take questions away from me, cant post individual or else you guys cant help me

take questions away from me, cant post individual or else you guys cant help me

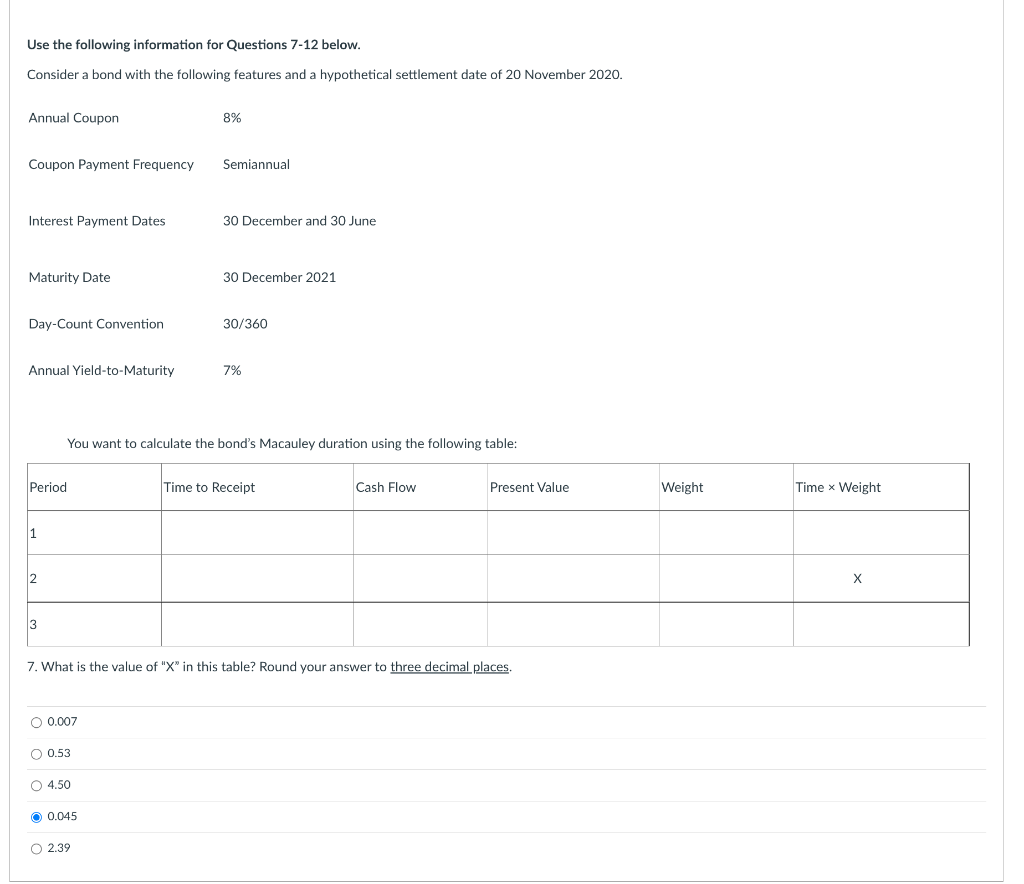

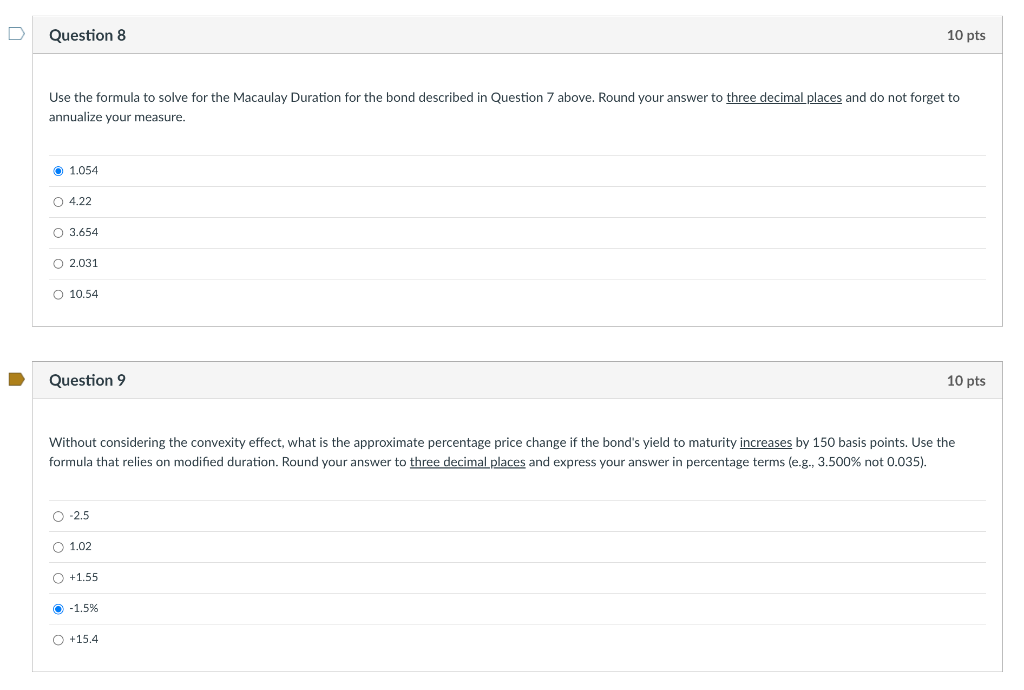

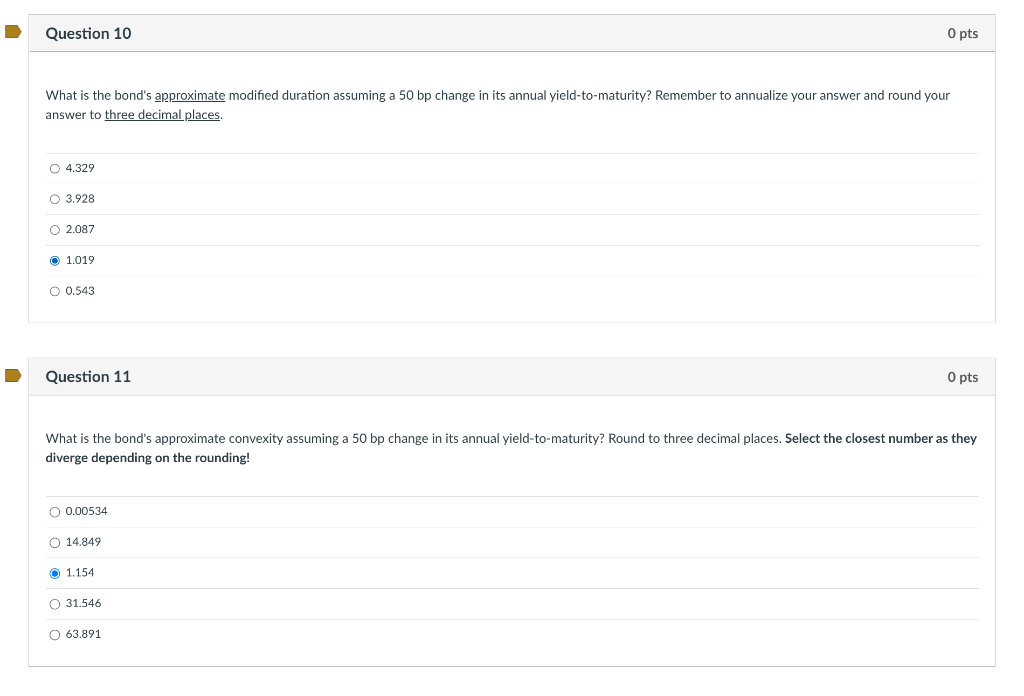

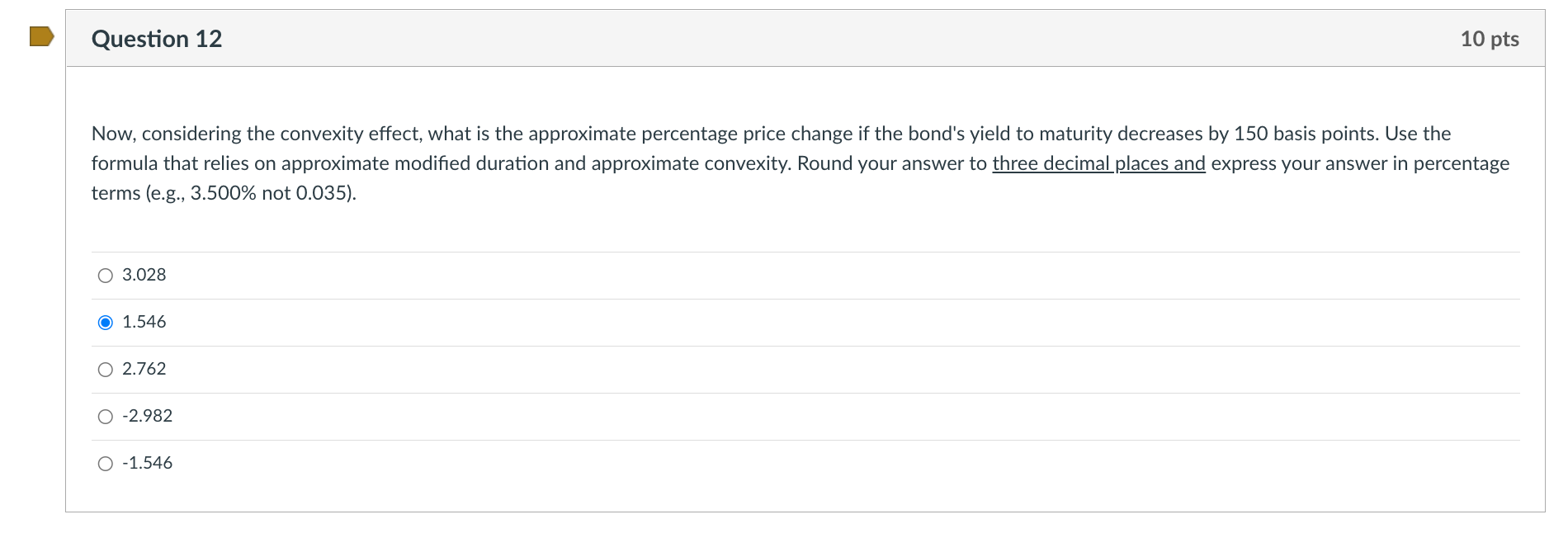

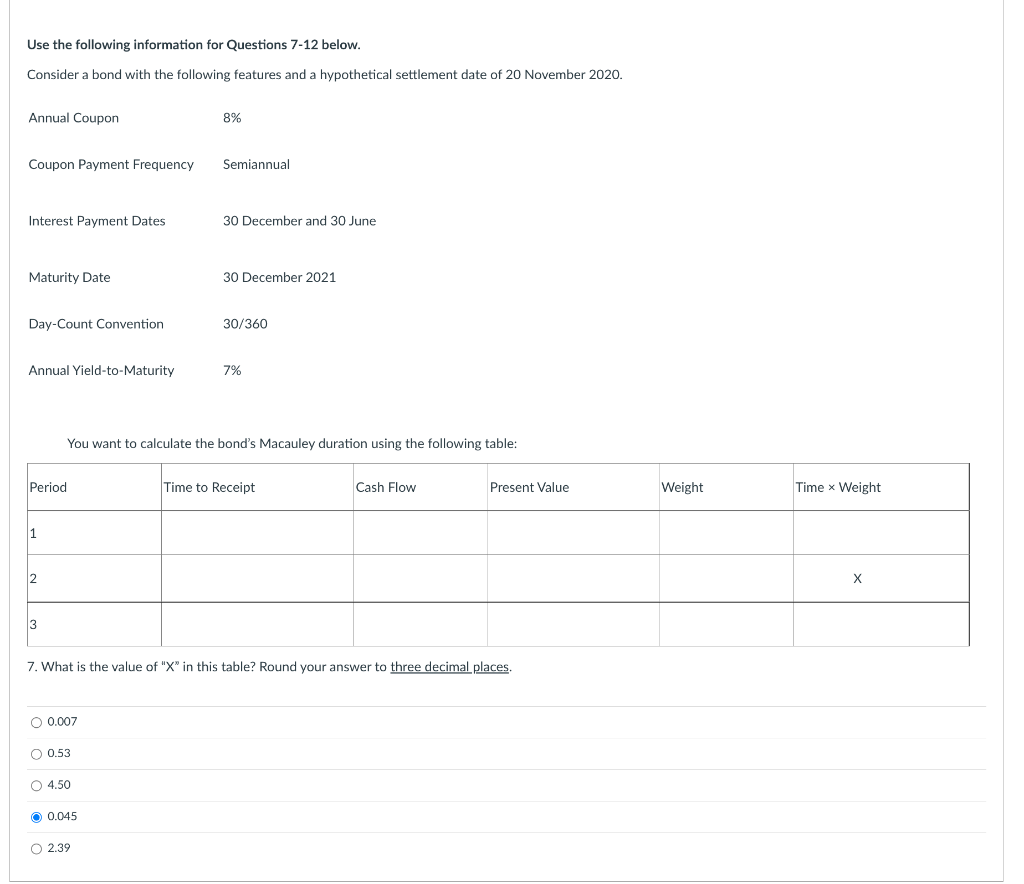

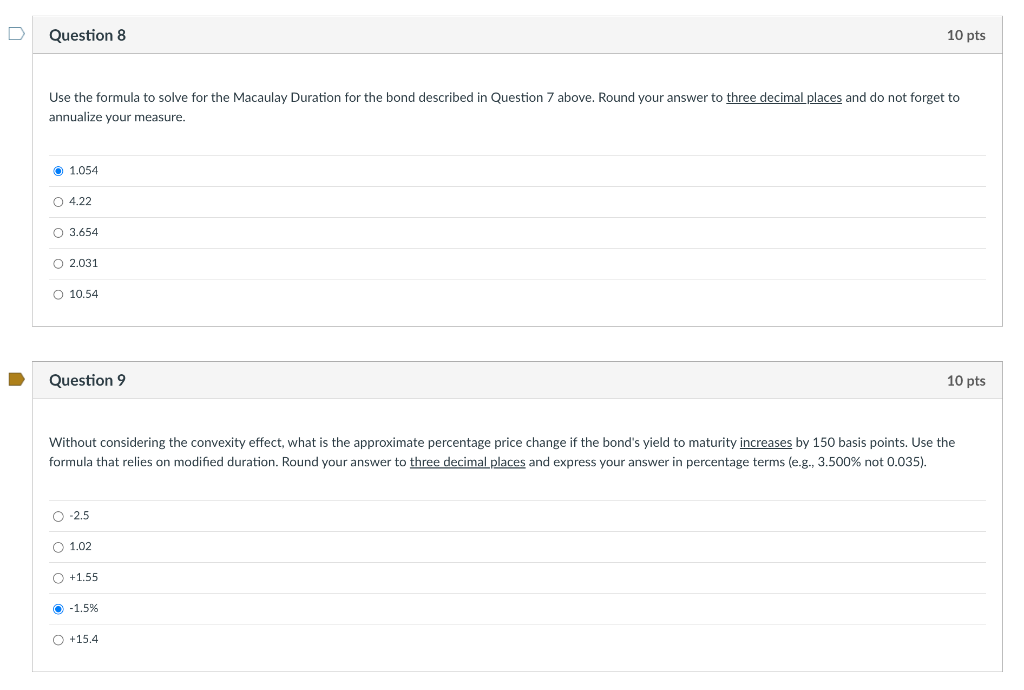

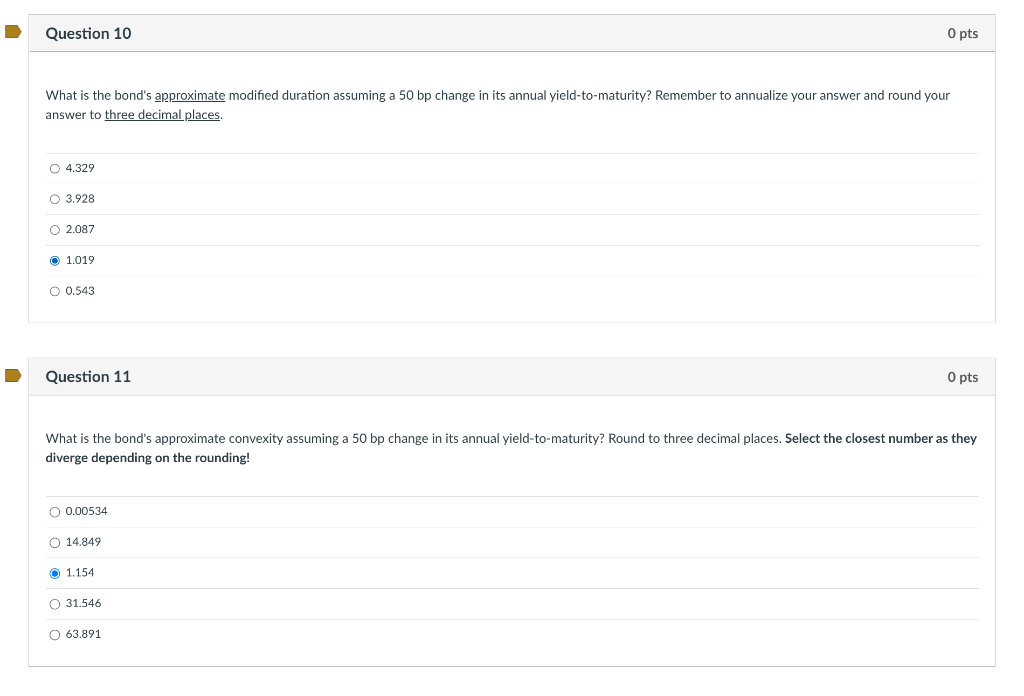

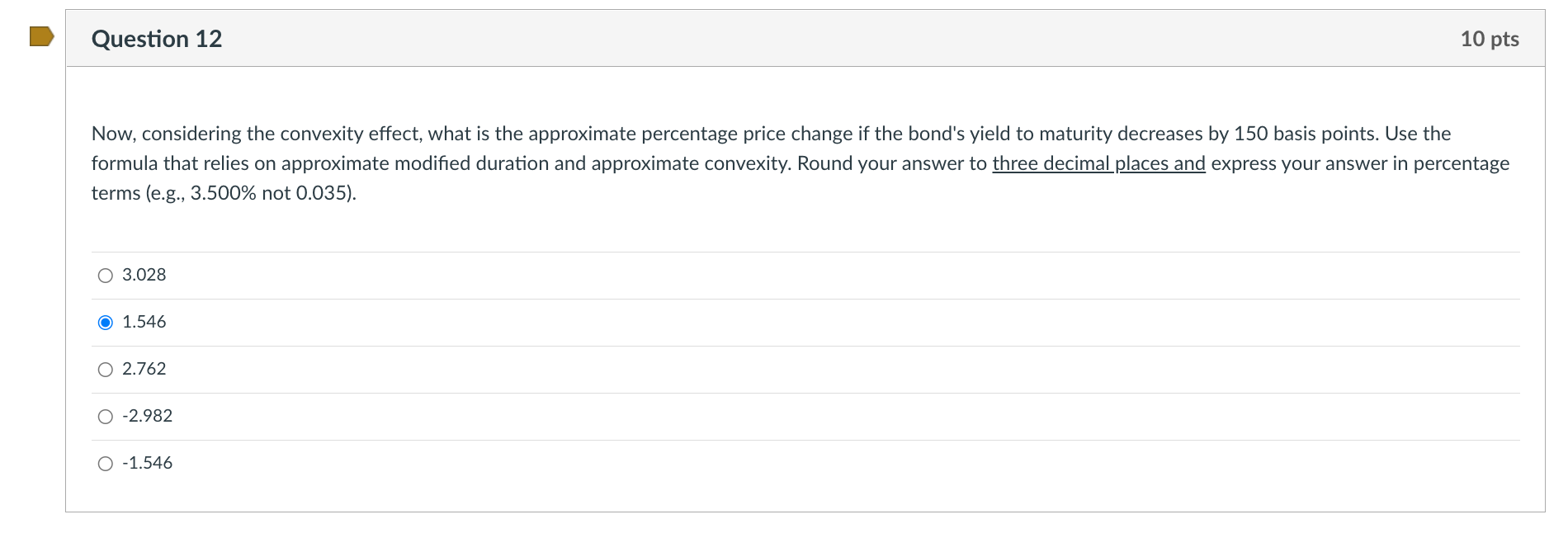

Use the following information for Questions 7-12 below. Consider a bond with the following features and a hypothetical settlement date