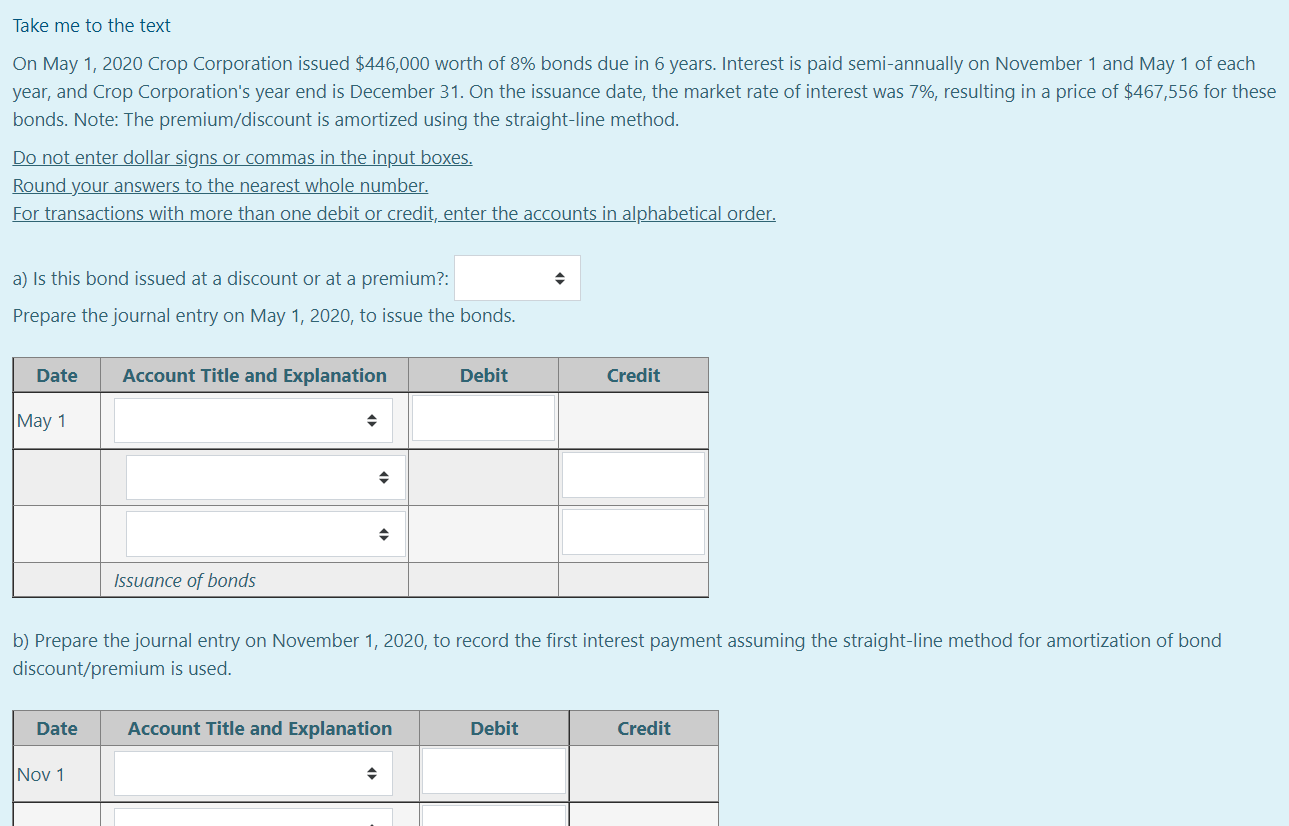

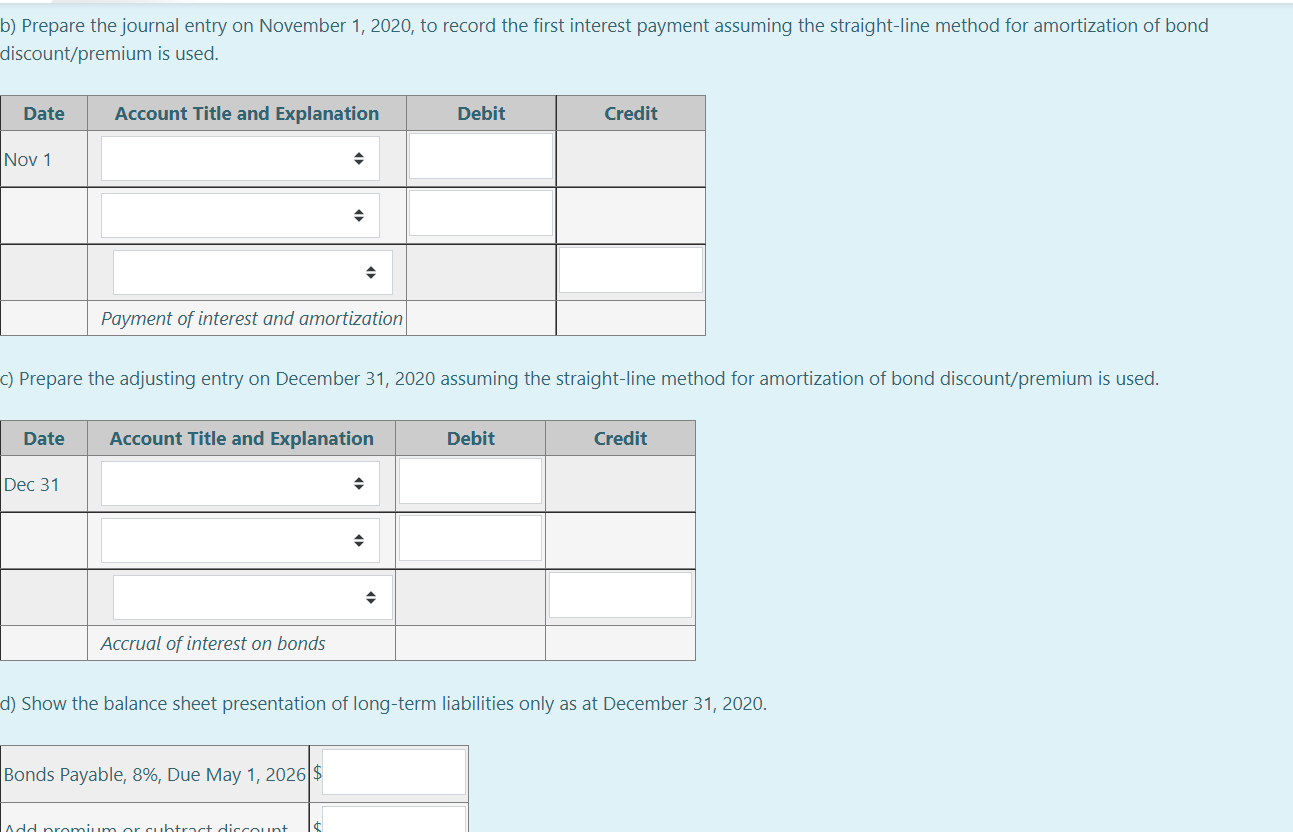

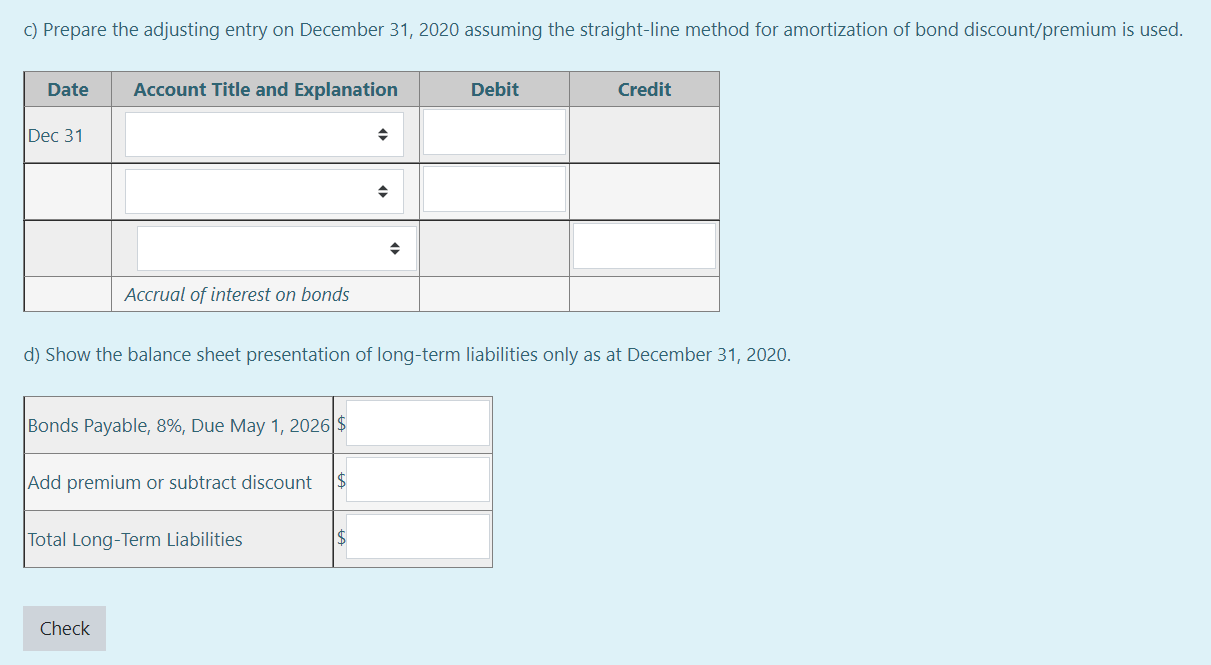

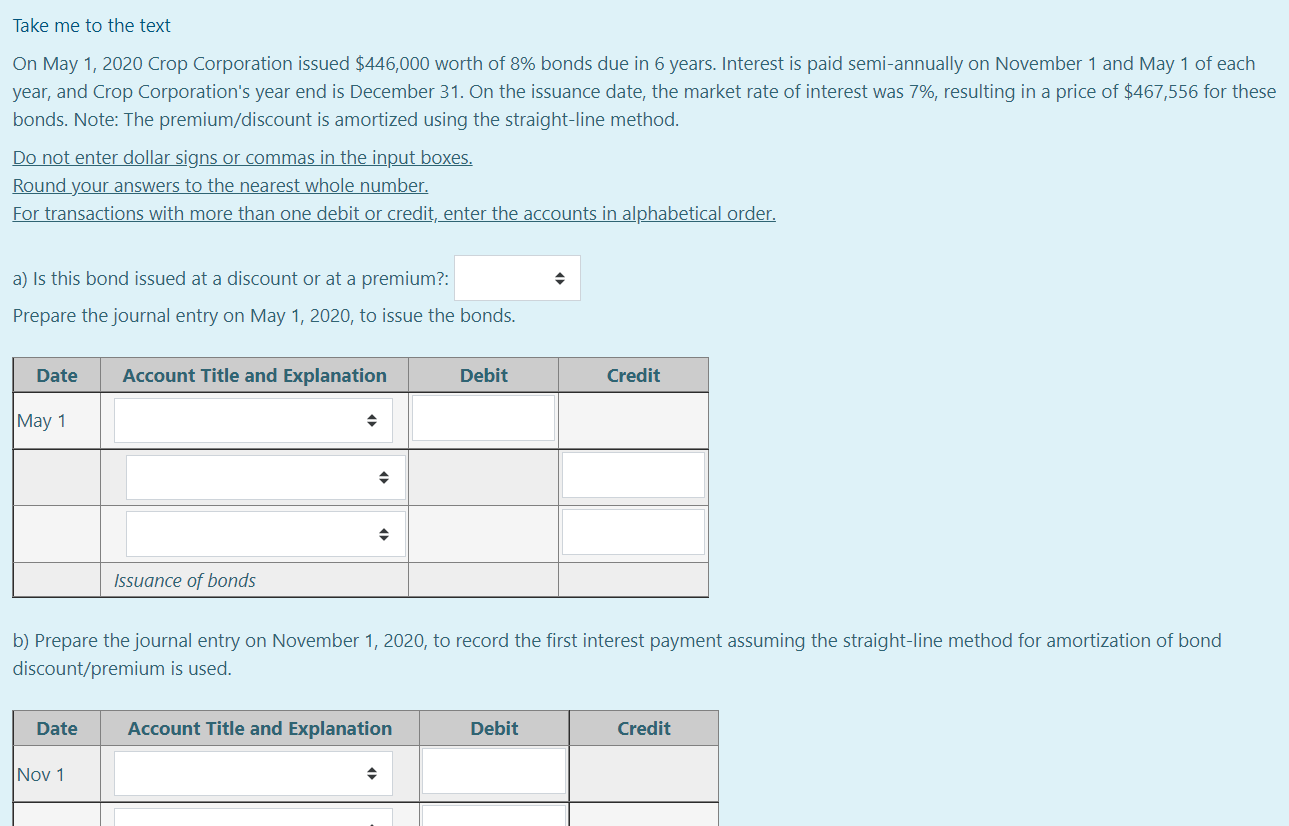

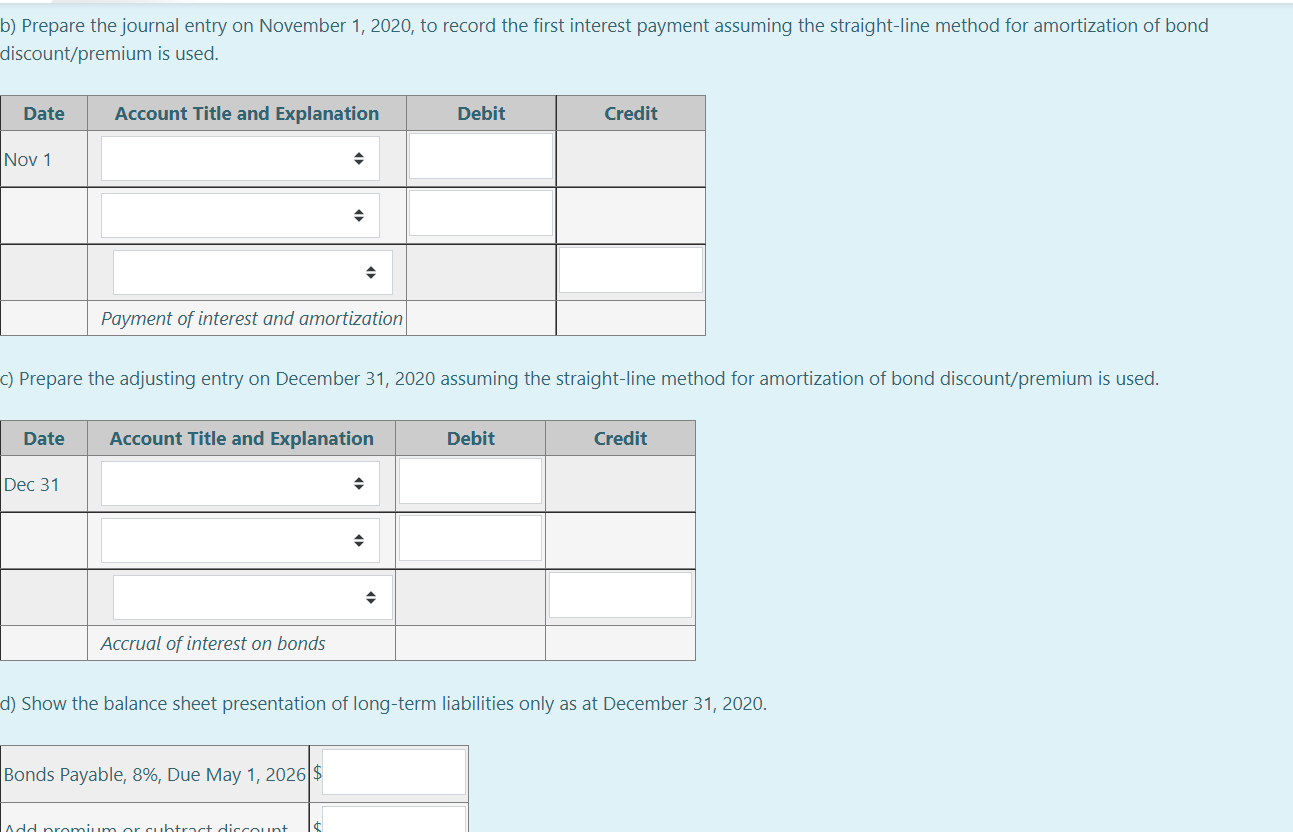

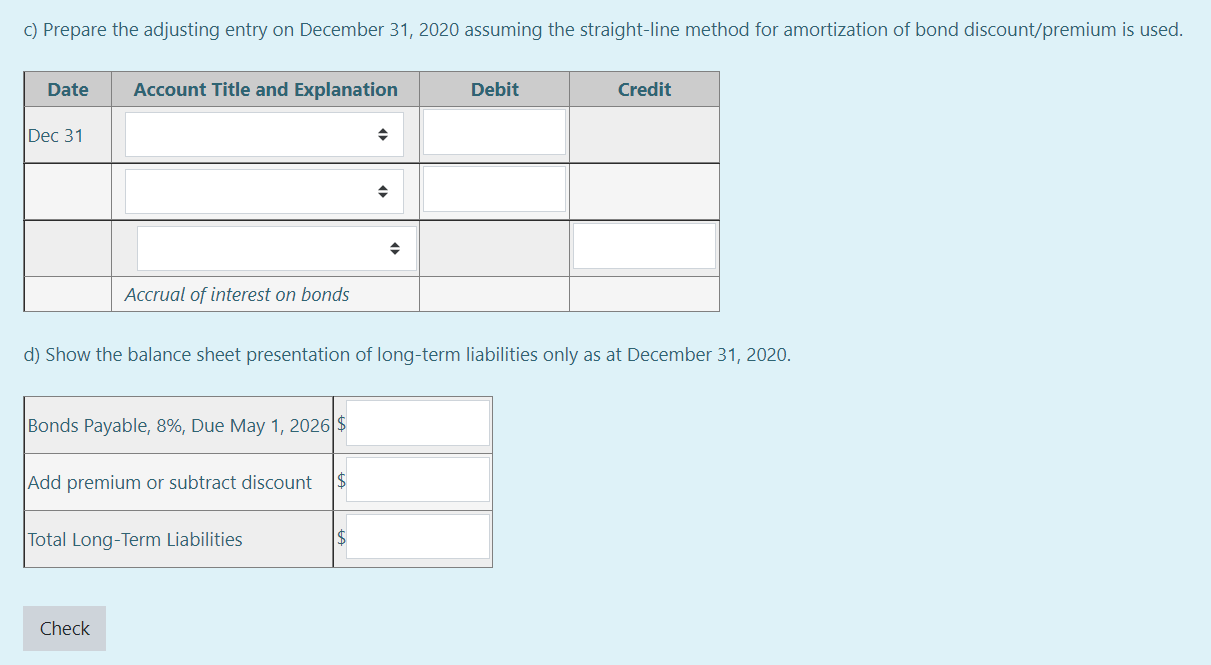

Take me to the text On May 1, 2020 Crop Corporation issued $446,000 worth of 8% bonds due in 6 years. Interest is paid semi-annually on November 1 and May 1 of each year, and Crop Corporation's year end is December 