Answered step by step

Verified Expert Solution

Question

1 Approved Answer

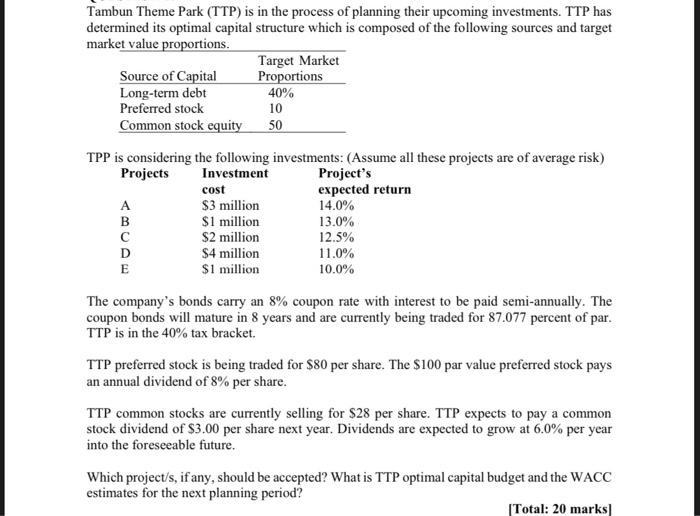

Tambun Theme Park (TTP) is in the process of planning their upcoming investments. TTP has determined its optimal capital structure which is composed of

Tambun Theme Park (TTP) is in the process of planning their upcoming investments. TTP has determined its optimal capital structure which is composed of the following sources and target market value proportions. Source of Capital Long-term debt Target Market Proportions 40% Preferred stock 10 Common stock equity 50 TPP is considering the following investments: (Assume all these projects are of average risk) Projects Investment A ABCDE cost $3 million $1 million $2 million $4 million $1 million Project's expected return 14.0% 13.0% 12.5% 11.0% 10.0% The company's bonds carry an 8% coupon rate with interest to be paid semi-annually. The coupon bonds will mature in 8 years and are currently being traded for 87.077 percent of par. TTP is in the 40% tax bracket. TTP preferred stock is being traded for $80 per share. The $100 par value preferred stock pays an annual dividend of 8% per share. TTP common stocks are currently selling for $28 per share. TTP expects to pay a common stock dividend of $3.00 per share next year. Dividends are expected to grow at 6.0% per year into the foreseeable future. Which project/s, if any, should be accepted? What is TTP optimal capital budget and the WACC estimates for the next planning period? [Total: 20 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started