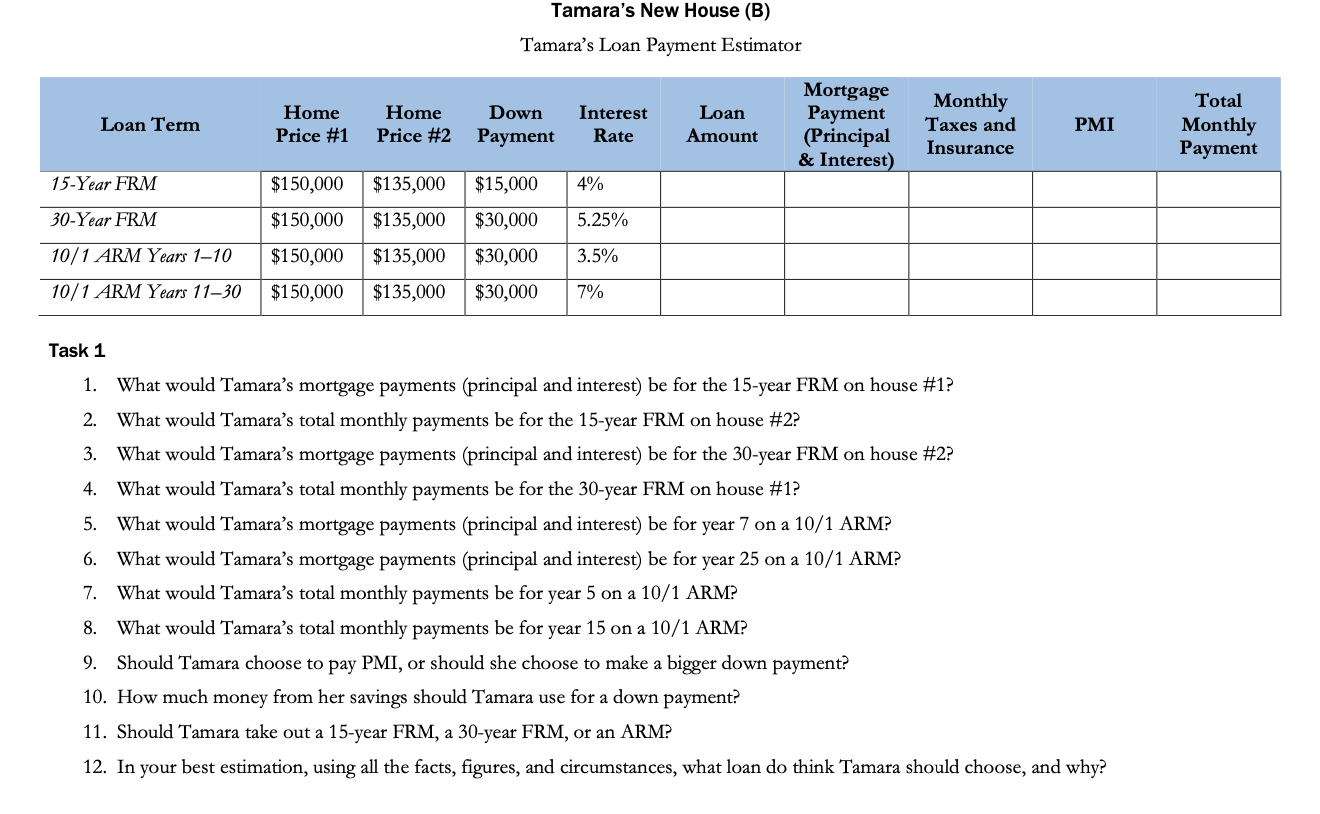

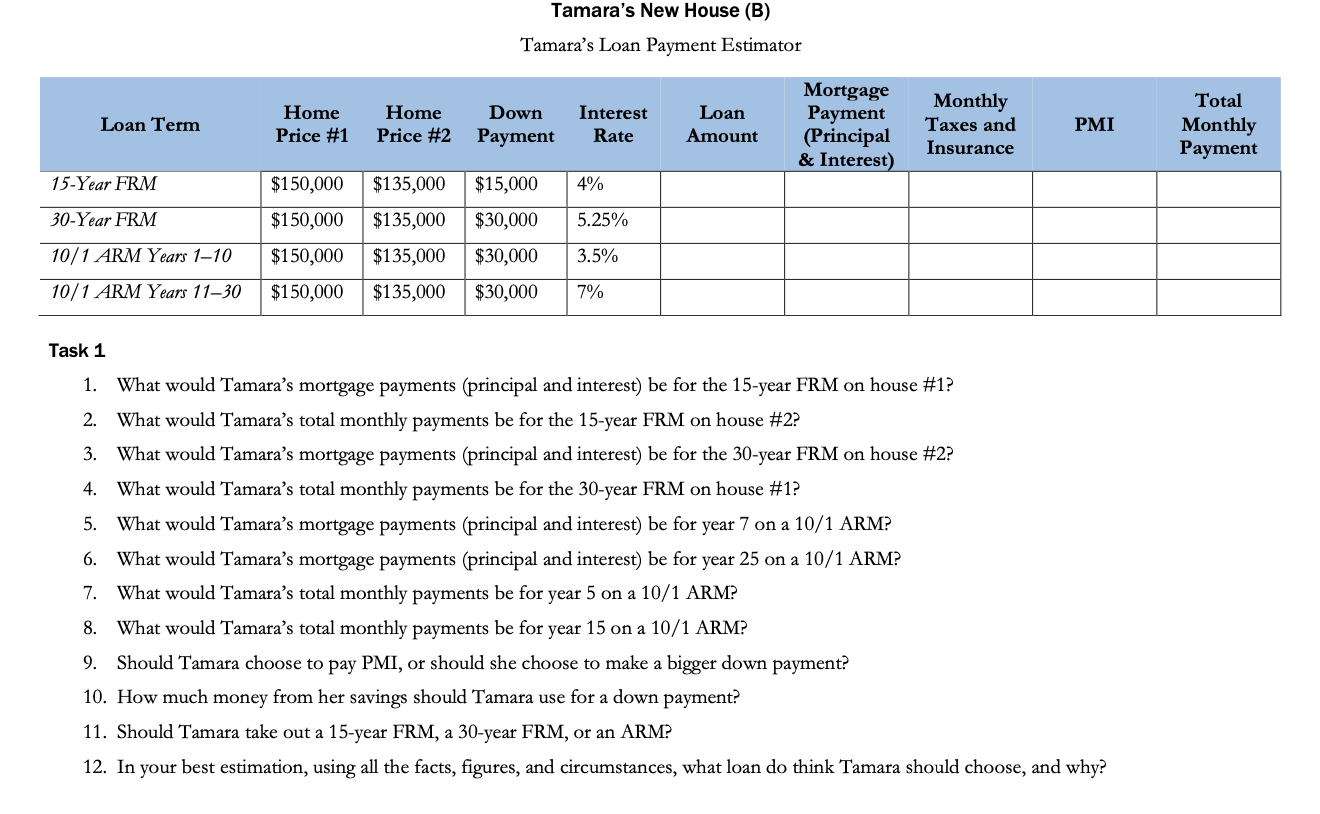

Tamara's New House (B) Tamara's Loan Payment Estimator Loan Term Home Price #1 Home Price #2 Down Payment Interest Rate Loan Amount Mortgage Payment (Principal & Interest) Monthly Taxes and Insurance PMI Total Monthly Payment 15-Year FRM $150,000 $135,000 4% 30-Year FRM $150,000 $150,000 5.25% $15,000 $30,000 $30,000 $135,000 $135,000 10/1 ARM Years 1-10 3.5% 10/1 ARM Years 1130 $150,000 $135,000 $30,000 7% Task 1 1. What would Tamara's mortgage payments (principal and interest) be for the 15-year FRM on house #1? 2. What would Tamara's total monthly payments be for the 15-year FRM on house #2? 3. What would Tamara's mortgage payments (principal and interest) be for the 30-year FRM on house #2? 4. What would Tamara's total monthly payments be for the 30-year FRM on house #1? 5. What would Tamara's mortgage payments (principal and interest) be for year 7 on a 10/1 ARM? 6. What would Tamara's mortgage payments (principal and interest) be for year 25 on a 10/1 ARM? 7. What would Tamara's total monthly payments be for year 5 on a 10/1 ARM? 8. What would Tamara's total monthly payments be for year 15 on a 10/1 ARM? 9. Should Tamara choose to pay PMI, or should she choose to make a bigger down payment? 10. How much money from her savings should Tamara use for a down payment? 