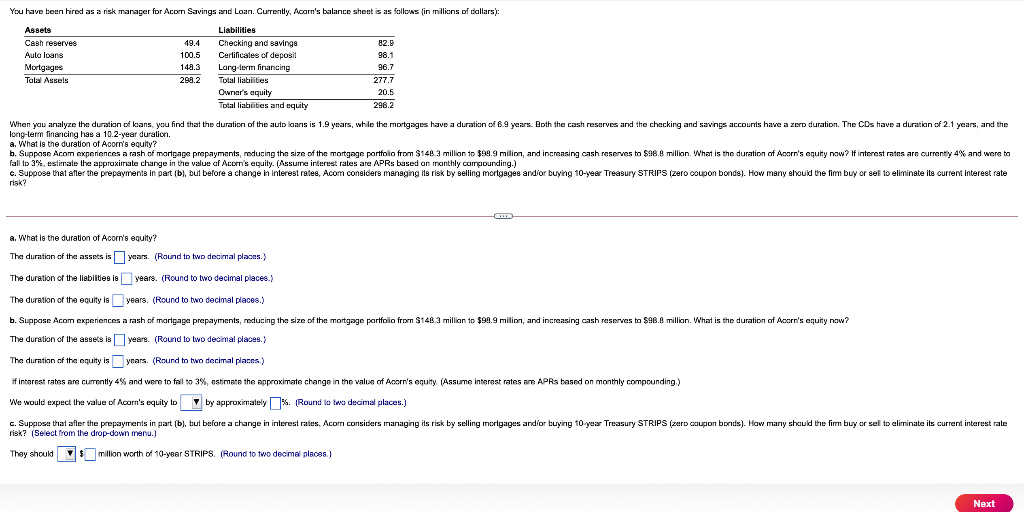

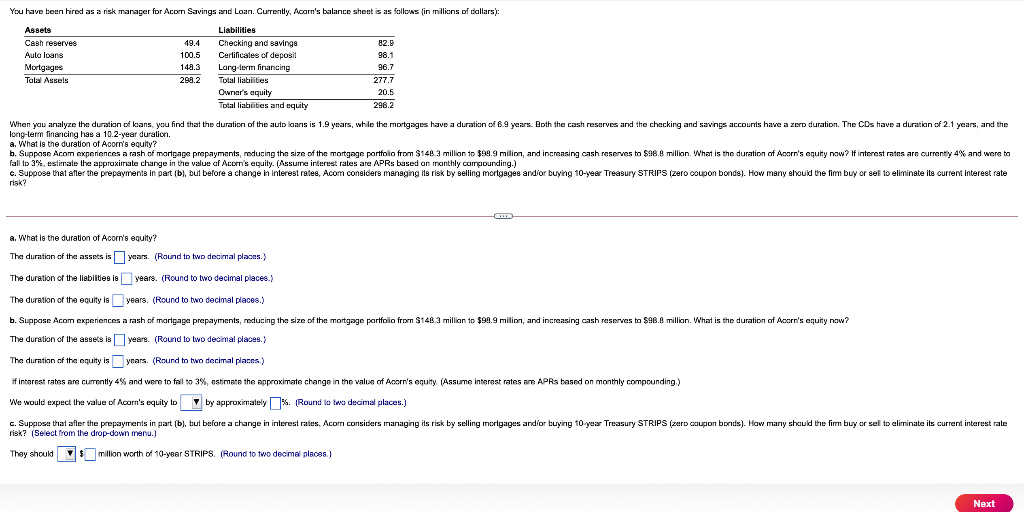

Talal Assels You have been hired as a risk manager for Acorn Savings and Loan. Currently, Acarn's balance sheet is as follows (in millions of dollars): Assets Liabilities Cash reserves 49.4 Checking and savings 82.9 Auta loans 100.5 Certificates of deposit 98.1 Mortgages 148.3 Long term financing 96.7 298.2 Total liabilities 277.7 Owner's equity 20.5 Total liabilities and equity 298.2 When you analyze the duration of lans, you find that the duration of the autolaans is 1.9 years, while the mortgages have a duration of 6.9 years. Both the cash reserves and the checking and savings accounts have a zero duration. The CDs have a duration of 2.1 years, and the long-term financing has a 10.2-year duration a. What is the duration of Acorn's equity? 6. Suppose Acom experiences a rash of mortgage prepayments, reducing the size of the mortgage portfolio from $148.3 million to $99.9 milion, and increasing cash reserves to $98.9 million. What is the duration of Acorn's equity now? If interest rates are currently 4% and were to fall to 3%, estimate the approximate change in the value of Acom's equity. (Assume interest rates are APRs based on monthly compounding.) 6. Suppose that after the prepayments in part {b}, but before a change in interest rates, com considers managing the risk by selling mortgages andior buying 10-year Treasury STRIPS (zero coupon bonds). How many should the fim buy or sell to eliminate its current interest rate cb), its RE a. What is the duration of Acorn's equity? The duration of the assets is year. (Round to two decimal places. The duration of the liabilties is years. (Round to two decimal places. . ) The duration of the equity is years. (Round to two decimal places.) . . b. Suppase Acom experiences a rash of martgage prepayments, reducing the size of the mortgage partfolio from $146.3 million to $99.9 milion, and increasing cash reserves to $96.8 million. What is the duration of Acorn's cquity now? The duration of the assets is years. (Round to two decimal places. The duration of the equity is years. (Round to two decimal places.) If interest rates are currently 4% and were to fail to 3%, estimate the approximate change in the value of Acorn's equity (Assume interest rates are APRs based on monthly compounding.) We would expect the value of corn's equity to by approximately %. (Round to two decimal places.) c. Suppose that after the prepayments in part (b), but before a change in interest rates. Acom considers managing its risk by selling mortgages and/or buying 10 year Treasury STRIPS (zero coupon bonds). How many should the firrn buy or sel to eliminate its current interest rate risk? (Select from the drop-down menu.) They should million worth of 10-year