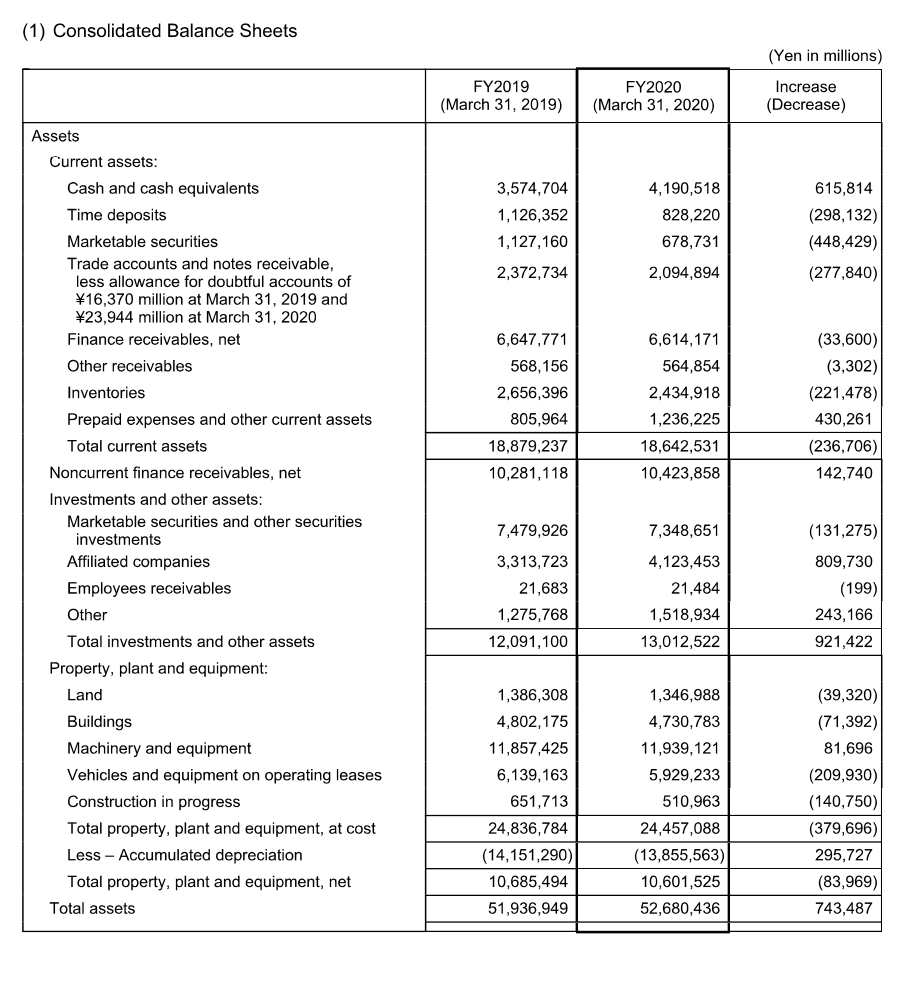

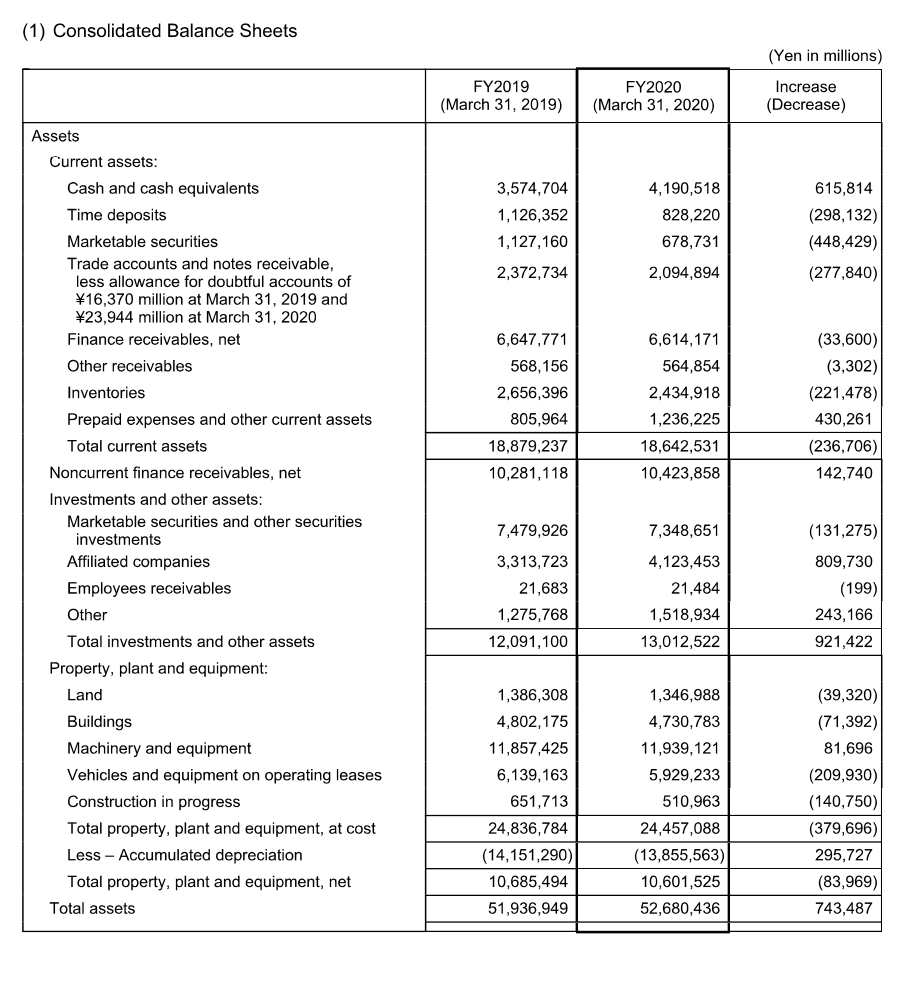

-- Take the FY2019 figures -- Calculate B/S P/L percentages/ratios in line with textbook -- Fill in the box provided below -- Rounding (ie number of figures below decimal point) to follow the textbook -- Use 1,792,375 for depreciation/amortization

Assets Cash and marketable securities % Accounts receivable % Inventories % Other current assets % Plant and equipment (net) % Other assets %

(1) Consolidated Balance Sheets (Yen in millions) FY2019 (March 31, 2019) FY2020 (March 31, 2020) Increase (Decrease) 3,574,704 1,126,352 1,127,160 4,190,518 828,220 678,731 615,814 (298,132) (448,429) (277,840) 2,372,734 2,094,894 Assets Current assets: Cash and cash equivalents Time deposits Marketable securities Trade accounts and notes receivable, less allowance for doubtful accounts of 16,370 million at March 31, 2019 and 23,944 million at March 31, 2020 Finance receivables, net Other receivables Inventories Prepaid expenses and other current assets Total current assets Noncurrent finance receivables, net Investments and other assets: Marketable securities and other securities investments Affiliated companies Employees receivables Other Total investments and other assets Property, plant and equipment: Land 6,647,771 568, 156 2,656,396 805,964 6,614,171 564,854 2,434,918 1,236,225 18,642,531 (33,600) (3,302) (221,478) 430,261 (236,706) 142,740 18,879,237 10,281,118 10,423,858 7,479,926 7,348,651 (131,275) 3,313,723 21,683 1,275,768 12,091,100 4,123,453 21,484 1,518,934 13,012,522 809,730 (199) 243,166 921,422 Buildings Machinery and equipment Vehicles and equipment on operating leases Construction in progress Total property, plant and equipment, at cost Less - Accumulated depreciation Total property, plant and equipment, net Total assets 1,386,308 4,802,175 11,857,425 