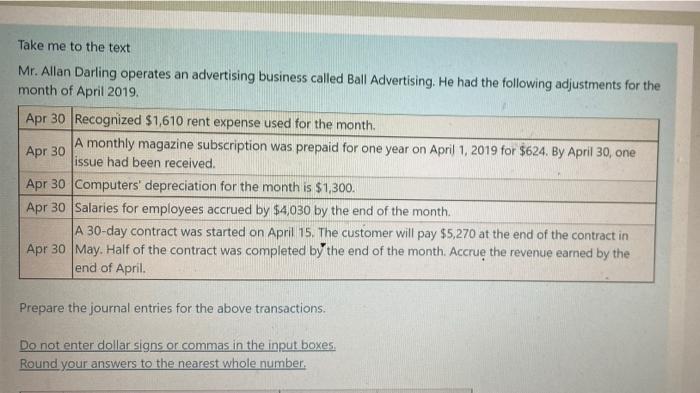

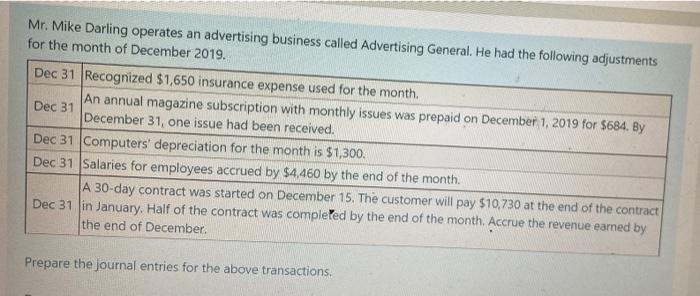

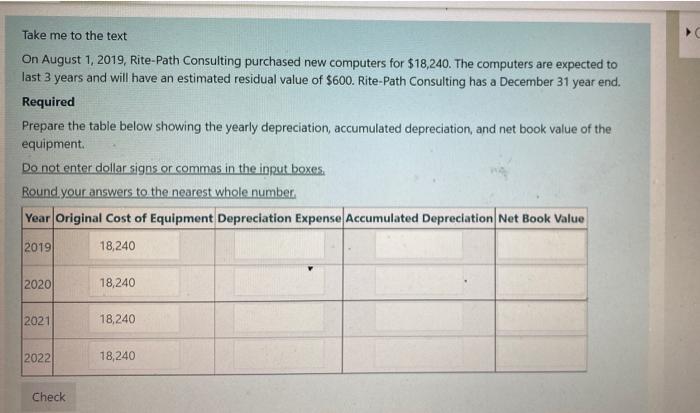

Take me to the text Mr. Allan Darling operates an advertising business called Ball Advertising. He had the following adjustments for the month of April 2019 Apr 30 Recognized $1,610 rent expense used for the month. A monthly magazine subscription was prepaid for one year on April 1, 2019 for $624. By April 30, one issue had been received. Apr 30 Computers' depreciation for the month is $1,300. Apr 30 Salaries for employees accrued by $4,030 by the end of the month. A 30-day contract was started on April 15. The customer will pay $5,270 at the end of the contract in Apr 30 May. Half of the contract was completed by the end of the month. Accrue the revenue earned by the end of April. Apr 30 Prepare the journal entries for the above transactions Do not enter dollar signs or commas in the input boxes. Round your answers to the nearest whole number Mr. Mike Darling operates an advertising business called Advertising General. He had the following adjustments for the month of December 2019. Dec 31 Recognized $1,650 insurance expense used for the month. An annual magazine subscription with monthly issues was prepaid on December 1, 2019 for $684. By Dec 31 December 31, one issue had been received. Dec 31 Computers' depreciation for the month is $1,300. Dec 31 Salaries for employees accrued by $4,460 by the end of the month. A 30-day contract was started on December 15. The customer will pay $10,730 at the end of the contract Dec 31 in January. Half of the contract was completed by the end of the month Accrue the revenue earned by the end of December Prepare the journal entries for the above transactions. Take me to the text On August 1, 2019, Rite-Path Consulting purchased new computers for $18,240. The computers are expected to last 3 years and will have an estimated residual value of $600. Rite-Path Consulting has a December 31 year end. Required Prepare the table below showing the yearly depreciation, accumulated depreciation, and net book value of the equipment Do not enter dollar signs or commas in the input boxes. Round your answers to the nearest whole number Year Original Cost of Equipment Depreciation Expense Accumulated Depreciation Net Book Value 2019 18,240 2020 18,240 2021 18,240 2022 18,240 Check