STRIPS. (Round to two decimal places) $ Next Talal Assels You have been hired as a risk manager for Acorn Savings and Loan. Currently, Acarn's balance sheet is as follows (in millions of dollars): Assets Liabilities Cash reserves 49.4 Checking and savings 82.9 Auta loans 100.5 Certificates of deposit 98.1 Mortgages 148.3 Long term financing 96.7 298.2 Total liabilities 277.7 Owner's equity 20.5 Total liabilities and equity 298.2 When you analyze the duration of lans, you find that the duration of the autolaans is 1.9 years, while the mortgages have a duration of 6.9 years. Both the cash reserves and the checking and savings accounts have a zero duration. The CDs have a duration of 2.1 years, and the long-term financing has a 10.2-year duration a. What is the duration of Acorn's equity? 6. Suppose Acom experiences a rash of mortgage prepayments, reducing the size of the mortgage portfolio from $148.3 million to $99.9 milion, and increasing cash reserves to $98.9 million. What is the duration of Acorn's equity now? If interest rates are currently 4% and were to fall to 3%, estimate the approximate change in the value of Acom's equity. (Assume interest rates are APRs based on monthly compounding.) 6. Suppose that after the prepayments in part {b}, but before a change in interest rates, com considers managing the risk by selling mortgages andior buying 10-year Treasury STRIPS (zero coupon bonds). How many should the fim buy or sell to eliminate its current interest rate cb), its RE a. What is the duration of Acorn's equity? The duration of the assets is year. (Round to two decimal places. The duration of the liabilties is years. (Round to two decimal places. . ) The duration of the equity is years. (Round to two decimal places.) . . b. Suppase Acom experiences a rash of martgage prepayments, reducing the size of the mortgage partfolio from $146.3 million to $99.9 milion, and increasing cash reserves to $96.8 million. What is the duration of Acorn's cquity now? The duration of the assets is years. (Round to two decimal places. The duration of the equity is years. (Round to two decimal places.) If interest rates are currently 4% and were to fail to 3%, estimate the approximate change in the value of Acorn's equity (Assume interest rates are APRs based on monthly compounding.) We would expect the value of corn's equity to by approximately %. (Round to two decimal places.) c. Suppose that after the prepayments in part (b), but before a change in interest rates. Acom considers managing its risk by selling mortgages and/or buying 10 year Treasury STRIPS (zero coupon bonds). How many should the firrn buy or sel to eliminate its current interest rate risk? (Select from the drop-down menu.) They should million worth of 10-year STRIPS. (Round to two decimal places) $ Next