of 20 November 2020. You want to calculate the bond's Macauley duration using the following table: 7. What is the value of " X " in this table? Round your answer to three decimal places. 0.007 0.53 4.50 0.045 2.39 Use the formula to solve for the Macaulay Duration for the bond described in Question 7 above. Round your answer to three decimal places and do not forget to annualize your measure. Question 9 Without considering the convexity effect, what is the approximate percentage price change if the bond's yield to maturity increases by 150 basis points. Use the formula that relies on modified duration. Round your answer to three decimal places and express your answer in percentage terms (e.g., 3.500% not 0.035 ). 2.5 1.02 +1.55 1.5% +15.4 What is the bond's approximate modified duration assuming a 50 bp change in its annual yield-to-maturity? Remember to annualize your answer and round your answer to three decimal places. 4.329 3.928 2.087 1.019 0.543 Question 11 0 pts What is the bond's approximate convexity assuming a 50 bp change in its annual yield-to-maturity? Round to three decimal places. Select the closest number as they diverge depending on the rounding! 0.00534 14.849 1.154 31.546 63.891 Now, considering the convexity effect, what is the approximate percentage price change if the bond's yield to maturity decreases by 150 basis points. Use the terms (e.g., 3.500\% not 0.035). 3.028 1.5462.762 2.982 1.546 Use the following information for Questions 7-12 below. Consider a bond with the following features and a hypothetical settlement date of 20 November 2020. You want to calculate the bond's Macauley duration using the following table: 7. What is the value of " X " in this table? Round your answer to three decimal places. 0.007 0.53 4.50 0.045 2.39 Use the formula to solve for the Macaulay Duration for the bond described in Question 7 above. Round your answer to three decimal places and do not forget to annualize your measure. Question 9 Without considering the convexity effect, what is the approximate percentage price change if the bond's yield to maturity increases by 150 basis points. Use the formula that relies on modified duration. Round your answer to three decimal places and express your answer in percentage terms (e.g., 3.500% not 0.035 ). 2.5 1.02 +1.55 1.5% +15.4 What is the bond's approximate modified duration assuming a 50 bp change in its annual yield-to-maturity? Remember to annualize your answer and round your answer to three decimal places. 4.329 3.928 2.087 1.019 0.543 Question 11 0 pts What is the bond's approximate convexity assuming a 50 bp change in its annual yield-to-maturity? Round to three decimal places. Select the closest number as they diverge depending on the rounding! 0.00534 14.849 1.154 31.546 63.891 Now, considering the convexity effect, what is the approximate percentage price change if the bond's yield to maturity decreases by 150 basis points. Use the terms (e.g., 3.500\% not 0.035). 3.028 1.5462.762 2.982 1.546

take questions away from me, cant post individual or else you guys cant help me

take questions away from me, cant post individual or else you guys cant help me