6,139,163 651,713 24,836,784 (14,151,290) 10,685,494 51,936,949 1,346,988 4,730,783 11,939,121 5,929,233 510,963 24,457,088 (13,855,563) 10,601,525 52,680,436 (39,320) (71,392) 81,696 (209,930) (140,750) (379,696) 295,727 (83,969) 743,487 (1) Consolidated Balance Sheets (Yen in millions) FY2019 (March 31, 2019) FY2020 (March 31, 2020) Increase (Decrease) 3,574,704 1,126,352 1,127,160 4,190,518 828,220 678,731 615,814 (298,132) (448,429) (277,840) 2,372,734 2,094,894 Assets Current assets: Cash and cash equivalents Time deposits Marketable securities Trade accounts and notes receivable, less allowance for doubtful accounts of 16,370 million at March 31, 2019 and 23,944 million at March 31, 2020 Finance receivables, net Other receivables Inventories Prepaid expenses and other current assets Total current assets Noncurrent finance receivables, net Investments and other assets: Marketable securities and other securities investments Affiliated companies Employees receivables Other Total investments and other assets Property, plant and equipment: Land 6,647,771 568, 156 2,656,396 805,964 6,614,171 564,854 2,434,918 1,236,225 18,642,531 (33,600) (3,302) (221,478) 430,261 (236,706) 142,740 18,879,237 10,281,118 10,423,858 7,479,926 7,348,651 (131,275) 3,313,723 21,683 1,275,768 12,091,100 4,123,453 21,484 1,518,934 13,012,522 809,730 (199) 243,166 921,422 Buildings Machinery and equipment Vehicles and equipment on operating leases Construction in progress Total property, plant and equipment, at cost Less - Accumulated depreciation Total property, plant and equipment, net Total assets 1,386,308 4,802,175 11,857,425 6,139,163 651,713 24,836,784 (14,151,290) 10,685,494 51,936,949 1,346,988 4,730,783 11,939,121 5,929,233 510,963 24,457,088 (13,855,563) 10,601,525 52,680,436 (39,320) (71,392) 81,696 (209,930) (140,750) (379,696) 295,727 (83,969) 743,487