Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A bank has an average asset duration of 5 years and an average liability duration of 3 years. This bank has total assets of

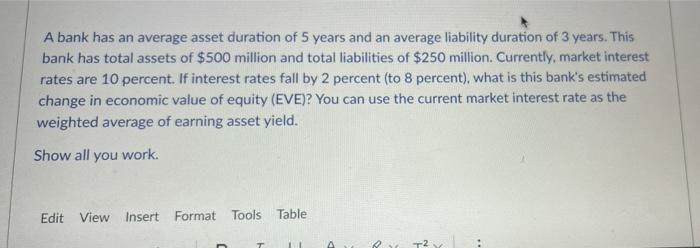

A bank has an average asset duration of 5 years and an average liability duration of 3 years. This bank has total assets of $500 million and total liabilities of $250 million. Currently, market interest rates are 10 percent. If interest rates fall by 2 percent (to 8 percent), what is this bank's estimated change in economic value of equity (EVE)? You can use the current market interest rate as the weighted average of earning asset yield. Show all you work. Edit View Insert Format Tools Table

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here Duration of Assets D1 5 Duration of liabilities D2 3 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d6a6d6f6d2_175383.pdf

180 KBs PDF File

635d6a6d6f6d2_175383.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started