Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Taking the role as the financial manager of the treasury department of Lululemon Athletica, you have been assigned to the team estimating Lululemon's WACC. You

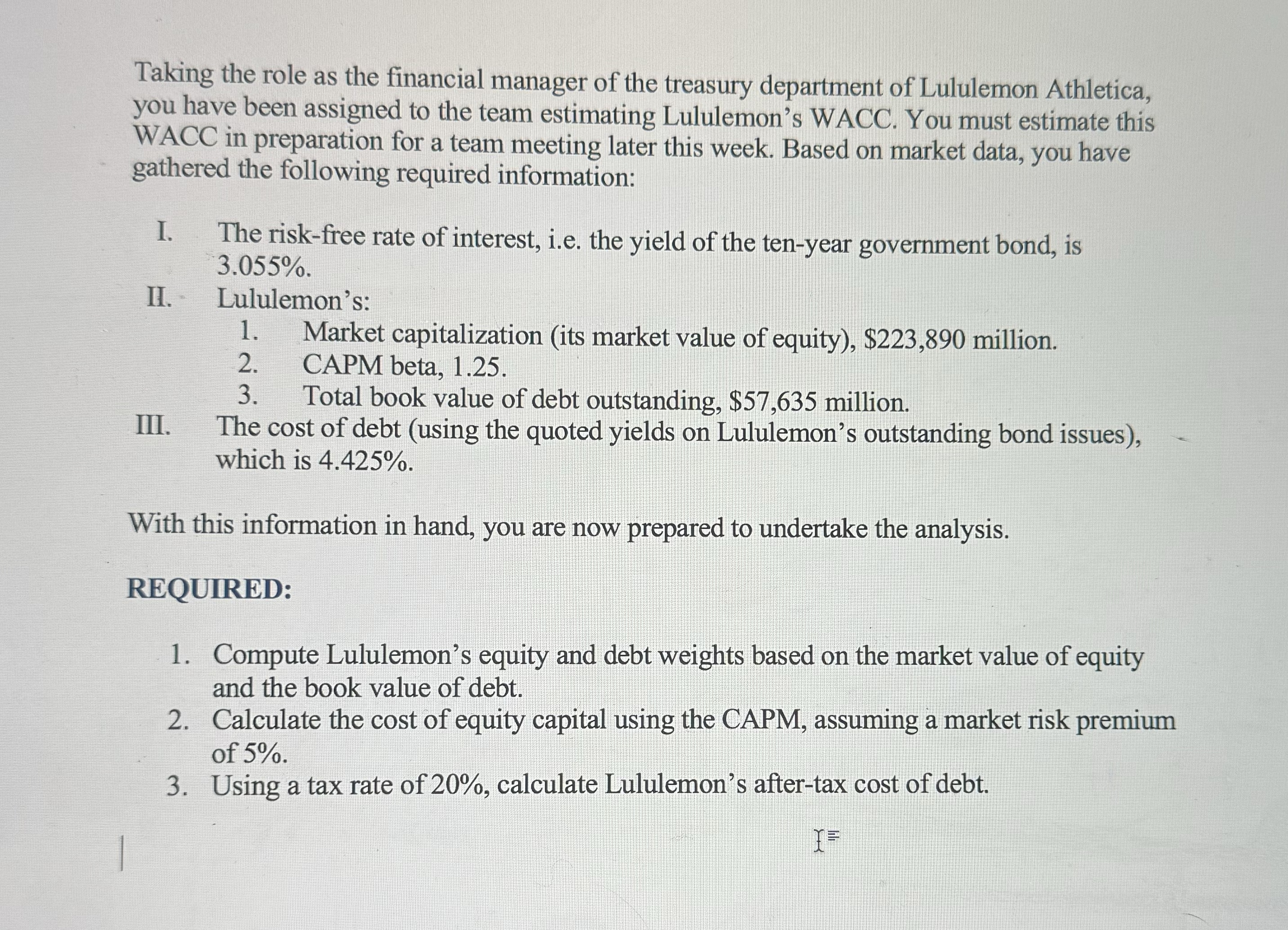

Taking the role as the financial manager of the treasury department of Lululemon Athletica, you have been assigned to the team estimating Lululemon's WACC. You must estimate this WACC in preparation for a team meeting later this week. Based on market data, you have gathered the following required information:

I. The riskfree rate of interest, ie the yield of the tenyear government bond, is

II Lululemon's:

Market capitalization its market value of equity $ million.

CAPM beta,

Total book value of debt outstanding, $ million.

III. The cost of debt using the quoted yields on Lululemon's outstanding bond issues which is

With this information in hand, you are now prepared to undertake the analysis.

REQUIRED:

Compute Lululemon's equity and debt weights based on the market value of equity and the book value of debt.

Calculate the cost of equity capital using the CAPM, assuming a market risk premium of

Using a tax rate of calculate Lululemon's aftertax cost of debt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started