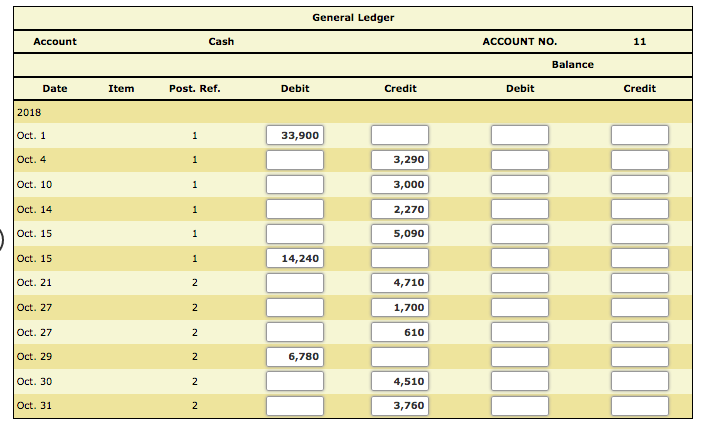

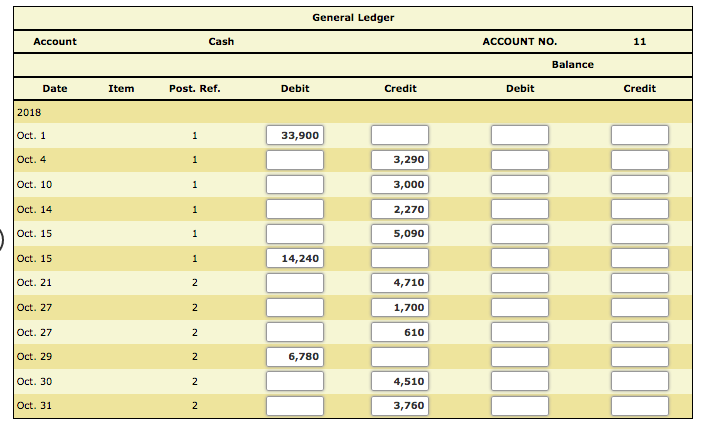

Take the information from the journal and transfer it to a 4-column ledger (Ledger examples included below)

I don't know how to do the Balance side Debits and Credits.... I have filled out the left side debits and credits...

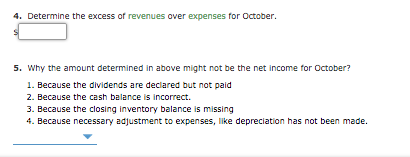

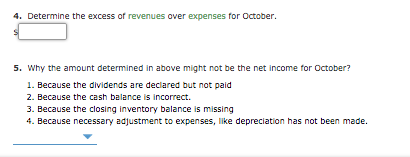

Then... The following two questions follow...