11. Should Tamara take out a 15-year FRM, a 30-year FRM, or an ARM? 12. In your best estimation, using all the facts, figures, and circumstances, what loan do think Tamara should choose, and why? Tamara's New House (B) Tamara's Loan Payment Estimator Loan Term Home Price #1 Home Price #2 Down Payment Interest Rate Loan Amount Mortgage Payment (Principal & Interest) Monthly Taxes and Insurance PMI Total Monthly Payment 15-Year FRM $150,000 $135,000 4% 30-Year FRM $150,000 $150,000 5.25% $15,000 $30,000 $30,000 $135,000 $135,000 10/1 ARM Years 1-10 3.5% 10/1 ARM Years 1130 $150,000 $135,000 $30,000 7% Task 1 1. What would Tamara's mortgage payments (principal and interest) be for the 15-year FRM on house #1? 2. What would Tamara's total monthly payments be for the 15-year FRM on house #2? 3. What would Tamara's mortgage payments (principal and interest) be for the 30-year FRM on house #2? 4. What would Tamara's total monthly payments be for the 30-year FRM on house #1? 5. What would Tamara's mortgage payments (principal and interest) be for year 7 on a 10/1 ARM? 6. What would Tamara's mortgage payments (principal and interest) be for year 25 on a 10/1 ARM? 7. What would Tamara's total monthly payments be for year 5 on a 10/1 ARM? 8. What would Tamara's total monthly payments be for year 15 on a 10/1 ARM? 9. Should Tamara choose to pay PMI, or should she choose to make a bigger down payment? 10. How much money from her savings should Tamara use for a down payment? 11. Should Tamara take out a 15-year FRM, a 30-year FRM, or an ARM? 12. In your best estimation, using all the facts, figures, and circumstances, what loan do think Tamara should choose, and why