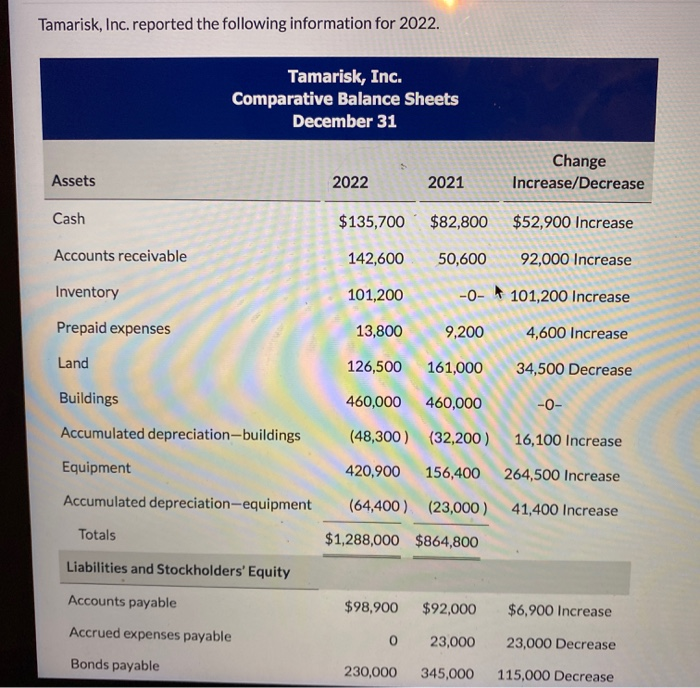

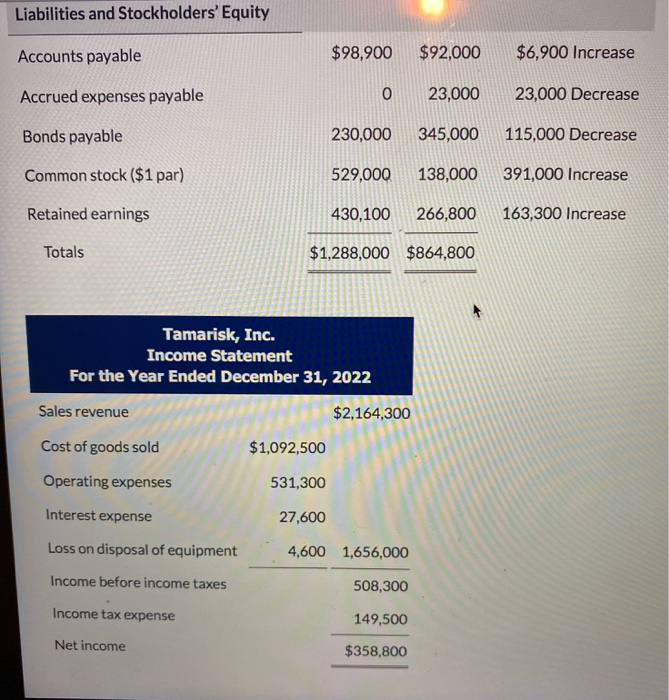

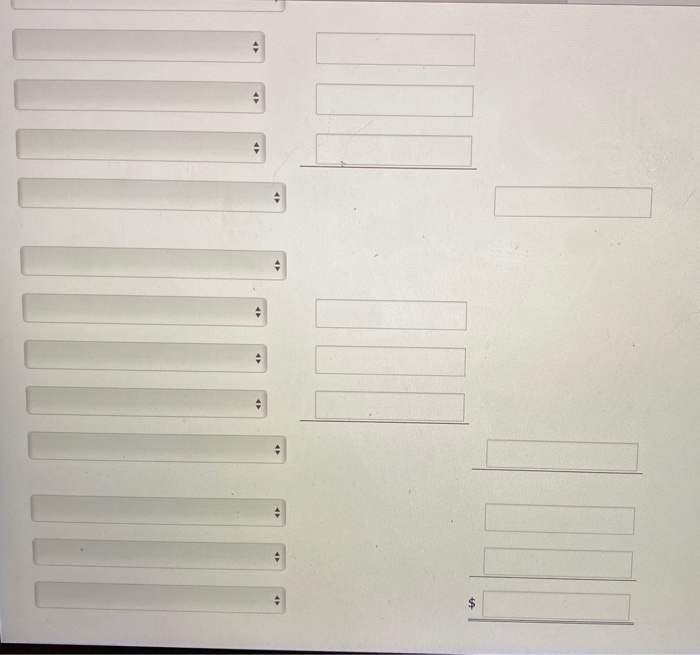

Tamarisk, Inc. reported the following information for 2022. Tamarisk, Inc. Comparative Balance Sheets December 31 Assets Change Increase/Decrease 2022 2021 Cash $135,700 $82,800 $52,900 Increase Accounts receivable 142,600 50,600 92,000 Increase Inventory 101,200 -O-101,200 Increase Prepaid expenses 13,800 9,200 4,600 Increase Land 126,500 161,000 34,500 Decrease Buildings 460,000 460,000 -0- Accumulated depreciation-buildings (48,300) (32,200) 16,100 Increase 420,900 156,400 264,500 Increase Equipment Accumulated depreciation equipment (64,400) (23,000) 41,400 Increase Totals $1,288,000 $864,800 Liabilities and Stockholders' Equity Accounts payable $98,900 $92,000 $6,900 Increase Accrued expenses payable 0 23,000 23,000 Decrease Bonds payable 230,000 345,000 115,000 Decrease Liabilities and Stockholders' Equity Accounts payable $98,900 $92,000 $6,900 Increase Accrued expenses payable 0 23,000 23,000 Decrease Bonds payable 230,000 345,000 115,000 Decrease Common stock ($1 par) 529,000 138,000 391,000 Increase Retained earnings 430,100 266,800 163,300 Increase Totals $1,288,000 $864,800 Tamarisk, Inc. Income Statement For the Year Ended December 31, 2022 Sales revenue $2,164,300 Cost of goods sold $1,092,500 Operating expenses 531,300 Interest expense 27,600 Loss on disposal of equipment 4,600 1,656,000 Income before income taxes 508,300 Income tax expense 149,500 Net income $358,800 Additional information: 1. Operating expenses include depreciation expense of $92,000 2. Land was sold at its book value for cash. 3. Cash dividends of $195,500 were declared and paid in 2022. 4. Equipment with a cost of $381,800 was purchased for cash. Equipment with a cost of $117,300 and a book value of $82,800 was sold for $78,200 cash. 5. Bonds of $115,000 were redeemed at their face value for cash. 6. Common stock ($1 par) of $391,000 was issued for cash. Use this information to prepare a statement of cash flows using the indirect method (Show amounts that decrease cash flow with either a - signes. 15,000 or in parenthesis es (15,000).) Tamarisk, Inc. Statement of Cash Flows-Indirect Method Adjustments to reconcile net income to Adjustments to reconcile net income to 4 ta 4 + A