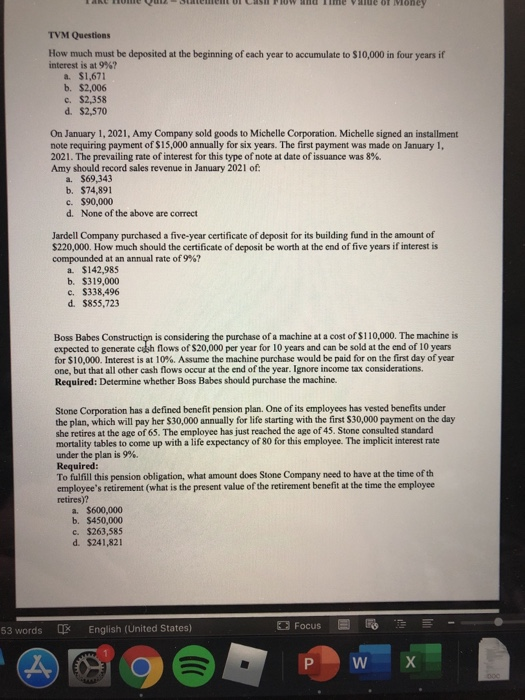

TAL TUMI VUJUMUIS H O oney TVM Questions How much must be deposited at the beginning of each year to accumulate to $10,000 in four years it! interest is at 9%? a $1,671 b. $2,006 c. $2,358 d. $2,570 On January 1, 2021, Amy Company sold goods to Michelle Corporation. Michelle signed an installment note requiring payment of $15,000 annually for six years. The first payment was made on January 1. 2021. The prevailing rate of interest for this type of note at date of issuance was 8%. Amy should record sales revenue in January 2021 of: a. $69,343 b. $74,891 c. $90,000 d. None of the above are correct Jardell Company purchased a five-year certificate of deposit for its building fund in the amount of $220,000. How much should the certificate of deposit be worth at the end of five years if interest is compounded at an annual rate of 9%? a $142,985 b. $319,000 c. $338,496 d. $855,723 Boss Babes Construction is considering the purchase of a machine at a cost of $110,000. The machine is expected to generate cash flows of S20,000 per year for 10 years and can be sold at the end of 10 years for $10,000. Interest is at 10%. Assume the machine purchase would be paid for on the first day of year one, but that all other cash flows occur at the end of the year. Ignore income tax considerations. Required: Determine whether Boss Babes should purchase the machine. Stone Corporation has a defined benefit pension plan. One of its employees has vested benefits under the plan, which will pay her $30,000 annually for life starting with the first $30,000 payment on the day she retires at the age of 65. The employee has just reached the age of 45. Stone consulted standard mortality tables to come up with a life expectancy of 80 for this employee. The implicit interest rate under the plan is 9% Required: To fulfill this pension obligation, what amount does Stone Company need to have at the time of th employee's retirement (what is the present value of the retirement benefit at the time the employee retires)? a. $600,000 b. $450,000 c. $263,585 d. $241,821 53 words K English (United States) Focus