Question

Talor Chemical Company is a highly diversified chemical processing company. The company manufactures swimming pool chemicals, chemicals for metal processing companies specialized chemical compounds for

Talor Chemical Company is a highly diversified chemical processing company. The company manufactures swimming pool chemicals, chemicals for metal processing companies specialized chemical compounds for other companies and a full line of pesticides and insecticides.

Currently, the Norwood plant is producing two derivatives, RNA-1 and RNA-2, from the chemical compound VDB developed by Talor’s research labs. Each week 1,200,000 pounds of VDB are processed at a cost of $246,000 into 800,000 pounds of RNA-1 and 400,000 pounds of RNA-2. The proportion of these two outputs is fixed and cannot be altered because this is a joint process. RNA-1 has no market value until it is converted into a product with the trade name Fastkil. The cost to process RNA-1 into Fastkil is $240,000. Fastkil wholesales at $50 per 100 pounds.

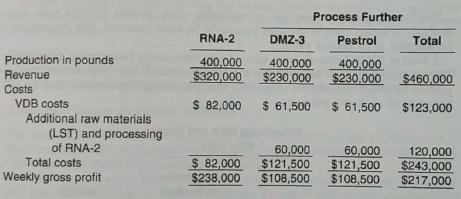

RNA-2 is sold as-is for $80 per hundred pounds. However, Talor has discovered that RNA-2 can be converted into two new products through further processing. Further processing would require the addition of 400,000 pounds of compound LST to the 400,000 pounds of RNA-2. The joint process would yield 400,000 pounds each of DMZ-3 and Pestrol—the two new products. The additional raw material and related processing costs of this joint process would be $120,000. DMZ-3 and Pestrol would each be sold for $57.50 per 100 pounds. Talor management has decided not to process RNA-2 further based on the analysis presented in the schedule below. Talor uses the physical method to allocate the common costs arising from joint processing.

A new staff account who was to review the analysis above commented that it should be revised and stated, “Product costing of products such as these should be done on a net relative sales value basis not a physical volume basis.”

Required:

1. Discuss whether the use of the net relative sales value method would provide data more relevant for the decision to market DMZ-3 and Pestrol.

2. Critique the Talor Company’s analysis and make any revisions that are necessary. Your critique and analysis should indicate:

a. whether Talor Chemical Company made the correct decision.

b. the gross savings (loss) per week of Talor’s decision not to process RNA-2 further, if different from the company-prepared analysis.

Production in pounds Revenue Costs VDB costs Additional raw materials (LST) and processing of RNA-2 Total costs Weekly gross profit Process Further RNA-2 DMZ-3 Pestrol 400,000 400,000 400,000 $320,000 $230,000 $230,000 $ 82,000 $61,500 $ 61,500 60,000 60,000 $ 82,000 $121,500 $121,500 $238,000 $108,500 $108,500 Total $460,000 $123,000 120,000 $243,000 $217,000

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation iA manufacturing organization producing various products may have processes where two or more outputs are produced from a single input ii Here the cost incurred for producing the mu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started