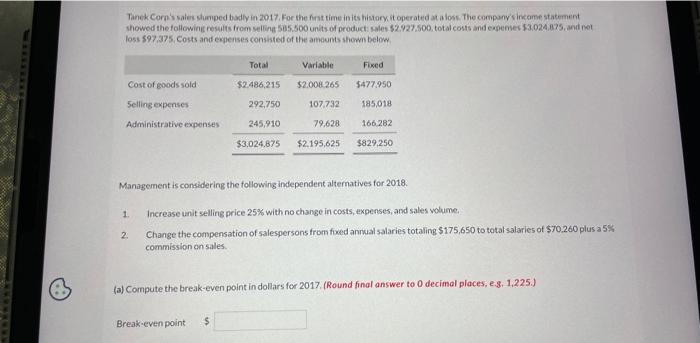

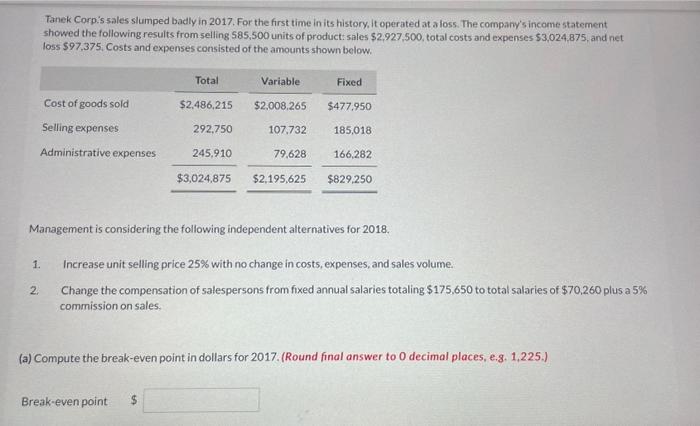

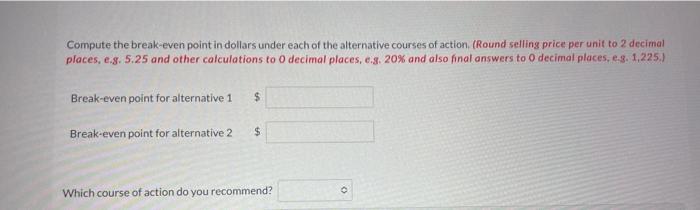

Tanek Corn's sales Mhanped badly in 2017, For the fnt time inits histors it operated at a losk The company sinceme statement showed the following nesulis from selling 505.500 units of product: sales 52.927 .500 , total costs and expene6 39.024 .875 , and not loss 597,375. Costs and experses consisted of the amaunts shown below Management is considering the following independent alternatives for 2018. 1. Increase unit selling price 25% with no change in costs, expenses, and sales volume. 2. Change the compensation of salespersons from foxed annual salaries totaling $175,650 to total salaries of $70,260 plus a 5$4 commission on sales. (a) Coumpute the break even point in dollars tor 2017. (Round final anzwer to 0 decimat ploces, e. 1. 1,225. Break-eveapoint (b) Conpute the contribution margin under esch of the altemative courses of action. (Round final answers to 0 decimal places ey. 125 .) Contribution margin for alternative 1 Contribution imargin for alternative 2 Compute the break-even point in dollars under each of the alternative courses of acticn. (Round selfing price per unit to 2 decimal places, es. 5,25 and other calculations to 0 decimal places, 6.3.20% and also final answers to 0 decimal places, es. 1,225 . Break-even point for alternative 1 Break-even point foc alternative 2 Which course of action do you recommend? Tanek Corp.'s sales slumped badly in 2017. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 585,500 units of product: sales $2,927,500, total costs and expenses $3,024,875, and net loss $97,375. Costs and expenses consisted of the amounts shown below. Management is considering the following independent alternatives for 2018. 1. Increase unit selling price 25% with no change in costs, expenses, and sales volume. 2. Change the compensation of salespersons from fixed annual salaries totaling $175,650 to total salaries of $70,260 plus a 5% commission on sales, (a) Compute the break-even point in dollars for 2017. (Round final answer to 0 decimal places, e.g. 1,225.) Break-even point (b) Compute the contribution margin under each of the alternative courses of action. (Round final answers to 0 decimal places, e.g. 1,225. Contribution margin for alternative 1 Contribution margin for alternative 2 Compute the break-even point in dollars under each of the alternative courses of action. (Round selling price per unit to 2 decimal places, e.8. 5.25 and other calculations to 0 decimal places, e.8. 20% and also final answers to 0 decimal places, e.g. 1,225. Break-even point for alternative 1 Break-even point for alternative 2 Compute the break-even point in dollars under each of the alternative courses of action. (Round selling price per unit to 2 decimal places, e.8. 5.25 and other calculations to 0 decimal places, e.8. 20% and also final answers to 0 decimal places, e.3. 1,225.1 Break-even point for alternative 1 Break-even point for alternative 2 Which course of action do you recommend