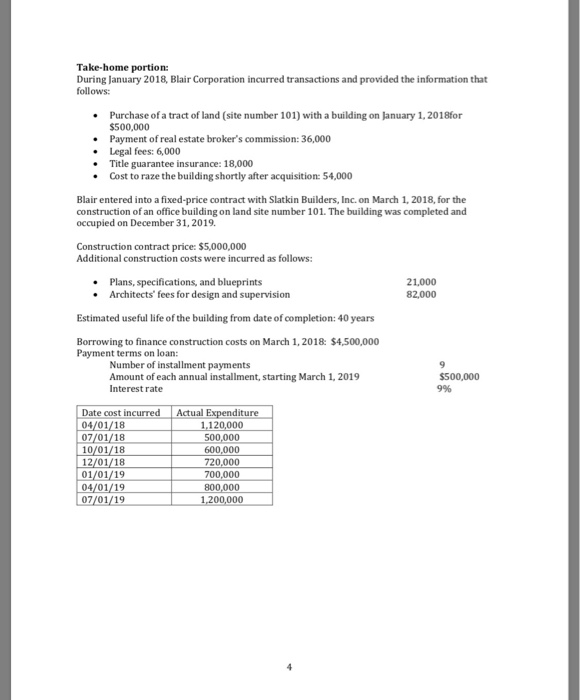

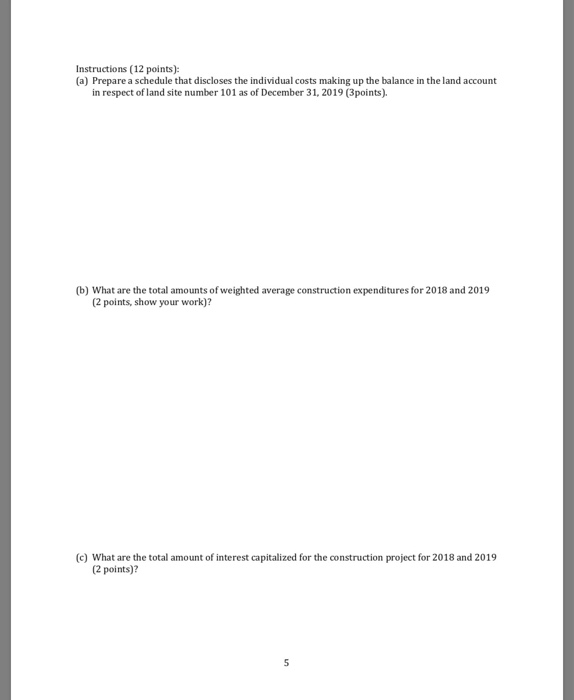

Take-home portion: During January 2018, Blair Corporation incurred transactions and provided the information that follows: .Purchase of a tract of land (site number 101) with a building on January 1, 2018for $500,000 Payment of real estate broker's commission: 36,000 Legal fees: 6,000 Title guarantee insurance: 18,000 Cost to raze the building shortly after acquisition: 54,000 . . Blair entered into a fixed-price contract with Slatkin Builders, Inc. on March 1, 2018, for the construction of an office building on land site number 101. The building was completed and occupied on December 31, 2019. Construction contract price: $5,000,000 Additional construction costs were incurred as follows: .Plans, specifications, and blueprints 21,000 82,000 Architects' fees for design and supervision Estimated useful life of the building from date of completion: 40 years Borrowing to finance construction costs on March 1, 2018: $4,500,000 Payment terms on loan: Number of installment payments Amount of each annual installment, starting March 1, 2019 Interest rate $500,000 9% ate cost incurred Actual Expendit 1,120,000 500,000 01/18 07/01/18 10/01/18 12/01/18 01/01/19 04/01/19 600 720,000 700 800 Instructions (12 points): (a) Prepare a schedule that discloses the individual costs making up the balance in the land account in respect of land site number 101 as of December 31, 2019 (3points) (b) What are the total amounts of weighted average construction expenditures for 2018 and 2019 (2 points, show your work)? (c) What are the total amount of interest capitalized for the construction project for 2018 and 2019 (2 points)? (d) What are the total amount of actual interest costs associated with borrowing to finance this construction project for 2018 & 2019 (3 points)? (e) Prepare a schedule that discloses total costs that should be capitalized for the building. building account as of December 31,2019. Show supporting computations in good form (2 points) Take-home portion: During January 2018, Blair Corporation incurred transactions and provided the information that follows: .Purchase of a tract of land (site number 101) with a building on January 1, 2018for $500,000 Payment of real estate broker's commission: 36,000 Legal fees: 6,000 Title guarantee insurance: 18,000 Cost to raze the building shortly after acquisition: 54,000 . . Blair entered into a fixed-price contract with Slatkin Builders, Inc. on March 1, 2018, for the construction of an office building on land site number 101. The building was completed and occupied on December 31, 2019. Construction contract price: $5,000,000 Additional construction costs were incurred as follows: .Plans, specifications, and blueprints 21,000 82,000 Architects' fees for design and supervision Estimated useful life of the building from date of completion: 40 years Borrowing to finance construction costs on March 1, 2018: $4,500,000 Payment terms on loan: Number of installment payments Amount of each annual installment, starting March 1, 2019 Interest rate $500,000 9% ate cost incurred Actual Expendit 1,120,000 500,000 01/18 07/01/18 10/01/18 12/01/18 01/01/19 04/01/19 600 720,000 700 800 Instructions (12 points): (a) Prepare a schedule that discloses the individual costs making up the balance in the land account in respect of land site number 101 as of December 31, 2019 (3points) (b) What are the total amounts of weighted average construction expenditures for 2018 and 2019 (2 points, show your work)? (c) What are the total amount of interest capitalized for the construction project for 2018 and 2019 (2 points)? (d) What are the total amount of actual interest costs associated with borrowing to finance this construction project for 2018 & 2019 (3 points)? (e) Prepare a schedule that discloses total costs that should be capitalized for the building. building account as of December 31,2019. Show supporting computations in good form (2 points)