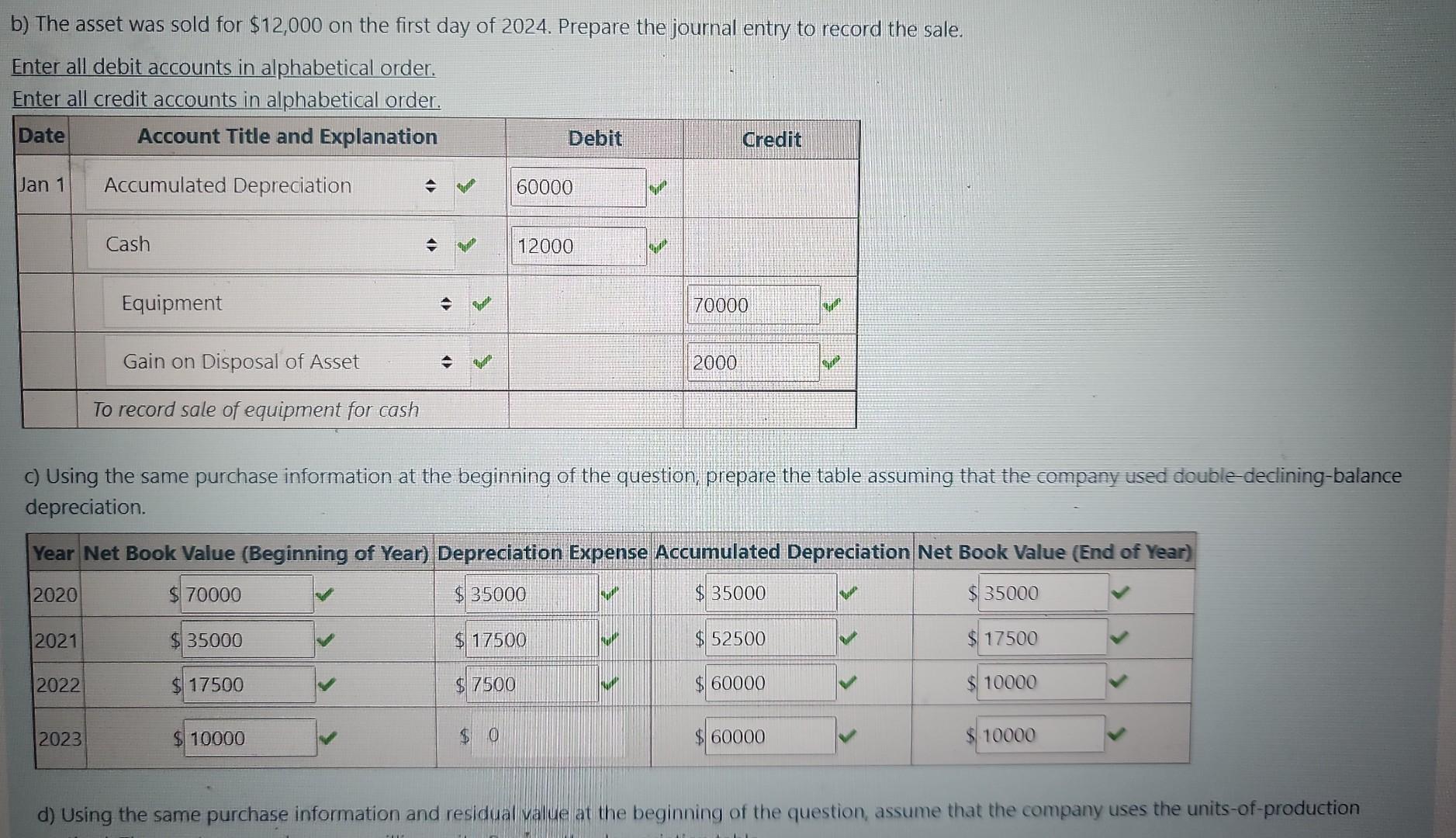

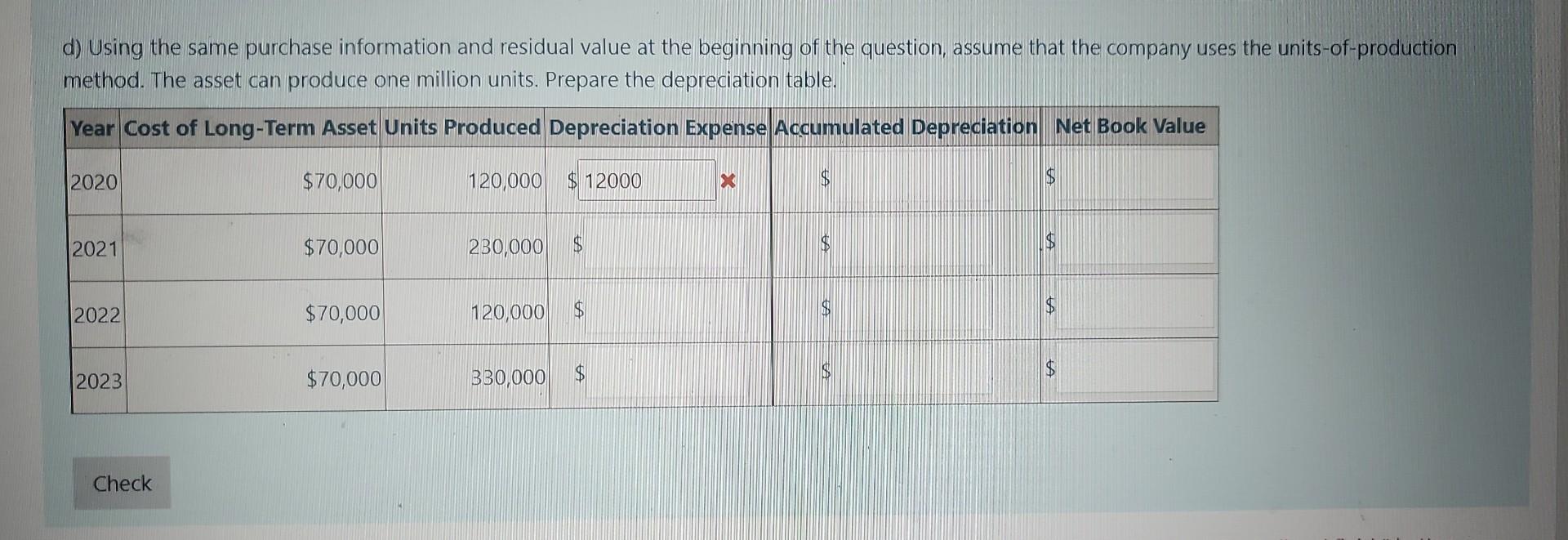

Take me to the text Equipment was purchased on January 1,2020 for $70,000. The asset is expected to last for four years, at which time the estimated residual value will be $10,000. Required a) Prepare a table showing the amount of depreciation expense each year, accumulated depreciation to date and net book value. The company uses straight-line depreciation. Do not enter dollar signs or commas in the input boxes. Round all dollar figure answers to the nearest whole number. b) The asset was sold for $12,000 on the first day of 2024. Prepare the journal entry to record the sale. Enter all debit accounts in alphabetical order. Enter all credit accounts in alphabetical order. b) The asset was sold for $12,000 on the first day of 2024. Prepare the journal entry to record the sale. Enter all debit accounts in alphabetical order. Enter all credit accounts in alphabetical order. c) Using the same purchase information at the beginning of the question, prepare the table assuming that the company used double-declining-balance depreciation. d) Using the same purchase information and residual value at the beginning of the question, assume that the company uses the units-of-production method. The asset can produce one million units. Prepare the depreciation table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started