Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Talize Inc. has the following balances at December 31, 2014, its year end: Preferred Shares, $4.25 cumulative (dividends in arrears for 2013 and 2014)

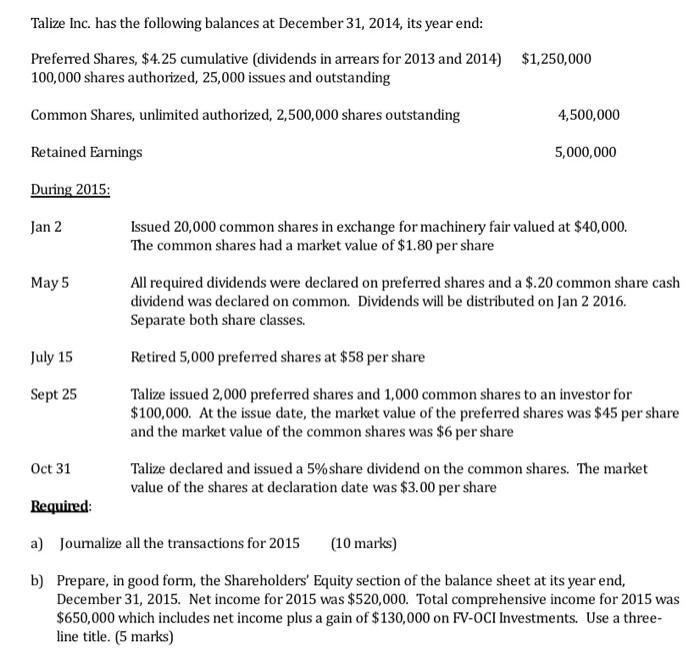

Talize Inc. has the following balances at December 31, 2014, its year end: Preferred Shares, $4.25 cumulative (dividends in arrears for 2013 and 2014) $1,250,000 100,000 shares authorized, 25,000 issues and outstanding Common Shares, unlimited authorized, 2,500,000 shares outstanding 4,500,000 Retained Earmings 5,000,000 During 2015: Issued 20,000 common shares in exchange for machinery fair valued at $40,000. The common shares had a market value of $1.80 per share Jan 2 May 5 All required dividends were declared on preferred shares and a $.20 common share cash dividend was declared on common. Dividends will be distributed on Jan 2 2016. Separate both share classes. July 15 Retired 5,000 prefered shares at $58 per share Sept 25 Talize issued 2,000 preferred shares and 1,000 common shares to an investor for $100,000. At the issue date, the market value of the preferred shares was $45 per share and the market value of the common shares was $6 per share Oct 31 Talize declared and issued a 5%share dividend on the common shares. The market value of the shares at declaration date was $3.00 per share Required: a) Joumalize all the transactions for 2015 (10 marks) b) Prepare, in good form, the Shareholders' Equity section of the balance sheet at its year end, December 31, 2015. Net income for 2015 was $520,000. Total comprehensive income for 2015 was $650,000 which includes net income plus a gain of $130,000 on FV-OCI Investments. Use a three- line title. (5 marks)

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

A Journal entry 02012015 Machinery ac dr 40000 To Profit on issue of share ac dr 4000 To Common Shar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started