Answered step by step

Verified Expert Solution

Question

1 Approved Answer

tament NJ 12 NALYSTS 1. Badonsky Manufacturing needs to obtain a gear-cutting machine, which can purchased for $75,000. Badonsky estimates that repair maintenance, insurance property

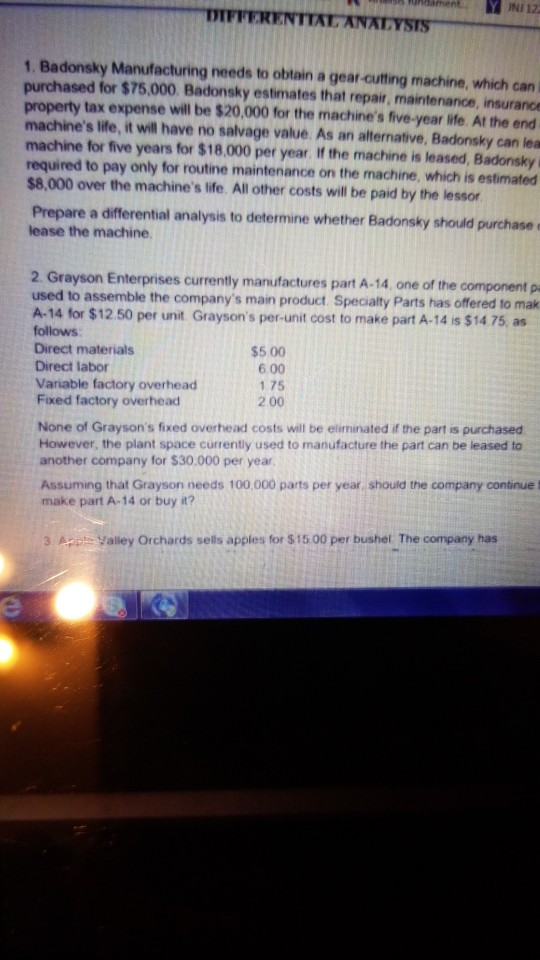

tament NJ 12 NALYSTS 1. Badonsky Manufacturing needs to obtain a gear-cutting machine, which can purchased for $75,000. Badonsky estimates that repair maintenance, insurance property tax expense will be $20,000 for the machine's five-year life. At the end machine's life, it will have no salvage value. As an alternative, Badonsky can lea machine for five years for $18,000 per year. If the machine is leased, Badonsky required to pay only for routine maintenance on the machine, which is estimated $8,000 over the machine's life. All other costs will be paid by the lessor Prepare a differential analysis to determine whether Badonsky should purchase lease the machine 2. Grayson Enterprises currently manufactures part A-14 one of the component used to assemble the company's main product Specialty Parts has offered to mak A-14 for $12.50 per unit Grayson's per-unit cost to make part A-14 is $14 75, as follows Direct materials $5.00 Direct labor 600 Variable factory overhead 1.75 Fixed factory overhead 200 None of Grayson's fixed overhead costs will be eliminated if the part is purchased However, the plant space currently used to manufacture the part can be leased to another company for $30.000 per year Assuming that Grayson needs 100,000 parts per year should the company continue make part A-14 or buy it? 3. ABD Valley Orchards sells apples for $15.00 per bushel The company has

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started