Question

Tamim Products is planning to invest in an equipment to implement a cost-cutting proposal. The pre-tax cost reduction is expected to equal $8,500 for

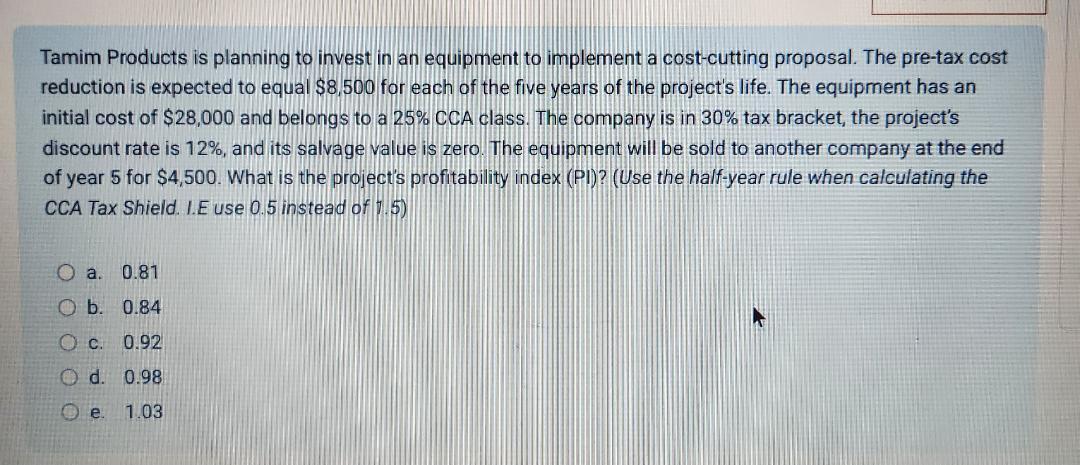

Tamim Products is planning to invest in an equipment to implement a cost-cutting proposal. The pre-tax cost reduction is expected to equal $8,500 for each of the five years of the project's life. The equipment has an initial cost of $28,000 and belongs to a 25% CCA class. The company is in 30% tax bracket, the project's discount rate is 12%, and its salvage value is zero. The equipment will be sold to another company at the end of year 5 for $4,500. What is the project's profitability index (PI)? (Use the half-year rule when calculating the CCA Tax Shield. I.E use 0.5 instead of 1.5) O a. 0.81 Ob. 0.84 O c. 0.92 O d. 0.98 1.03 e.

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The correc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing and Assurance services an integrated approach

Authors: Alvin a. arens, Randal j. elder, Mark s. Beasley

14th Edition

133081605, 132575957, 9780133081602, 978-0132575959

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App