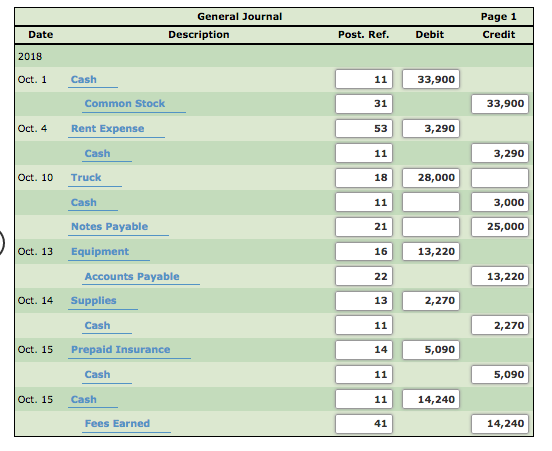

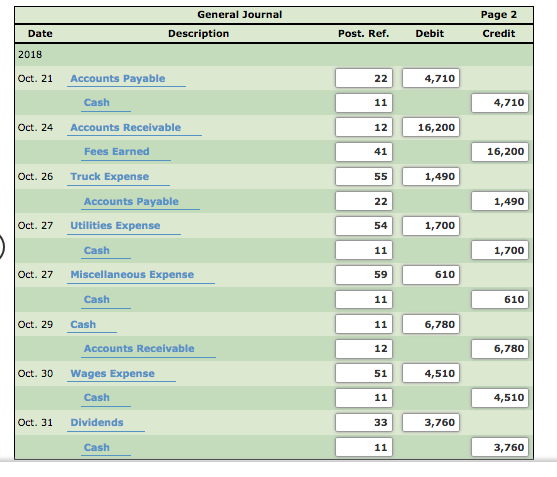

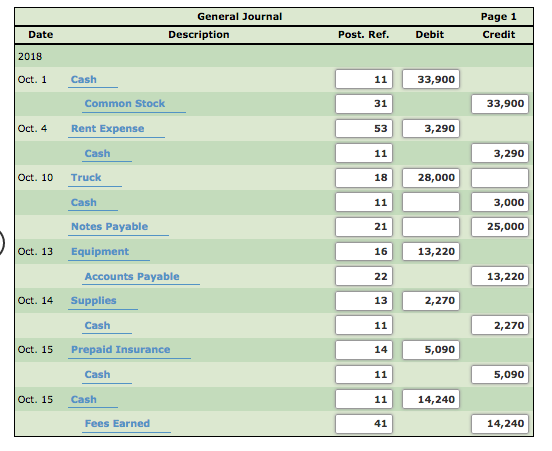

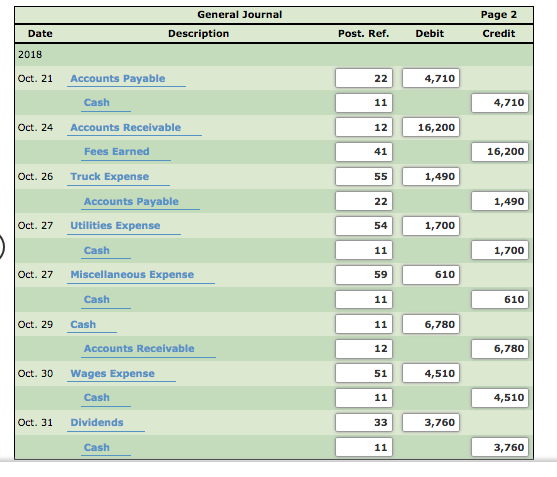

General Journal Page 1 Date 2018 Oct. 1 Cash Description Post. Ref Debit Credit 33,900 31 33,900 Common Stock Oct. 4 Rent Expense 53 3,290 Cash 3,290 Oct. 10 Truck 18 28,000 Cash 3,000 21 Notes Payable 25,000 16 Oct. 13 Equipment 13,220 13,220 Accounts Payable Oct. 14 Supplies 13 2,270 Cash 2,270 Oct. 15 Prepaid Insurance 14 5,090 Cash 5,090 Oct. 15 Cash 14,240 41 Fees Earned 14,240 General Journal Page 2 Date Description Post. Ref Debit Credit 2018 4,710 Oct. 21 Accounts Payable Cash 4,710 Oct. 24 Accounts Receivable 12 16,200 41 Fees Earned 16,200 Oct. 26 Truck Expense 1,490 Accounts Payable 1,490 Oct. 27 Utilities Expense 54 1,700 Cash 1,700 Oct. 27 Miscellaneous Expense 59 610 Cash 610 Oct. 29 Cash 6,780 Accounts Receivable 12 6,780 51 Oct. 30 Wages Expense 4,510 Cash 4,510 Oct. 31 Dividends 3,760 Cash 3,760 General Ledger Account Cash ACCOUNT NO. Balance Credit Date Item Post. Ref Debit Credit Debit 2018 Oct. 1 Oct. 4 Oct. 10 Oct. 14 Oct. 15 Oct. 15 Oct. 21 Oct. 27 Oct. 27 Oct. 29 Oct. 30 Oct. 31 33,900 3,290 3,000 2,270 5,090 14,240 4,710 610 6,780 4,510 3,760 4. Determine the excess of revenues over expenses for October. 5. Why the amount determined in above might not be the net income for October? 1. Because the dividends are declared but not paid 2. Because the cash balance is incorrect 3. Because the closing inventory balance is missing 4. Because necessary adjustment to expenses, like depreciation has not been made. General Journal Page 1 Date 2018 Oct. 1 Cash Description Post. Ref Debit Credit 33,900 31 33,900 Common Stock Oct. 4 Rent Expense 53 3,290 Cash 3,290 Oct. 10 Truck 18 28,000 Cash 3,000 21 Notes Payable 25,000 16 Oct. 13 Equipment 13,220 13,220 Accounts Payable Oct. 14 Supplies 13 2,270 Cash 2,270 Oct. 15 Prepaid Insurance 14 5,090 Cash 5,090 Oct. 15 Cash 14,240 41 Fees Earned 14,240 General Journal Page 2 Date Description Post. Ref Debit Credit 2018 4,710 Oct. 21 Accounts Payable Cash 4,710 Oct. 24 Accounts Receivable 12 16,200 41 Fees Earned 16,200 Oct. 26 Truck Expense 1,490 Accounts Payable 1,490 Oct. 27 Utilities Expense 54 1,700 Cash 1,700 Oct. 27 Miscellaneous Expense 59 610 Cash 610 Oct. 29 Cash 6,780 Accounts Receivable 12 6,780 51 Oct. 30 Wages Expense 4,510 Cash 4,510 Oct. 31 Dividends 3,760 Cash 3,760 General Ledger Account Cash ACCOUNT NO. Balance Credit Date Item Post. Ref Debit Credit Debit 2018 Oct. 1 Oct. 4 Oct. 10 Oct. 14 Oct. 15 Oct. 15 Oct. 21 Oct. 27 Oct. 27 Oct. 29 Oct. 30 Oct. 31 33,900 3,290 3,000 2,270 5,090 14,240 4,710 610 6,780 4,510 3,760 4. Determine the excess of revenues over expenses for October. 5. Why the amount determined in above might not be the net income for October? 1. Because the dividends are declared but not paid 2. Because the cash balance is incorrect 3. Because the closing inventory balance is missing 4. Because necessary adjustment to expenses, like depreciation has not been made