Answered step by step

Verified Expert Solution

Question

1 Approved Answer

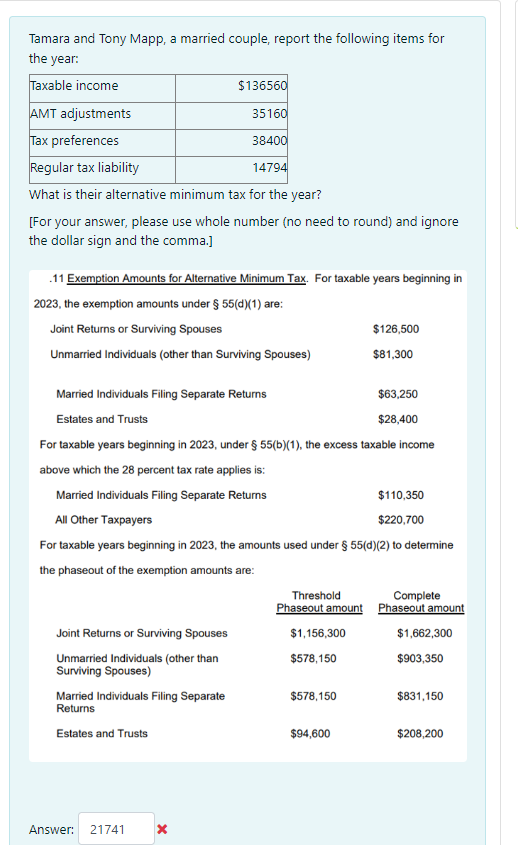

Tamara and Tony Mapp, a married couple, report the following items for the year: Taxable income AMT adjustments Tax preferences Regular tax liability $136560

Tamara and Tony Mapp, a married couple, report the following items for the year: Taxable income AMT adjustments Tax preferences Regular tax liability $136560 35160 38400 14794 What is their alternative minimum tax for the year? [For your answer, please use whole number (no need to round) and ignore the dollar sign and the comma.] .11 Exemption Amounts for Alternative Minimum Tax. For taxable years beginning in 2023, the exemption amounts under 55(d)(1) are: Joint Returns or Surviving Spouses $126,500 Unmarried Individuals (other than Surviving Spouses) $81,300 Married Individuals Filing Separate Returns Estates and Trusts $63,250 $28,400 For taxable years beginning in 2023, under 55(b)(1), the excess taxable income above which the 28 percent tax rate applies is: Married Individuals Filing Separate Returns All Other Taxpayers $110,350 $220,700 For taxable years beginning in 2023, the amounts used under 55(d)(2) to determine the phaseout of the exemption amounts are: Joint Returns or Surviving Spouses Threshold Phaseout amount Phaseout amount Complete $1,156,300 $1,662,300 Unmarried Individuals (other than Surviving Spouses) $578,150 $903,350 Married Individuals Filing Separate Returns $578,150 $831,150 Estates and Trusts $94,600 $208,200 Answer: 21741

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the alternative minimum tax AMT for Tamara and Tony Mapp we need to determine their alt...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started