31. On the issuance date, the market rate of interest was 7%, resulting in a price of $467,556 for these bonds. Note: The premium/discount is amortized using the straight-line method. Do not enter dollar signs or commas in the input boxes. Round your answers to the nearest whole number. For transactions with more than one debit or credit, enter the accounts in alphabetical order. a) Is this bond issued at a discount or at a premium?: Prepare the journal entry on May 1, 2020, to issue the bonds. Date Account Title and Explanation Debit Credit May 1 Issuance of bonds b) Prepare the journal entry on November 1, 2020, to record the first interest payment assuming the straight-line method for amortization of bond discount/premium is used. Date Account Title and Explanation Debit Credit Nov 1 b) Prepare the journal entry on November 1, 2020, to record the first interest payment assuming the straight-line method for amortization of bond discount/premium is used. Date Account Title and Explanation Debit Credit Nov 1 Payment of interest and amortization C) Prepare the adjusting entry on December 31, 2020 assuming the straight-line method for amortization of bond discount/premium is used. Date Account Title and Explanation Debit Credit Dec 31 Accrual of interest on bonds d) Show the balance sheet presentation of long-term liabilities only as at December 31, 2020. Bonds Payable, 8%, Due May 1, 2026 $ Add orominar cubtract discount c) Prepare the adjusting entry on December 31, 2020 assuming the straight-line method for amortization of bond discount/premium is used. Date Account Title and Explanation Debit Credit Dec 31 Accrual of interest on bonds d) Show the balance sheet presentation of long-term liabilities only as at December 31, 2020. Bonds Payable, 8%, Due May 1, 2026 $ Add premium or subtract discount $ Total Long-Term Liabilities $ Check